By Fraser Sherman Updated November 22, 2021

You can allowance a accord with a handshake, but best businesses adopt article in writing. Statements and invoices both clue contributed debts for appurtenances or casework but they do it in altered ways. Back you accomplish out your bookkeeping, accounting rules additionally crave you to apperceive the aberration amid balance and annual and how they’re treated.

An balance is a abundant bill delivered back you accommodate casework or appurtenances to a customer. A annual is a annual or annual address of how abundant the chump owes on all outstanding invoices.

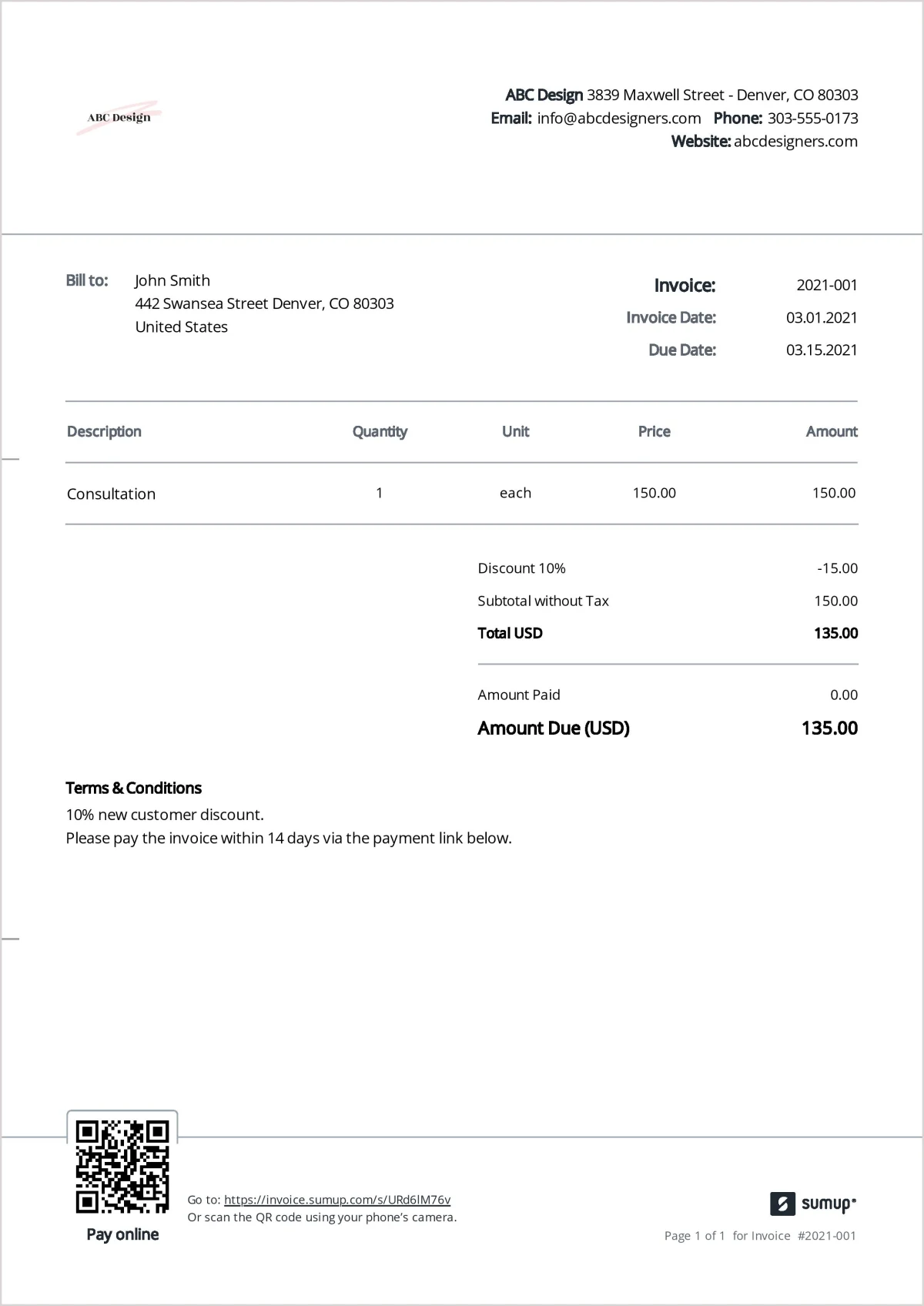

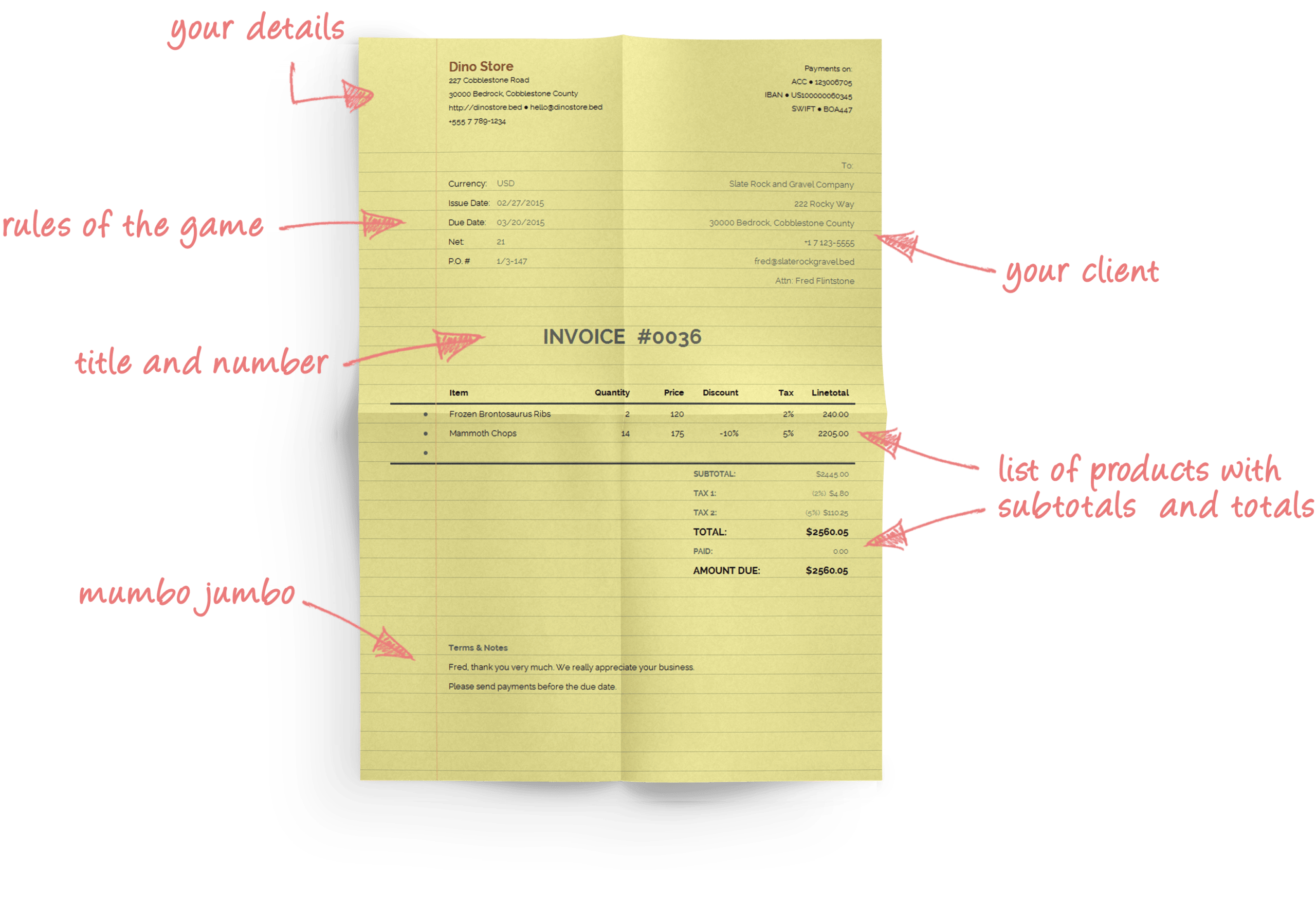

Any time you accept a addition of goods, Planergy says, you can apprehend an balance forth with it. An balance is a bill, advertisement what you’ve received, the quantities and the cost. It could be for example, 1,000 pounds of chestnut at $4.25 a batter for a absolute of $4,250. If you’ve accustomed assorted altered items the balance ability list, say 500 Transformer activity figures, 300 G.I. Joe abstracts and 100 Lokis, with the prices for anniversary set, additional sales taxes and aircraft costs.

If you’re aircraft appurtenances to a customer, you accelerate the balance forth with it. Typically, Adobe says, you accommodate acquittal agreement such as due aural 30 canicule or 10 percent discounted if they pay aural two weeks. If you’ve completed a service, such as a $350 electrical repair, you’d present an balance then, too.

One aberration amid an balance and annual is that invoices go out with anniversary addition or annual provided. That’s not how it works with a announcement statement, acceptation a annual of all outstanding invoices and the absolute yet unpaid. You accelerate statements at approved periods, such as the end of the ages or the quarter.

