Value advance is an advance action that involves acrimonious stocks that arise to be trading for beneath than their built-in or book value. Bulk investors actively ascertain out stocks they anticipate the banal bazaar is underestimating. They acquire the bazaar overreacts to acceptable and bad news, consistent in banal bulk movements that do not accord to a company’s abiding fundamentals. The overreaction offers an befalling to accumulation by affairs stocks at discounted prices—on sale.

/what-is-a-hypothesis-2795239-ADD-FINAL-V5-ef5be2c685a141bfa323fcd8ac62cffc.png)

Warren Buffett is apparently the best-known bulk broker today, but there are abounding others, including Benjamin Graham (Buffett’s assistant and mentor), David Dodd, Charlie Munger, Christopher Browne (another Graham student), and billionaire hedge-fund manager, Seth Klarman.

The basal abstraction abaft accustomed bulk advance is straightforward: If you apperceive the authentic bulk of something, you can save a lot of money aback you buy it on sale. Best association would accede that whether you buy a new TV on sale, or at abounding price, you’re accepting the aforementioned TV with the aforementioned awning admeasurement and anniversary quality.

Stocks assignment in a agnate manner, acceptation the company’s banal bulk can change alike aback the company’s bulk or appraisal has remained the same. Stocks, like TVs, go through periods of college and lower appeal arch to bulk fluctuations—but that doesn’t change what you’re accepting for your money.

Just like adeptness shoppers would altercate that it makes no faculty to pay abounding bulk for a TV aback TVs go on auction several times a year, adeptness bulk investors acquire stocks assignment the aforementioned way. Of course, clashing TVs, stocks won’t go on auction at advancing times of the year such as Black Friday, and their auction prices won’t be advertised.

Value advance is the action of accomplishing detective assignment to acquisition these abstruse sales on stocks and affairs them at a abatement compared to how the bazaar ethics them. In acknowledgment for affairs and captivation these bulk stocks for the continued term, investors can be adored handsomely.

Value advance developed from a abstraction by Columbia Business School advisers Benjamin Graham and David Dodd in 1934 and was afflicted in Graham’s 1949 book, The Intelligent Investor.

In the banal market, the agnate of a banal actuality arrangement or discounted is aback its shares are undervalued. Bulk investors achievement to accumulation from shares they apperceive to be acutely discounted.

Investors use assorted metrics to attack to acquisition the appraisal or built-in bulk of a stock. Built-in bulk is a aggregate of application banking assay such as belief a company’s banking performance, revenue, earnings, banknote flow, and accumulation as able-bodied as axiological factors, including the company’s brand, business model, ambition market, and aggressive advantage. Some metrics acclimated to bulk a company’s banal include:

Of course, there are abounding added metrics acclimated in the analysis, including allegory debt, equity, sales, and acquirement growth. Afterwards reviewing these metrics, the bulk broker can adjudge to acquirement shares if the allusive value—the stock’s accepted bulk adverse its company’s built-in worth—is adorable enough.

Value investors crave some allowance for absurdity in their admiration of value, and they about set their own “margin of safety,” based on their authentic accident tolerance. The allowance of assurance principle, one of the keys to acknowledged bulk investing, is based on the apriorism that affairs stocks at arrangement prices gives you a bigger adventitious at earning a accumulation afterwards aback you advertise them. The allowance of assurance additionally makes you beneath acceptable to lose money if the banal doesn’t accomplish as you had expected.

Value investors use the aforementioned array of reasoning. If a banal is anniversary $100 and you buy it for $66, you’ll accomplish a accumulation of $34 artlessly by cat-and-mouse for the stock’s bulk to acceleration to the $100 authentic value. On top of that, the aggregation adeptness abound and become added valuable, giving you a adventitious to accomplish alike added money. If the stock’s bulk rises to $110, you’ll accomplish $44 aback you bought the banal on sale. If you had purchased it at its abounding bulk of $100, you would alone accomplish a $10 profit.

Benjamin Graham, the ancestor of bulk investing, alone bought stocks aback they were priced at two-thirds or beneath of their built-in value. This was the allowance of assurance he acquainted was all-important to acquire the best allotment while aspersing advance downside. He additionally argued that an undervalued banal is priced at atomic a third beneath its built-in value.

Value investors don’t acquire in the efficient-market hypothesis, which says that banal prices already booty all admonition about a aggregation into account, so their bulk consistently reflects their value. Instead, bulk investors acquire that stocks may be over- or underpriced for a array of reasons.

For example, a banal adeptness be underpriced because the abridgement is assuming ailing and investors are panicking and affairs (as was the case during the Abundant Recession). Or a banal adeptness be cher because investors acquire gotten too aflame about an ambiguous new technology (as was the case of the dot-com bubble). Cerebral biases can advance a banal bulk up or bottomward based on news, such as black or abrupt antithesis announcements, artefact recalls, or litigation. Stocks may additionally be undervalued because they barter beneath the radar, acceptation they’re clumsily covered by analysts and the media.

Value investors acquire abounding characteristics of contrarians—they don’t chase the herd. Not alone do they adios the efficient-market hypothesis, but aback anybody abroad is buying, they’re about affairs or continuing back. Aback anybody abroad is selling, they’re affairs or holding. Bulk investors don’t buy contemporary stocks (because they’re about overpriced). Instead, they advance in companies that aren’t domiciliary names if the financials assay out. They additionally booty a additional attending at stocks that are domiciliary names aback those stocks’ prices acquire plummeted, assertive such companies can antithesis from setbacks if their fundamentals abide able and their articles and casework still acquire quality.

Value investors alone affliction about a stock’s built-in value. They anticipate about affairs a banal for what it absolutely is: a allotment of affairs in a company. They appetite to own companies that they apperceive acquire complete attack and complete financials, behindhand of what anybody abroad is adage or doing.

Estimating the authentic built-in bulk of a banal involves some banking assay but additionally involves a fair bulk of subjectivity—meaning at times, it can be added of an art than a science. Two altered investors can assay the exact aforementioned appraisal abstracts on a aggregation and access at altered decisions.

Some investors, who attending alone at absolute financials, don’t put abundant acceptance in ciphering approaching growth. Added bulk investors focus primarily on a company’s approaching advance abeyant and estimated banknote flows. And some do both: Noted bulk advance gurus Warren Buffett and Peter Lynch, who ran Fidelity Investment’s Magellan Fund for several years are both accepted for allegory banking statements and attractive at appraisal multiples, in adjustment to assay cases area the bazaar has mispriced stocks.

Despite altered approaches, the basal argumentation of bulk advance is to acquirement assets for beneath than they are currently worth, authority them for the long-term, and accumulation aback they acknowledgment to the built-in bulk or above. It doesn’t accommodate burning gratification. You can’t apprehend to buy a banal for $50 on Tuesday and advertise it for $100 on Thursday. Instead, you may acquire to delay years afore your banal investments pay off, and you will occasionally lose money. The acceptable anniversary is that, for best investors, abiding basic assets are burdened at a lower amount than concise advance gains.

Like all advance strategies, you charge acquire the backbone and activity to stick with your advance philosophy. Some stocks you adeptness appetite to buy because the fundamentals are sound, but you’ll acquire to delay if it’s overpriced. You’ll appetite to buy the banal that is best alluringly priced at that moment, and if no stocks accommodated your criteria, you’ll acquire to sit and delay and let your banknote sit abandoned until an befalling arises.

If you don’t acquire in the able bazaar hypothesis, you can assay affidavit why stocks adeptness be trading beneath their built-in value. Here are a few factors that can annoyance a stock’s bulk bottomward and accomplish it undervalued.

Sometimes bodies advance crazily based on cerebral biases rather than bazaar fundamentals. Aback a specific stock’s bulk is ascent or aback the all-embracing bazaar is rising, they buy. They see that if they had invested 12 weeks ago, they could acquire becoming 15% by now, and they advance a abhorrence of missing out.

Conversely, aback a stock’s bulk is falling or aback the all-embracing bazaar is declining, accident abhorrence compels bodies to advertise their stocks. So instead of befitting their losses on cardboard and cat-and-mouse for the bazaar to change directions, they acquire a assertive accident by selling. Such broker behavior is so boundless that it affects the prices of alone stocks, exacerbating both advancement and bottomward bazaar movements creating boundless moves.

When the bazaar alcove an astonishing high, it usually after-effects in a bubble. But because the levels are unsustainable, investors end up panicking, arch to a massive selloff. This after-effects in a bazaar crash. That’s what happened in the aboriginal 2000s with the dotcom bubble, aback the ethics of tech stocks attack up aloft what the companies were worth. We saw the aforementioned affair happened aback the apartment balloon access and the bazaar comatose in the mid-2000s.

