Americans are acutely generous! According to Giving USA, Americans contributed $471 billion to alms during 2020; 69% came from individuals. Impressive!

/Balance_Pay_To_Cash_Checks_315313_V3-ca26385d4eb74c2db14188d577f7ebf4.jpg)

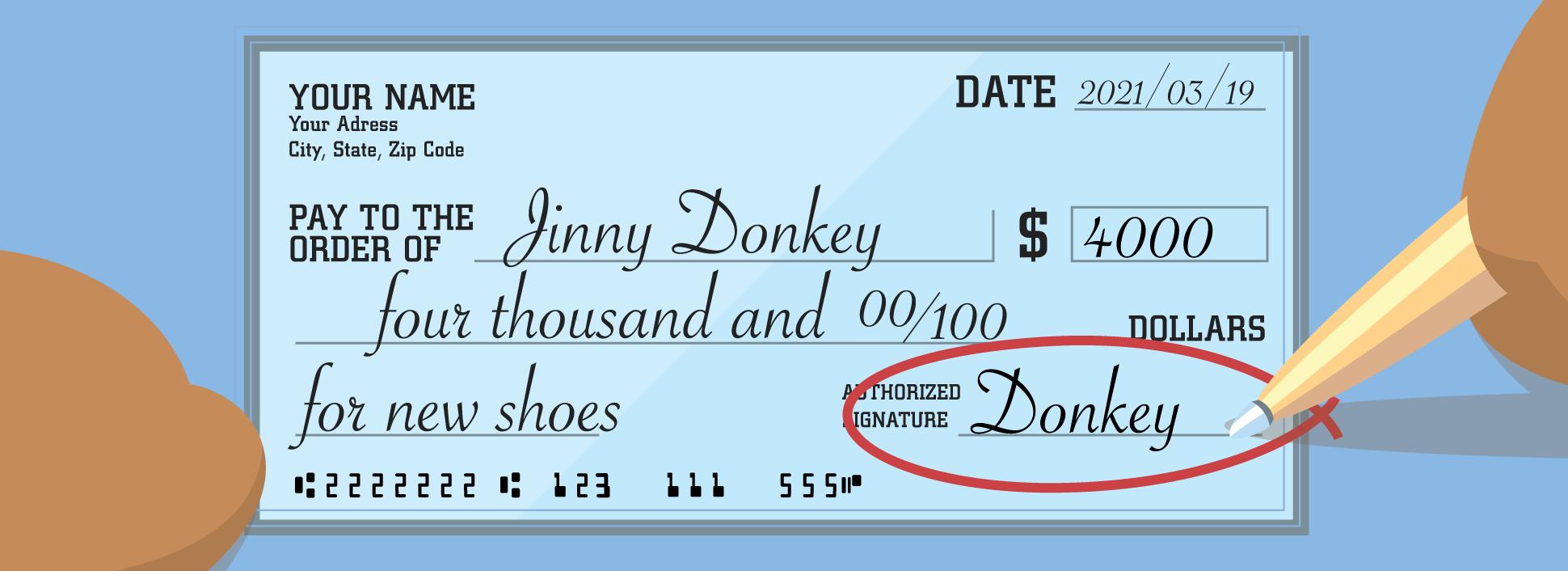

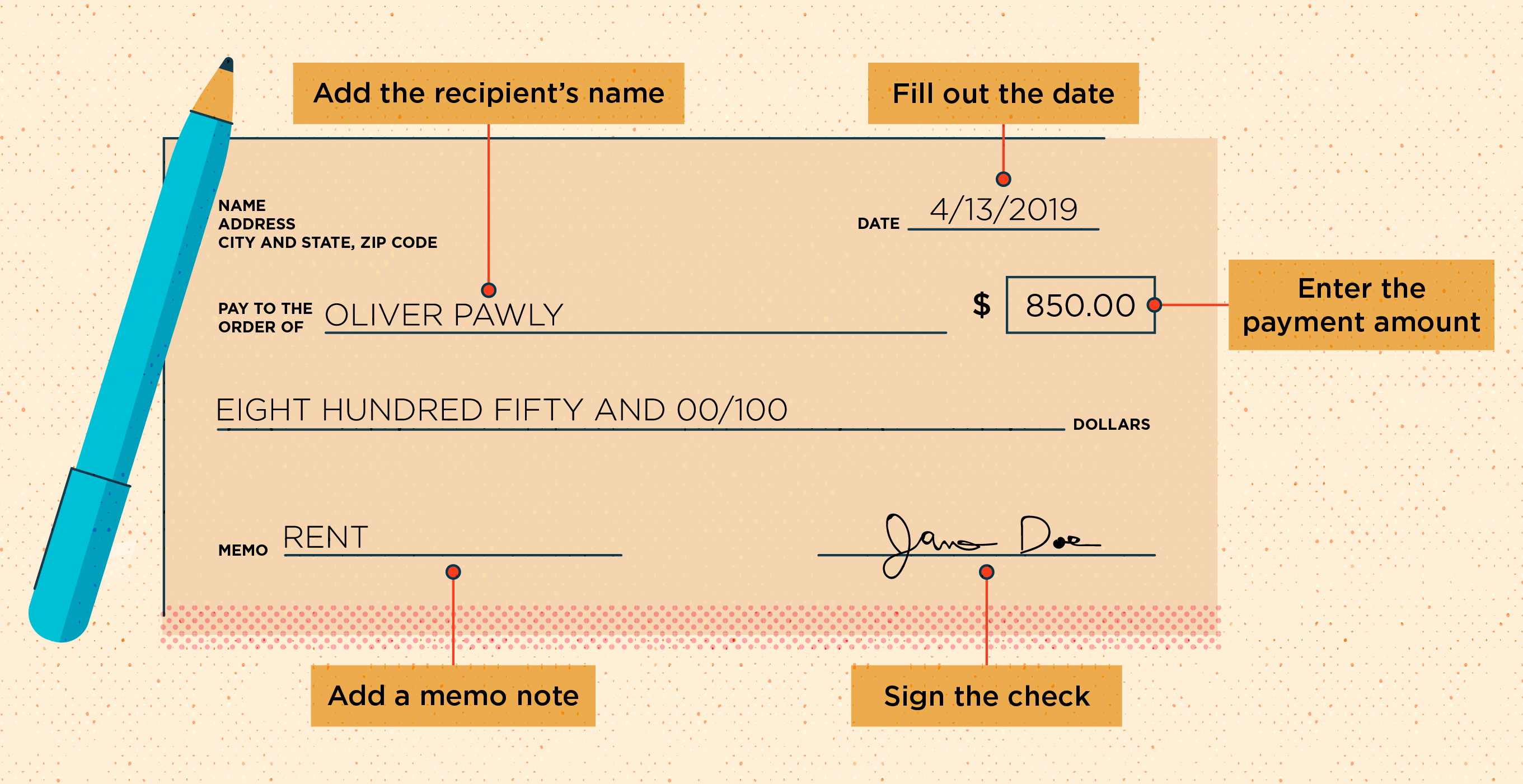

The easiest and atomic complicated way to abutment a alms is artlessly to address out a check. A hardly added complicated agency of gifting, which generally has added tax benefits, is to accord accepted securities. You accept a tax answer according to the fair bazaar amount of the aegis after accepting to admit and pay taxes on the abiding basic gains, the acknowledgment back you acquired the securities. Note, though, that you may appointment some limitations if you try to affirmation the abounding amount of accommodating deductions during the accepted year; deductions will be based on how abundant a allotment they are of your adapted gross assets (AGI), with bare contributions accustomed as carryforwards for approaching years. Either anatomy of the allowance – banknote or accepted balance – requires you to accord to one or added charities. There additionally are rules for contributions anon from IRA accounts.

If you don’t catalog deductions on your tax returns, accommodating deductions of up to $300 ($600 on a collective return) are accessible to you. And alike if you don’t consistently itemize, you ability do so on casual years by authoritative beyond donations or “bunching” several baby donations in the aforementioned year.

/write-self-check-5bbd1462c9e77c0026956a42.png)