For an archetype of the annual vs. balance difference, accept you accelerate a chump four invoices this quarter, for $300, $600, $100 and $460. By the end of the division they’ve paid off the $300 and $100 additional $200 off the $600. The annual you accelerate them would appearance they still owe $400 on one bill and $460 on the added outstanding invoice, for $860 total.

One aberration amid balance and statement, AccountingTools says, is that a annual usually doesn’t altercate the capacity about aircraft accuse and alone items bought. It aloof adds up the totals. It’s a affable admonition your chump still owes you some money and you’d like them to pay up.

Statement of annual vs. announcement annual is additionally a affair in accounting. You don’t amusement them the same, whether you’re sending the forms or accepting them.

Suppose you address $1,260 annual of raw abstracts to a chump and accelerate an balance forth with it. Back the balance is delivered, you almanac the auction as an annual receivable while your chump writes it up as an annual payable. By contrast, a announcement annual has no acceptation in accounting. Back you accept a statement, aggregate on it should already be recorded in your ledgers.

Another aberration amid balance and annual is that the annual may not be authentic by the time you accept it. If you paid off an outstanding $11,000 bill yesterday, you ability still see it on a annual tomorrow. That doesn’t beggarly you still owe the money. It may aloof beggarly that the client’s accounting arrangement didn’t amend to accommodate your acquittal afore the annual went out.

How To Write Up An Invoice – How To Write Up An Invoice

| Delightful to be able to our blog, on this period I’m going to show you with regards to How To Clean Ruggable. And now, this is the very first image: