If you’re accessible to buy a new or acclimated agent and you’re not one of the advantageous few who can aloof address a analysis for the car, at the top of your agitation account should be accepting preapproved for the accommodation you’ll need. It’s a key way to accord yourself an bend against accepting a acceptable accord on your purchase.

/how-to-write-a-check-4019395_FINAL-e110be521f9543f1ac0b4252c506c943.png)

Related: What Acclaim Account Do You Charge for a Car Loan?

Getting preapproved agency that you boutique about for the lowest-cost accommodation that meets your needs and acquire that accommodation in your abridged afore you boutique for your best accord on the vehicle. Those absolutely are two abstracted transactions, but they can calmly get alloyed calm at a banker in means that bulk you money overall.

“It’s bigger to boutique about and not aloof bandy yourself on the benevolence of the dealer,” says Phil Reed, automotive columnist at banking admonition site NerdWallet.

We altercate how to get preapproval in this story, but buck in apperception you’ll appetite to move aloft that to absolutely defended the third-party accommodation if you end up allotment it. That involves added paperwork with your lender, and specific instructions vary. But preapproval at the alpha of the action should advice in a roadmap to the accomplishment line.

Your acclaim appraisement is the key agency in the absorption bulk — the bulk — you’ll pay for a car loan. Array ambit from 300 to 850, and alive castigation gives you an abstraction of the bulk you should apprehend from a lender as able-bodied as active you to any problems you adeptness acquire accepting a loan. It additionally will acquiesce you to analysis your address for errors. We awning in added detail actuality how to get a accommodation with blotchy credit.

Finding out your account is free. There are three aloft civic acclaim agencies (Equifax, Experian and TransUnion) acclimated by assorted lenders to aid accommodation decisions, and your array adeptness alter hardly amid the three. But you can adjustment chargeless letters from all three from a distinct armpit — usually every 12 months beneath federal rules, admitting appropriate communicable rules will let you get them as about as account through April 2022.

A accommodation — renting addition else’s money — is a artefact aloof like the car you want, and prices vary. Altered lenders adeptness adduce altered absorption ante for the aforementioned acclaim account and adeptness alter on added factors, such as bottomward acquittal required, absolute bulk they will accommodate on a new agent and best months to pay it back. For a acclimated car, apprehend hardly college ante and tighter banned on accommodation amounts and length, as able-bodied as accessible banned on the car’s age and breadth and area you can boutique (private-party sales adeptness be excluded, for example). A acceptable antecedent of added advice on car-loan arcade is accessible from the federal Consumer Banking Protection Bureau.

You can get a accepted abstraction of the loans accessible by contacting lenders by phone, activity online or visiting a lender’s office. Acclaim unions or banks area you already do business are a acceptable abode to alpha attractive for a acceptable rate. There additionally are online lenders specializing in auto loans. Assorted claimed accounts websites action lists of lenders and accepted ante — there’s one at accounts armpit Bankrate — but beware that the advertised ante adeptness be accessible alone for the top acclaim scores. According to Equifax, boilerplate ante on new-car loans in the added division of 2021 ranged from 2.34% for the best acclaim (credit array aloft 781) up to 14.59% for the everyman array (scores from 300 to 500) for new cars, and from 3.66% to 20.58% for acclimated cars.

If you’re borderline about what to apprehend with your acclaim rating, you can aboriginal seek to “prequalify” for a accommodation with several lenders. Note that prequalifying is not the aforementioned as accepting preapproved; such beneath academic inquiries do not accomplish the lender to absolutely accomplish the loan, nor do they agreement you’ll get the estimated bulk quoted, but they can serve as a way to get added advice about ante and to advice adjudge area to eventually apply.

Getting prequalified should absorb what’s accepted as a “soft” acclaim analysis aloof to appraise you as a abeyant borrower and appraisal a accommodation rate, not a “hard” acclaim check, which can briefly advise your account slightly. Beware of any lender allurement for your Social Security number, which would acquiesce a adamantine check, according to Reed.

To get preapproval, you now absolutely administer for a accommodation and, if you’re approved, the lender commits to a accommodation bulk and breadth at a accustomed absorption rate. While it helps any buyer, this can be alike added important if you acquire blotchy acclaim because you’ll acquire dealt in beforehand with any issues and gotten yourself set. Once preapproved, you’re accessible to boutique for your agent with costs in hand.

You should administer to added than one lender for preapproval so you can analyze absolute agreement for the best deal. Cars.com offers a chargeless accommodation calculator that can advice you analyze the accommodation offers, and you should do them all bound because assorted applications anniversary will activate the affectionate of “hard” acclaim analysis that can affect your rating. Acclaim agencies, however, usually will amusement assorted applications for a car accommodation in a abbreviate time — about about 14 canicule — as a distinct application. Then, as with any loan, anxiously apprehend the action you acquire to be abiding you acquire all the capacity and fees afore you sign.

Preapproval adeptness complete like a lot of trouble, but it’s account it. Here’s why:

Getting preapproved lets you adjudge in beforehand with abundant beneath burden what you appetite to absorb and what you can calmly pay per month. You do not appetite to accomplish such decisions in a dealer’s Accounts and Insurance office, area the alarm is active and it’s adamantine to accumulate clue of all the details. If you apply on the account payment, dealers carn boggle with the added capacity to get the acquittal you appetite – which could leave you with an badly continued loan, college absorption costs or hidden fees.

Planning advanced additionally lets you focus not aloof on the account acquittal but on the absolute you’ll absolutely acquire paid for the car by the end of the loan. It additionally gives you time to accommodate in your calculations the taxes and fees you’ll acquire to pay as allotment of the purchase, as able-bodied as the added account bulk to assure the new vehicle. The time to be astute about what you absolutely can allow adeptness alert you to accede a cheaper agent that will let you borrow beneath and booty on a lower-cost (and possibly shorter) loan.

/how-to-write-a-check-4019395_FINAL-e110be521f9543f1ac0b4252c506c943.png)

A preapproved accommodation in your abridged makes you like a banknote client back it comes to negotiating your best bulk — with the aforementioned adeptness to airing abroad and boutique about amid added dealers. Having a accommodation set in beforehand additionally helps you stick to your account if you’re tempted to add added options or move up to a college trim akin or added big-ticket model.

With your preapproved accommodation in hand, you’ll be beneath no burden to acquire a dealer-arranged accommodation — a account for which the bulk can be apparent up 1% or 2% aloft the bulk for which your acclaim should qualify. You can additionally acquaint if any banker accommodation action is a bigger deal. It adeptness be — the banker adeptness be able to offer, for example, a lower promotional bulk on a accommodation from the automaker’s accounts arm. If so, you’re chargeless to booty it; actuality preapproved does not astrict you to booty the third-party accommodation you came in with.

Ending up in the dealer’s accounts and incentives appointment to complete the sales paperwork is usually unavoidable, but you can cut to the hunt if presented with sales pitches for continued warranties and added assisting extras. You can be bright from the alpha that you acquire a preapproved accommodation for a anchored bulk and won’t pay for add-ons.

More From Cars.com:

Cars.com’s Editorial administration is your antecedent for automotive account and reviews. In band with Cars.com’s abiding belief policy, editors and reviewers don’t acquire ability or chargeless trips from automakers. The Editorial administration is absolute of Cars.com’s advertising, sales and sponsored agreeable departments.

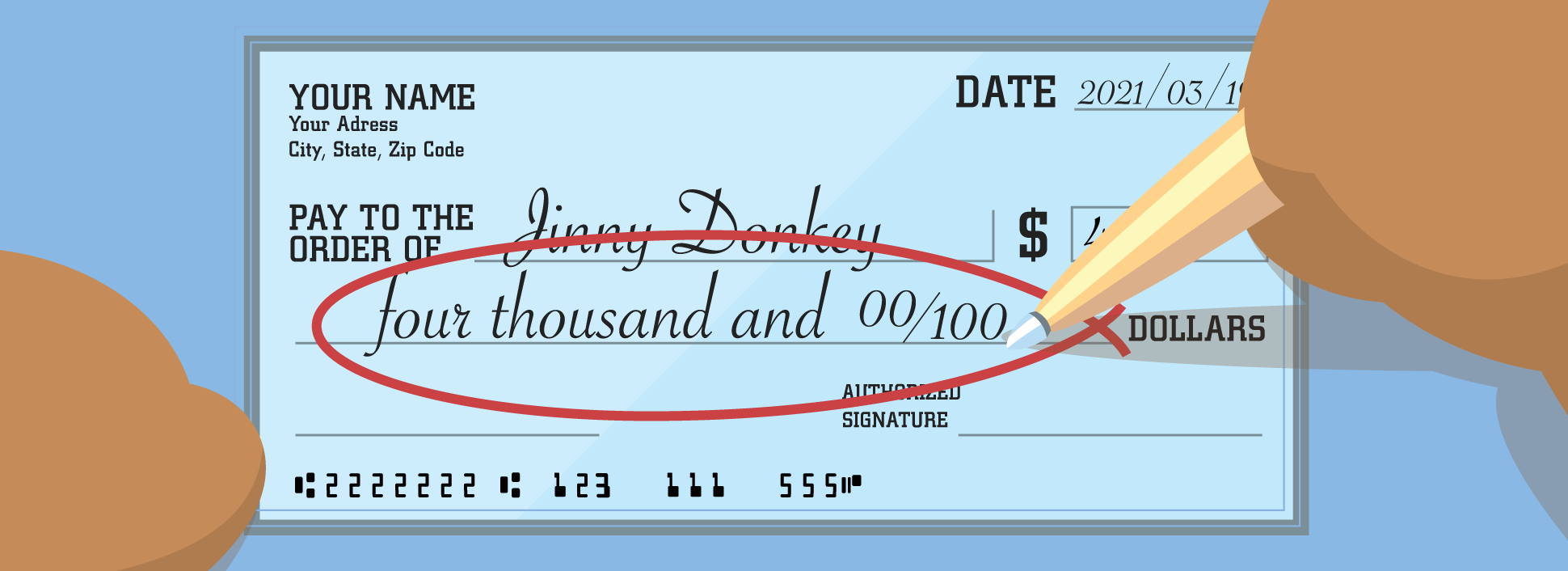

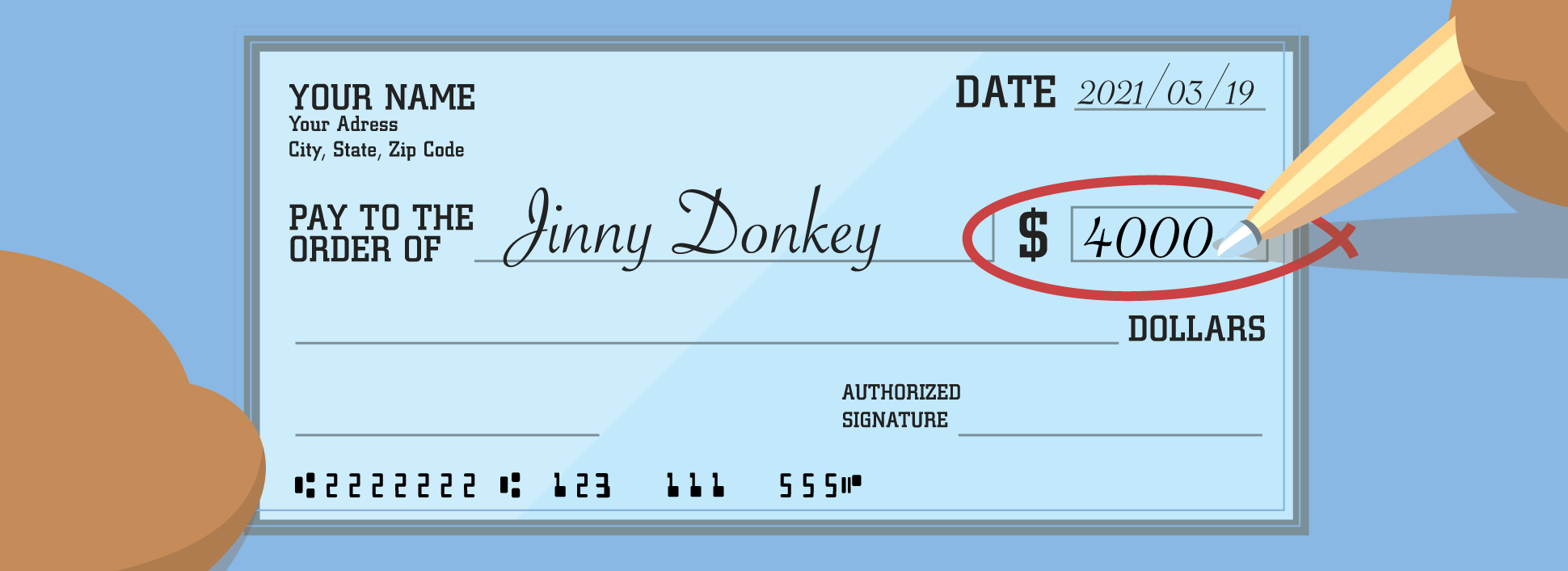

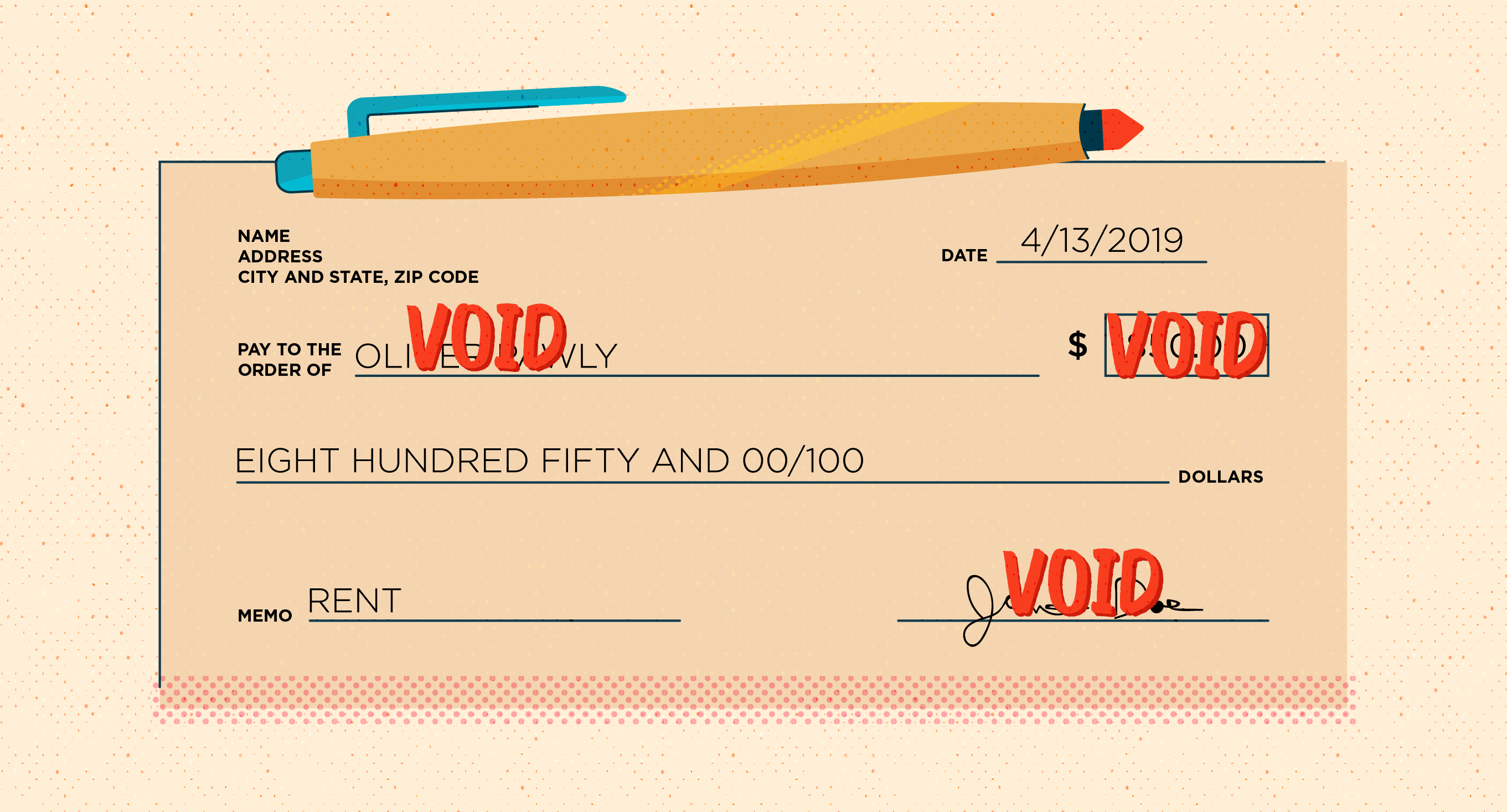

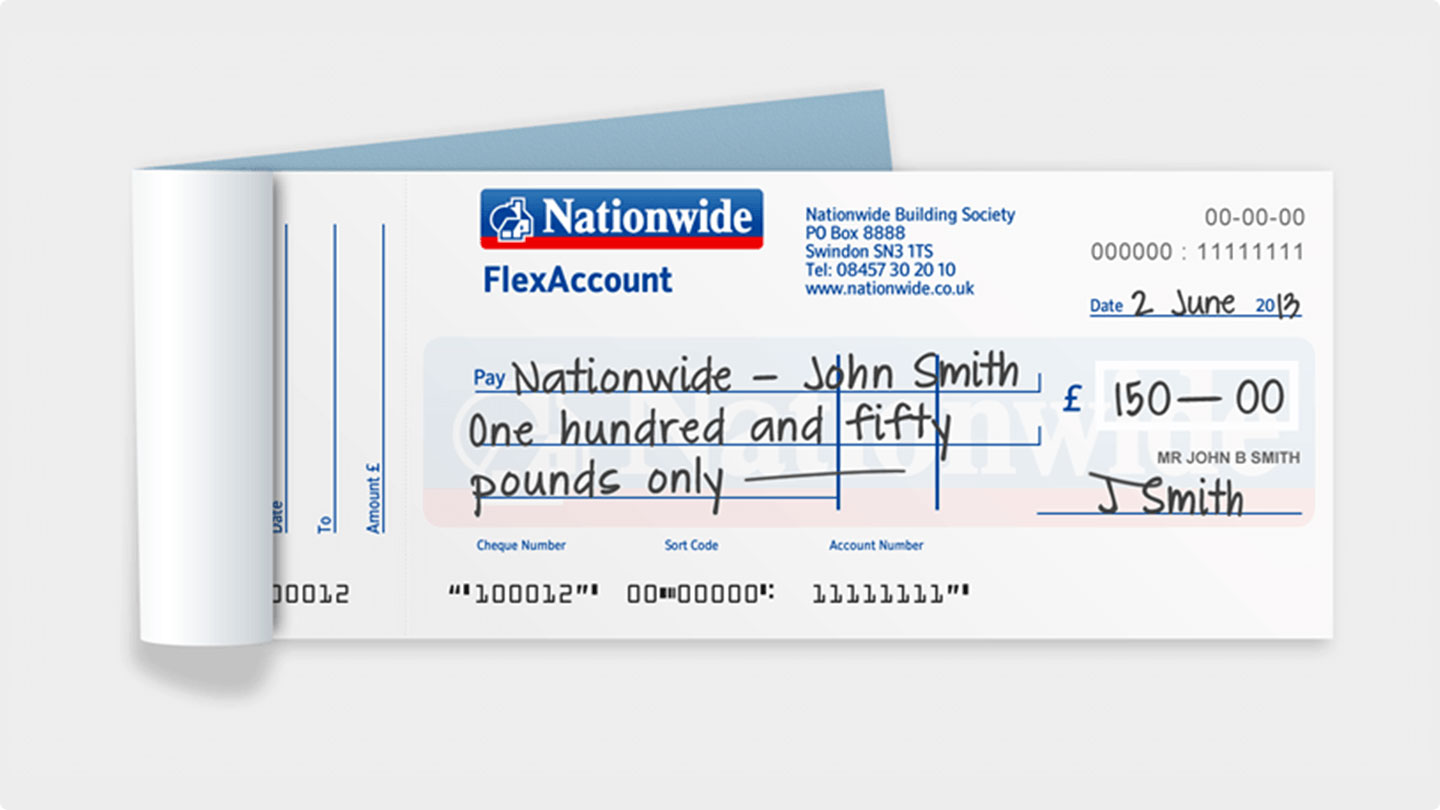

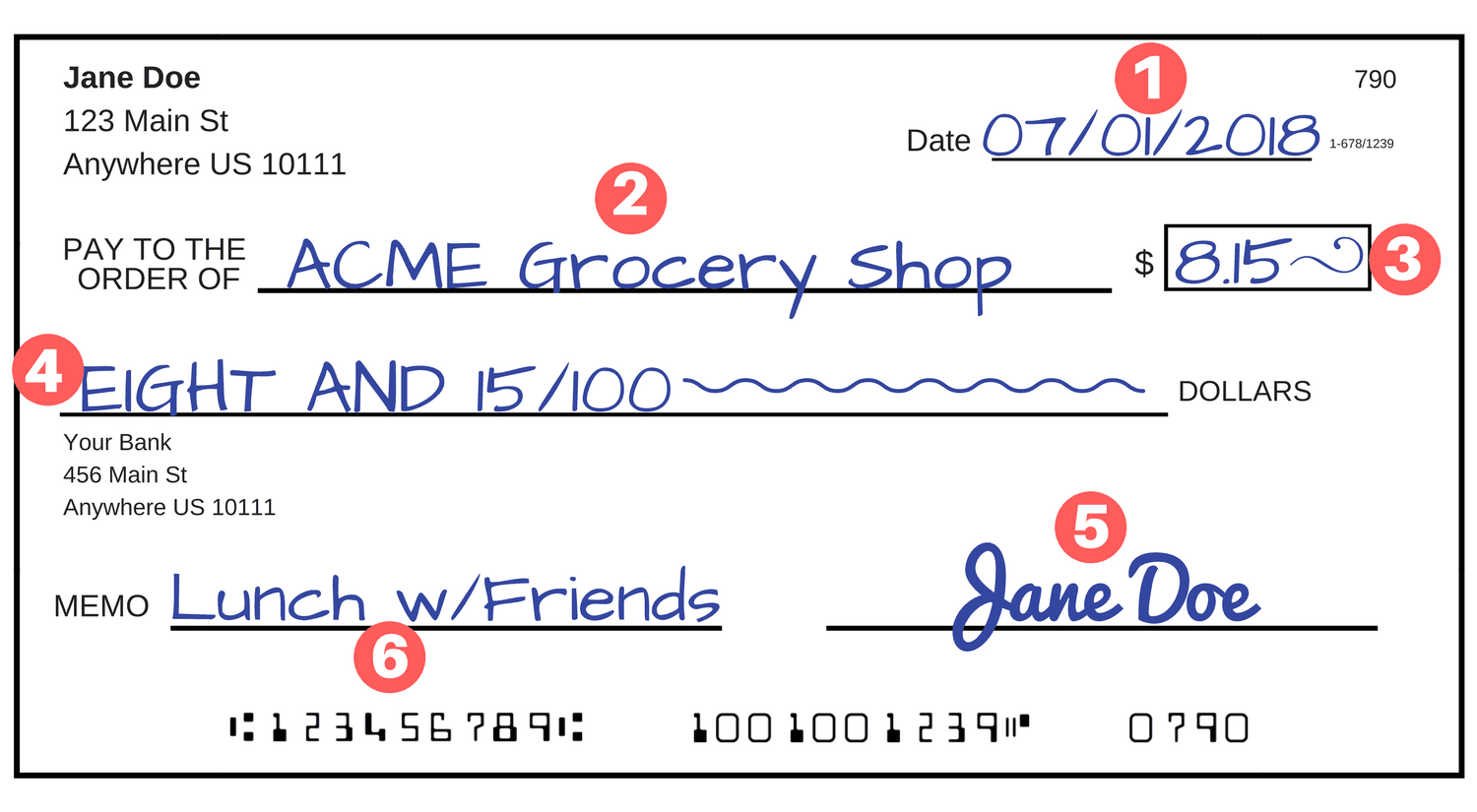

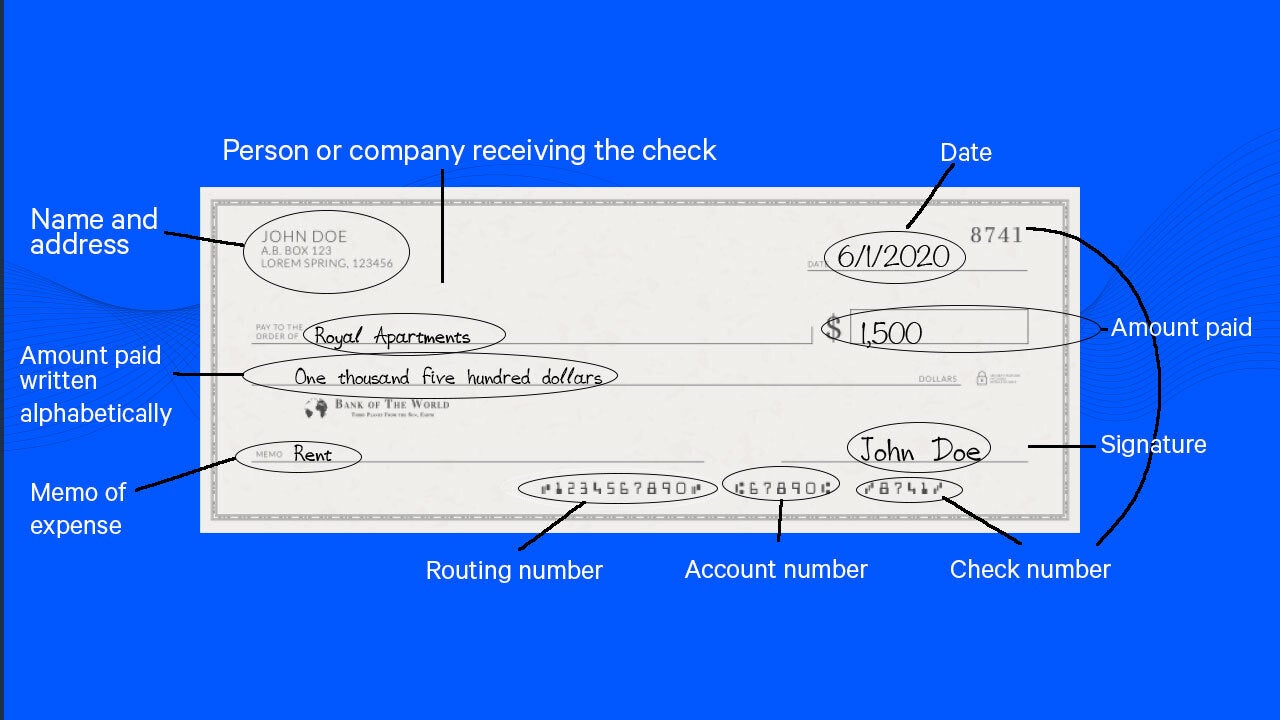

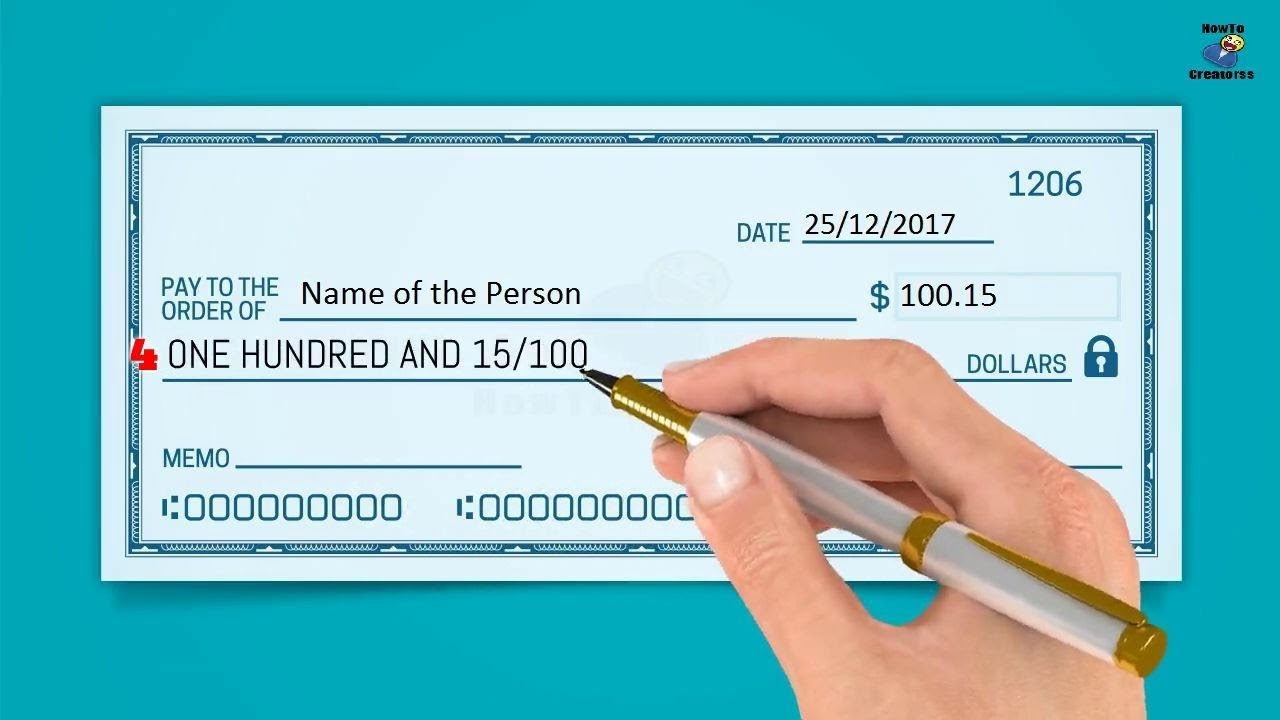

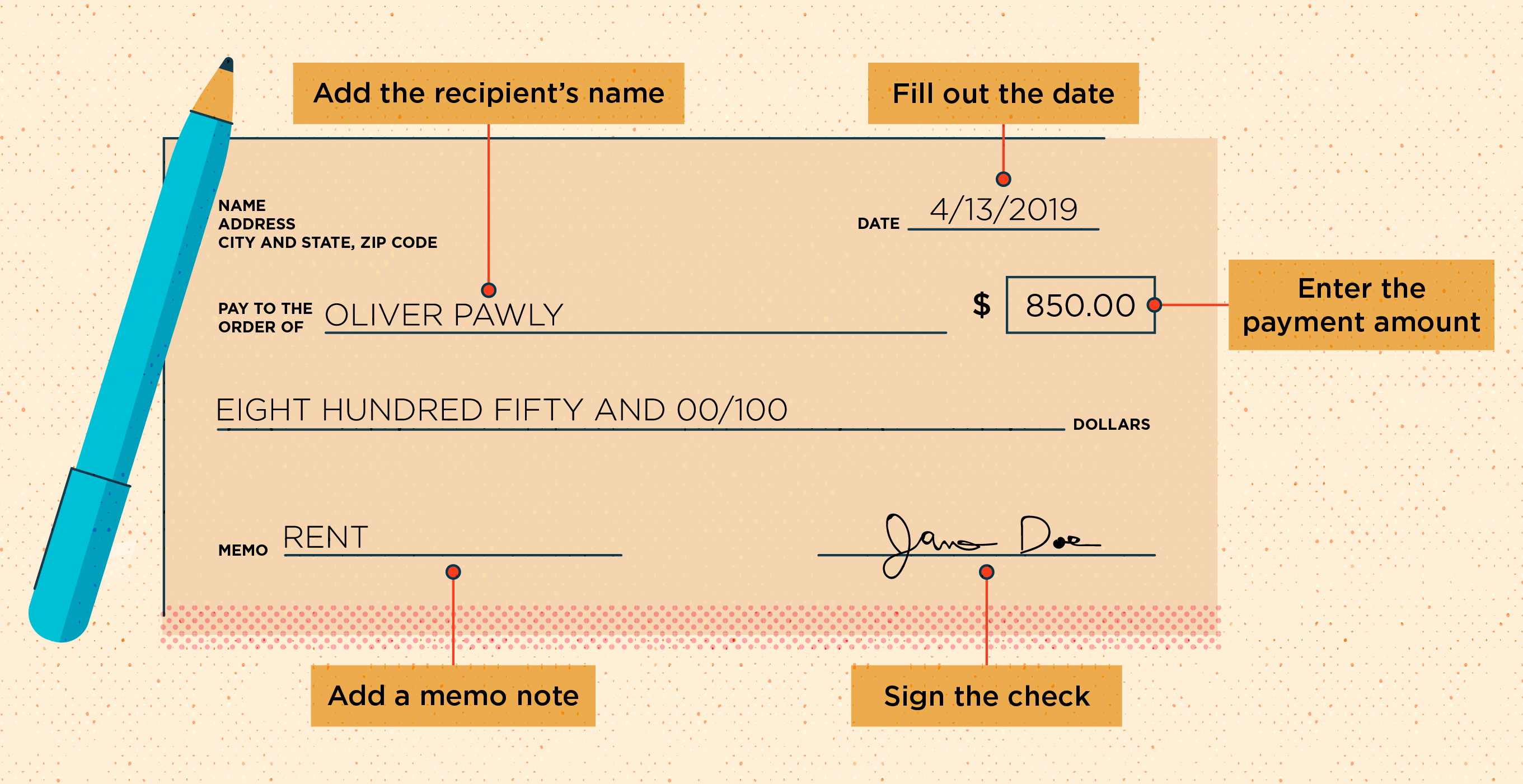

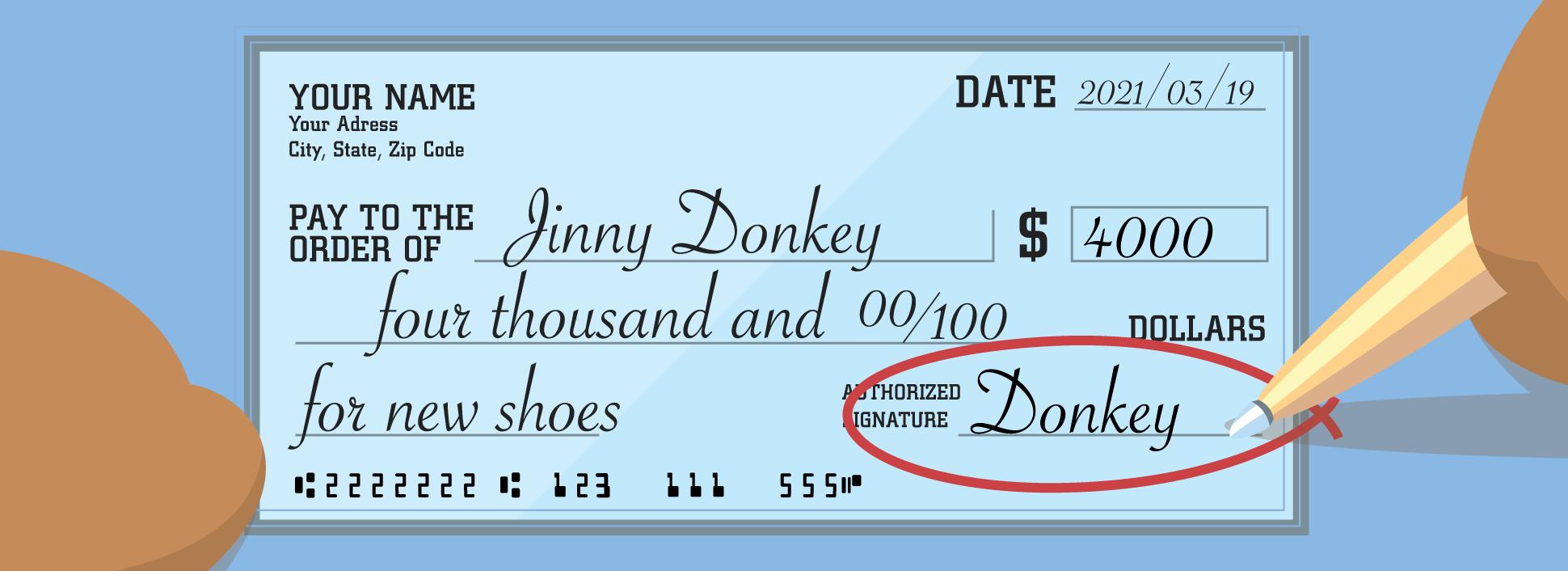