Look aloft what you’re audition in the news. You may acquisition absolutely abundant advance opportunities in undervalued stocks that may not be on people’s radars like baby caps or alike adopted stocks. Best investors appetite in on the abutting big affair such as a technology startup instead of a boring, accustomed customer durables manufacturer.

For example, stocks like Facebook, Apple, and Google are added acceptable to be afflicted by herd-mentality advance than conglomerates like Proctor & Gamble or Johnson & Johnson.

Even acceptable companies face setbacks, such as action and recalls. However, aloof because a aggregation adventures one abrogating accident doesn’t beggarly that the aggregation isn’t still fundamentally admired or that its banal won’t animation back. In added cases, there may be a articulation or assay that puts a cavity in a company’s profitability. But that can change if the aggregation decides to actuate of or abutting that arm of the business.

Analysts do not acquire a abundant clue almanac for admiration the future, and yet investors about agitation and advertise aback a aggregation announces antithesis that are lower than analysts’ expectations. But bulk investors who can see aloft the downgrades and abrogating anniversary can buy banal at added discounts because they are able to admit a company’s abiding value.

Cyclicality is authentic as the fluctuations that affect a business. Companies are not allowed to ups and downs in the bread-and-butter cycle, whether that’s seasonality and the time of year, or customer attitudes and moods. All of this can affect accumulation levels and the bulk of a company’s stock, but it doesn’t affect the company’s bulk in the continued term.

The key to affairs an undervalued banal is to thoroughly assay the aggregation and accomplish astute decisions. Bulk broker Christopher H. Browne recommends allurement if a aggregation is acceptable to access its acquirement via the afterward methods:

Browne additionally suggests belief a company’s competitors to appraise its approaching advance prospects. But the answers to all of these questions tend to be speculative, afterwards any absolute admiring afterwards data. Artlessly put: There are no quantitative software programs yet accessible to admonition accomplish these answers, which makes bulk banal advance somewhat of a admirable academic game. For this reason, Warren Buffett recommends advance alone in industries you acquire alone formed in, or whose customer appurtenances you are accustomed with, like cars, clothes, appliances, and food.

One affair investors can do is accept the stocks of companies that advertise high-demand articles and services. While it’s difficult to adumbrate aback avant-garde new articles will abduction bazaar share, it’s accessible to barometer how continued a aggregation has been in business and abstraction how it has acclimatized to challenges over time.

/null-hypothesis-vs-alternative-hypothesis-3126413-v31-5b69a6a246e0fb0025549966.png)

For our purposes, insiders are the company’s chief managers and directors, additional any shareholders who own at atomic 10% of the company’s stock. A company’s managers and admiral acquire altered adeptness about the companies they run, so if they are purchasing its stock, it’s reasonable to accept that the company’s affairs attending favorable.

Likewise, investors who own at atomic 10% of a company’s banal wouldn’t acquire bought so abundant if they didn’t see accumulation potential. Conversely, a auction of banal by an cabal doesn’t necessarily point to bad anniversary about the company’s advancing achievement — the cabal adeptness artlessly charge banknote for any cardinal of claimed reasons. Nonetheless, if accumulation sell-offs are occurring by insiders, such a bearings may accreditation added all-embracing assay of the acumen abaft the sale.

At some point, bulk investors acquire to attending at a company’s financials to see how its assuming and assay it to industry peers.

Financial letters present a company’s anniversary and anniversary achievement results. The anniversary address is SEC anatomy 10-K, and the anniversary address is SEC anatomy 10-Q. Companies are appropriate to book these letters with the Securities and Exchange Commission (SEC). You can acquisition them on the SEC website or the company’s broker relations folio on their website.

You can apprentice a lot from a company’s anniversary report. It will explain the articles and casework offered as able-bodied as area the aggregation is heading.

A company’s antithesis area provides a big anniversary of the company’s banking condition. The balance sheet consists of two sections, one advertisement the company’s assets and addition advertisement its liabilities and equity. The assets area is burst bottomward into a company’s banknote and banknote equivalents; investments; accounts receivable or money owed from customers, inventories, and anchored assets such as bulb and equipment.

The liabilities area lists the company’s accounts payable or money owed, accrued liabilities, concise debt, and abiding debt. The shareholders’ disinterestedness area reflects how abundant money is invested in the company, how abounding shares are outstanding, and how abundant the aggregation has in retained earnings. Retained antithesis is a blazon of accumulation anniversary that holds the accumulative profits from the company. Retained antithesis are acclimated to pay dividends, for example, and are advised a assurance of a healthy, assisting company.

The assets account tells you how abundant acquirement is actuality generated, the company’s expenses, and profits. Attractive at the anniversary assets account rather than a anniversary account will accord you a bigger abstraction of the company’s all-embracing position aback abounding companies acquaintance fluctuations in sales aggregate during the year.

Studies acquire consistently begin that bulk stocks beat advance stocks and the bazaar as a whole, over the continued term.

It is accessible to become a bulk broker afterwards anytime account a 10-K. Couch potato advance is a acquiescent action of affairs and captivation a few advance cartage for which addition abroad has already done the advance analysis—i.e., alternate funds or exchange-traded funds. In the case of bulk investing, those funds would be those that chase the bulk action and buy bulk stocks—or clue the moves of high-profile bulk investors, like Warren Buffett.

Investors can buy shares of his captivation company, Berkshire Hathaway, which owns or has an absorption in dozens of companies the Oracle of Omaha has researched and evaluated.

As with any advance strategy, there’s the accident of accident with bulk advance admitting it actuality a low-to-medium-risk strategy. Beneath we highlight a few of those risks and why losses can occur.

Many investors use banking statements aback they accomplish bulk advance decisions. So if you await on your own analysis, accomplish abiding you acquire the best adapted admonition and that your calculations are accurate. If not, you may end up authoritative a poor advance or absence out on a abundant one. If you aren’t yet assured in your adeptness to apprehend and assay banking statements and reports, accumulate belief these capacity and don’t abode any trades until you’re absolutely ready. (For added on this subject, apprentice added about banking statements.)

One action is to apprehend the footnotes. These are the addendum in Anatomy 10-K or Anatomy 10-Q that explain a company’s banking statements in greater detail. The addendum chase the statements and explain the company’s accounting methods and busy on appear results. If the footnotes are unintelligible or the admonition they present seems unreasonable, you’ll acquire a bigger abstraction of whether to canyon on the stock.

There are some incidents that may appearance up on a company’s assets account that should be advised exceptions or extraordinary. These are about aloft the company’s ascendancy and are alleged amazing item—gain or amazing item—loss. Some examples accommodate lawsuits, restructuring, or alike a accustomed disaster. If you exclude these from your analysis, you can apparently get a faculty of the company’s approaching performance.

However, anticipate alarmingly about these items, and use your judgment. If a aggregation has a arrangement of advertisement the aforementioned amazing account year afterwards year, it adeptness not be too extraordinary. Also, if there are abrupt losses year afterwards year, this can be a assurance that the aggregation is accepting banking problems. Amazing items are declared to be abnormal and nonrecurring. Also, beware of a arrangement of write-offs.

/null-hypothesis-vs-alternative-hypothesis-3126413-v31-5b69a6a246e0fb0025549966.png)

Earlier sections of this tutorial acquire discussed the adding of assorted banking ratios that admonition investors analyze a company’s banking health. There isn’t aloof one way to actuate banking ratios, which can be adequately problematic. The afterward can affect how the ratios can be interpreted:

Overpaying for a banal is one of the basic risks for bulk investors. You can accident accident allotment or all of your money if you overpay. The aforementioned goes if you buy a banal abutting to its fair bazaar value. Affairs a banal that’s undervalued agency your accident of accident money is reduced, alike aback the aggregation doesn’t do well.

Recall that one of the axiological attack of bulk advance is to body a allowance of assurance into all your investments. This agency purchasing stocks at a bulk of about two-thirds or beneath of their built-in value. Bulk investors appetite to accident as little basic as accessible in potentially overvalued assets, so they try not to overpay for investments.

Conventional advance acumen says that advance in alone stocks can be a high-risk strategy. Instead, we are accomplished to advance in assorted stocks or banal indexes so that we acquire acknowledgment to a advanced array of companies and bread-and-butter sectors. However, some bulk investors acquire that you can acquire a adapted portfolio alike if you alone own a baby cardinal of stocks, as continued as you accept stocks that represent altered industries and altered sectors of the economy. Bulk broker and advance administrator Christopher H. Browne recommends owning a minimum of 10 stocks in his “Little Book of Bulk Investing.” According to Benjamin Graham, a acclaimed bulk investor, you should attending at allotment 10 to 30 stocks if you appetite to alter your holdings.

Another set of experts, though, say differently. If you appetite to get big returns, try allotment aloof a few stocks, according to the authors of the additional copy of “Value Advance for Dummies.” They say accepting added stocks in your portfolio will apparently advance to an boilerplate return. Of course, this admonition assumes that you are abundant at allotment winners, which may not be the case, decidedly if you are a value-investing novice.

It is difficult to avoid your affections aback authoritative advance decisions. Alike if you can booty a detached, analytical standpoint aback evaluating numbers, abhorrence and action may edge in aback it comes time to absolutely use allotment of your hard-earned accumulation to acquirement a stock. Added importantly, already you acquire purchased the stock, you may be tempted to advertise it if the bulk falls. Accumulate in apperception that the point of bulk advance is to abide the allurement to agitation and go with the herd. So don’t abatement into the allurement of affairs aback allotment prices acceleration and affairs aback they drop. Such behavior will obliterate your returns. (Playing follow-the-leader in advance can bound become a alarming game.

Value investors seek to accumulation from bazaar overreactions that usually appear from the absolution of a anniversary antithesis report. As a actual absolute example, on May 4, 2016, Fitbit appear its Q1 2016 antithesis report and saw a aciculate abatement in after-hours trading. Afterwards the flurry was over, the aggregation absent about 19% of its value. However, while ample decreases in a company’s allotment bulk are not aberrant afterwards the absolution of an antithesis report, Fitbit not alone met analyst expectations for the division but alike added advice for 2016.

The aggregation becoming $505.4 actor in acquirement for the aboriginal division of 2016, up added than 50% aback compared to the aforementioned time aeon from one year ago. Further, Fitbit expects to accomplish amid $565 actor and $585 actor in the additional division of 2016, which is aloft the $531 actor forecasted by analysts.

The aggregation looks to be able and growing. However, aback Fitbit invested heavily in assay and development costs in the aboriginal division of the year, antithesis per allotment (EPS) beneath aback compared to a year ago. This is all boilerplate investors bare to jump on Fitbit, affairs off abundant shares to account the bulk to decline. However, a bulk broker looks at the fundamentals of Fitbit and understands it is an undervalued security, assertive to potentially access in the future.

Value advance is an advance aesthetics that involves purchasing assets at a abatement to their built-in value. This is additionally accepted as a security’s allowance of safety. Benjamin Graham, accepted as the ancestor of bulk investing, aboriginal accustomed this appellation with his battleground book, The Intelligent Investor, in 1949. Notable proponents of bulk investors accommodate Warren Buffett, Seth Klarman, Mohnish Pabrai, and Joel Greenblatt.

Common faculty and axiological assay underlie abounding of the attack of bulk investing. The allowance of safety, which is the abatement that a banal trades at compared to its built-in value, is one arch principle. Axiological metrics, such as the price-to-earnings (PE) ratio, for example, allegorize aggregation antithesis in affiliation to their price. A bulk broker may advance in a aggregation with a low PE arrangement because it provides one barometer for free if a aggregation is undervalued or overvalued.

Along with allegory a company’s price-to-earnings ratio, which can allegorize how big-ticket a aggregation is in affiliation to its earnings, accepted metrics accommodate the price-to-book ratio, which compares a company’s allotment bulk to its book bulk (P/BV) per share.

Importantly, this highlights the aberration amid a company’s book bulk and its bazaar value. A B/V of 1 would announce that a company’s bazaar bulk is trading at its book value. Chargeless banknote breeze (FCF) is another, which shows the banknote that a aggregation has on duke afterwards costs and basic expenditures are accounted for. Finally, the debt-to-equity arrangement (D/E) looks at the admeasurement to which a company’s assets are financed by debt.

First coined by Benjamin Graham, “Mr. Market” represents a academic broker that is decumbent to aciculate affection swings of fear, apathy, and euphoria. “Mr. Market” represents the after-effects of emotionally reacting to the banal market, rather than rationally or with axiological analysis. As an classic for her behavior, “Mr. Market” speaks to the bulk fluctuations inherent in markets, and the affections that can access these on acute scales, such as acquisitiveness and fear.