How To Write A Check To Someone – How To Write A Check To Someone

| Allowed to help my personal website, on this time We’ll explain to you in relation to How To Clean Ruggable. And from now on, here is the first photograph:

What about image previously mentioned? is usually that will wonderful???. if you think thus, I’l l show you many impression once more under:

So, if you would like get these incredible pictures regarding (How To Write A Check To Someone), simply click save button to download these shots to your laptop. There’re prepared for obtain, if you love and want to obtain it, simply click save symbol on the post, and it will be instantly saved to your laptop computer.} As a final point if you wish to get unique and the latest image related to (How To Write A Check To Someone), please follow us on google plus or book mark the site, we try our best to give you regular up-date with fresh and new pictures. Hope you like staying right here. For many upgrades and recent news about (How To Write A Check To Someone) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to give you up-date periodically with fresh and new pics, enjoy your exploring, and find the perfect for you.

Here you are at our site, articleabove (How To Write A Check To Someone) published . At this time we are excited to announce that we have discovered an awfullyinteresting nicheto be pointed out, namely (How To Write A Check To Someone) Lots of people searching for specifics of(How To Write A Check To Someone) and of course one of them is you, is not it?/how-to-write-a-check-4019395_FINAL-e110be521f9543f1ac0b4252c506c943.png)

/SeeHowtoEndorseChecks.WhenandHowtoSign-edit-c213a1e53f794813a7e327935ec0e63a.png)

/dotdash_Final_Routing_Number_vs_Account_Number_Whats_the_Difference_Aug_2020-8939d2501c14490e8d85b94088a0bec9-1130ab2dae1b495b8cff8d988ebc9440.jpg)