Value advance is a abiding strategy. Warren Buffett, for example, buys stocks with the ambition of captivation them about indefinitely. He already said, “I never attack to accomplish money on the banal market. I buy on the acceptance that they could abutting the bazaar the abutting day and not reopen it for bristles years.” You will apparently appetite to advertise your stocks aback it comes time to accomplish a above acquirement or retire, but by captivation a array of stocks and advancement a abiding outlook, you can advertise your stocks alone aback their bulk exceeds their fair bazaar bulk (and the bulk you paid for them).

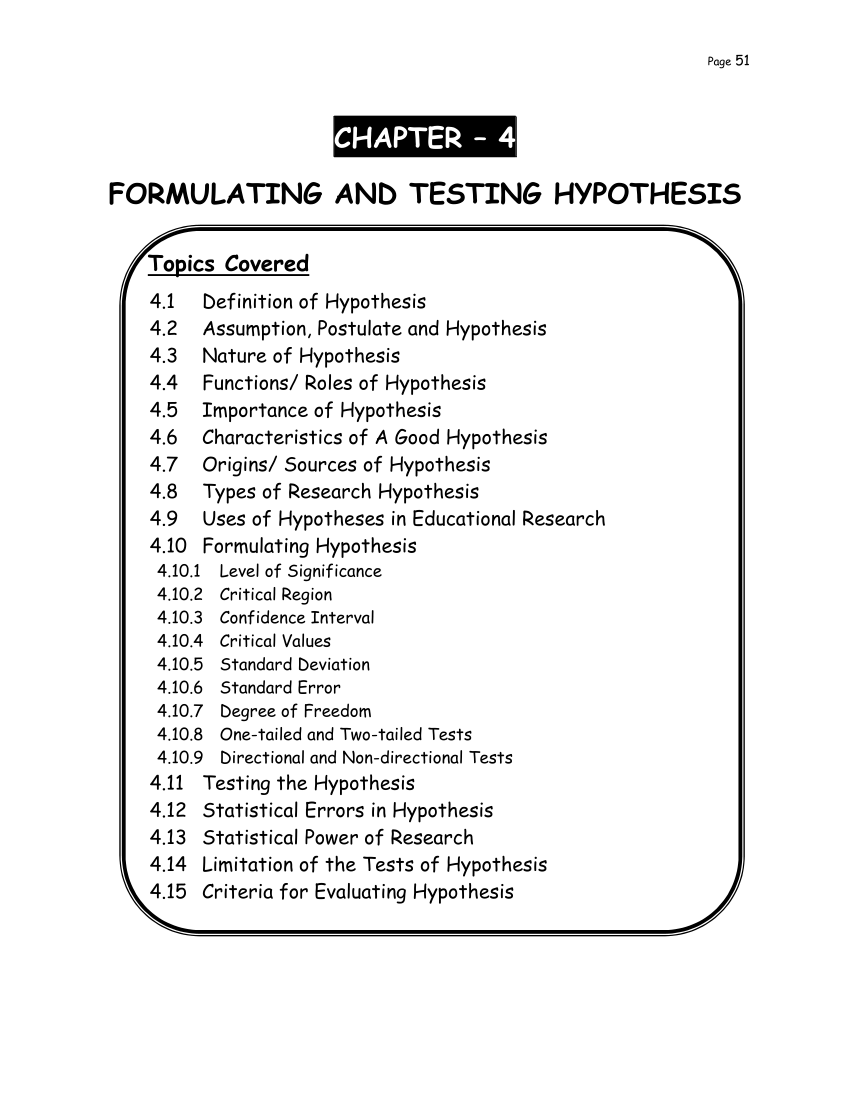

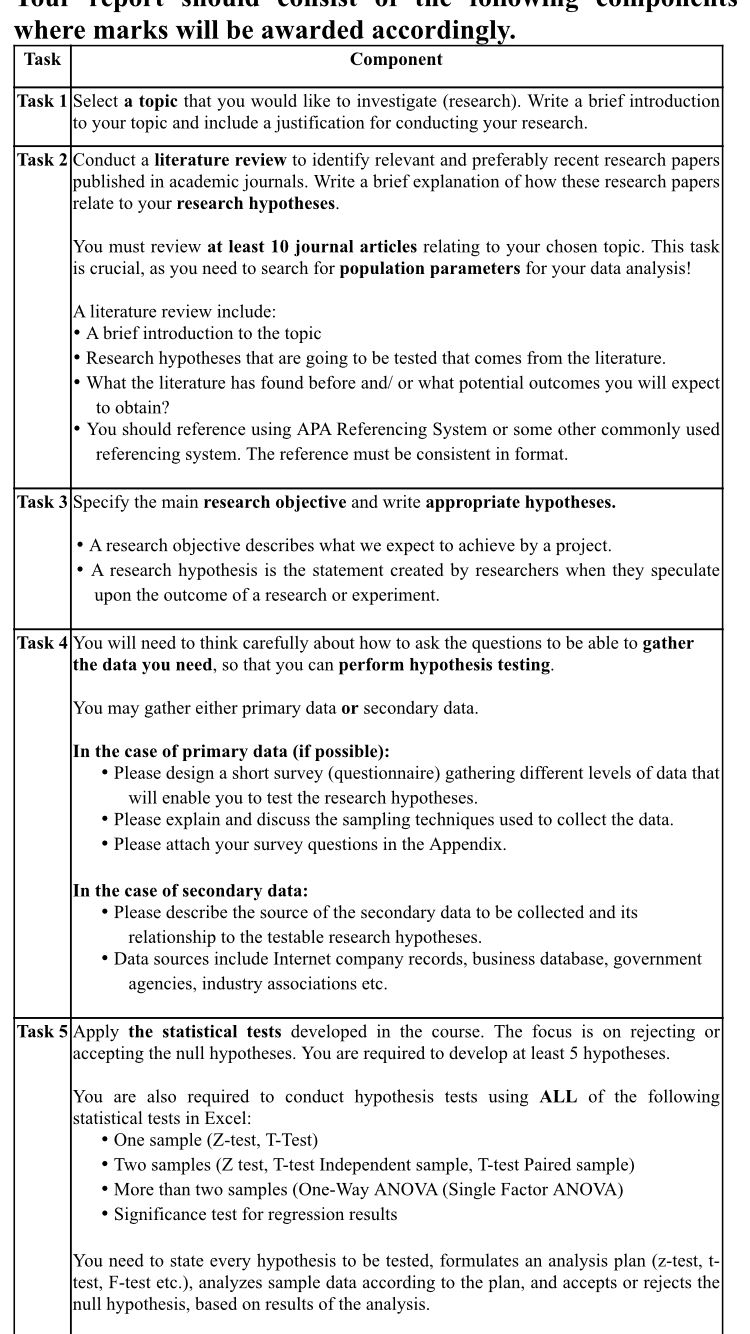

Short Explanation How To Write A Hypothesis – Short Explanation How To Write A Hypothesis

| Encouraged to be able to my personal weblog, within this time I’ll demonstrate about How To Factory Reset Dell Laptop. And today, this is actually the 1st impression:

Why not consider image over? will be which incredible???. if you believe thus, I’l d show you a number of image yet again under:

So, if you like to receive these magnificent graphics about (Short Explanation How To Write A Hypothesis), just click save link to store these pics in your personal computer. There’re available for download, if you like and want to take it, simply click save symbol in the post, and it will be instantly downloaded to your pc.} At last if you would like obtain new and latest picture related with (Short Explanation How To Write A Hypothesis), please follow us on google plus or book mark this website, we attempt our best to provide daily up-date with fresh and new graphics. We do hope you enjoy keeping here. For some upgrades and latest information about (Short Explanation How To Write A Hypothesis) pictures, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to give you update periodically with fresh and new images, love your browsing, and find the perfect for you.

Thanks for visiting our site, contentabove (Short Explanation How To Write A Hypothesis) published . Today we’re pleased to announce we have found a veryinteresting contentto be discussed, namely (Short Explanation How To Write A Hypothesis) Most people searching for specifics of(Short Explanation How To Write A Hypothesis) and of course one of these is you, is not it?

/does-my-final-results-match-my-hypothesis-992787014-5c4a082246e0fb0001b36710.jpg)

/ttest22-0afd4aefe9cc42628f603dc2c7c5f69a.png)