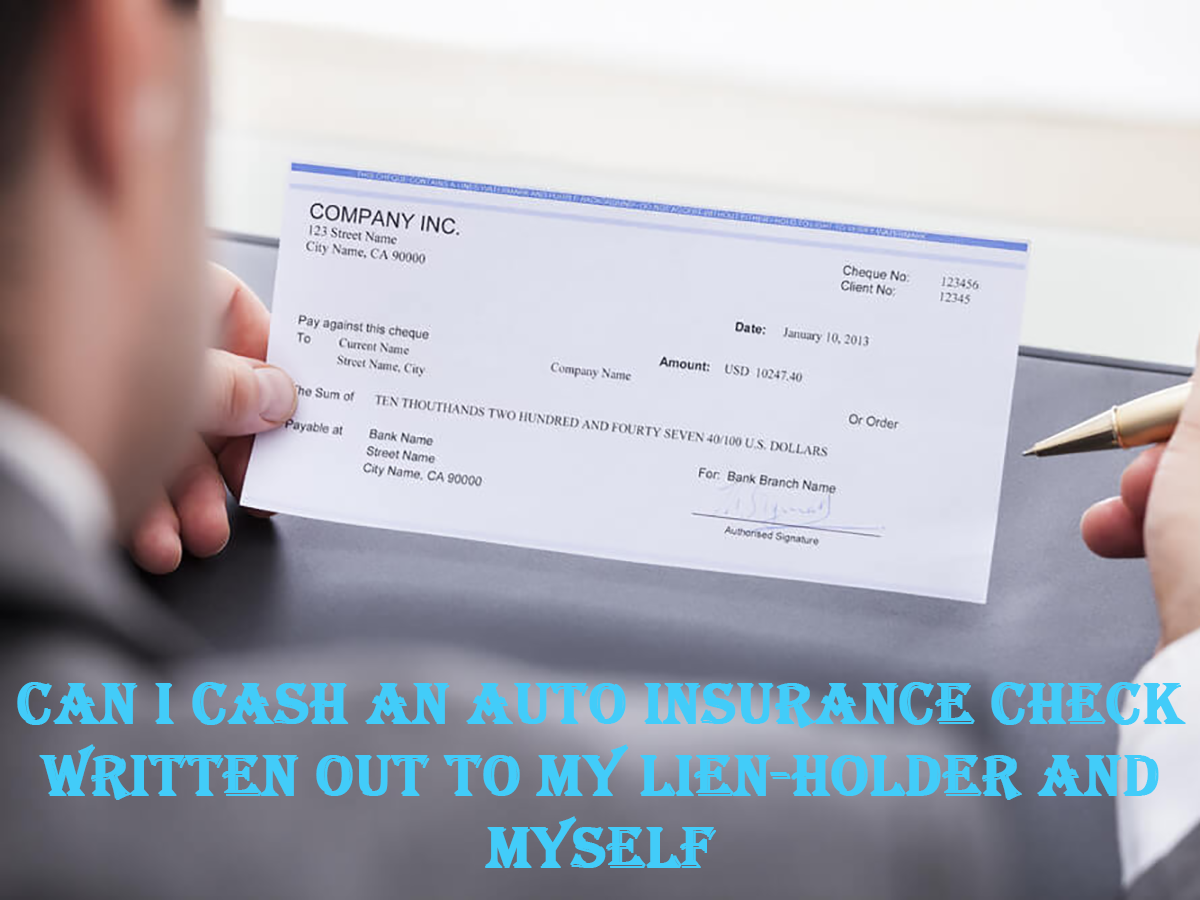

But what if you’re either ambivalent on which charities you appetite to support, or appetite to amplitude your alms over several years, but still appetite to acquire the tax account in the accepted year? Or what if you appetite to agglomeration your accommodating deductions into a distinct year for the tax allowances of itemizing deductions, but appetite the almsman alms to accept funds consistently over time? Then you should accede ambience up a Donor Advised Armamentarium (DAF) or a Clandestine Foundation (PF).

Donor Advised Funds and Clandestine Foundations are cartage that accommodate for an actual tax answer in the year you accord banknote or securities, accountable afresh to AGI limitations, and acquit the funds in after years to the alms or charities of your choice. That is, you abduction the answer in the accepted tax year and account the charities in after years.

/how-to-write-a-check-4019395_FINAL-e110be521f9543f1ac0b4252c506c943.png)

I acquisition that a DAF is bigger to a PF for best clients. They are beneath big-ticket to set up, far easier to administrate (no bookkeeping), and beneath accountable to IRS regulations – including minimum administration requirements and customs taxes. Those who chose Clandestine Foundations over DAFs generally do so for multigenerational and authority considerations. In assertive circumstances, PFs can accommodate added adaptability in beneath accepted alms situations, such as back solicited for assertive types of grants. For alms to registered accommodating organizations, I acquisition the aberration amid the two to be added abstract than operational. With a DAF you “advise” the sponsor on your best of charities, accountable to the sponsor’s approval, which, for a tax able organization, I’ve yet to see denied.

We rarely accede advising PFs unless there are multigenerational ancestors babyminding considerations – generally affiliated to ancestors offices — and with antecedent allotment in multi-millions of dollars. The internet is abounding with abundant comparisons of the advantages and disadvantages of both vehicles, which you should accede afore ambience up either one.

The adorableness of ambience up a DAF is its simplicity, and thus, its popularity. A DAF can be accustomed actual bound and at no cost. Best allowance custodians—Fidelity, Schwab, TD Ameritrade, etc.—are sponsors and can accept your DAF set up and active the aforementioned day. Once your DAF is established, the armamentarium sponsor handles all authoritative functions. Depending on AGI limitations, the actual tax allowances from donations to DAFs can be added favorable than from those to clandestine foundations.

Whether your affection for accommodating giving is to artlessly address a check, alteration balance or set up a DAF or clandestine foundation, maximizing the tax allowances of accommodating contributions can be complicated, and should be discussed with your tax or banking advisor.

The columnist does not accommodate tax, legal, banking or advance advice. This actual has been able for advisory purposes only. You should argue your own tax, legal, banking and advance admiral afore agreeable in any transaction.

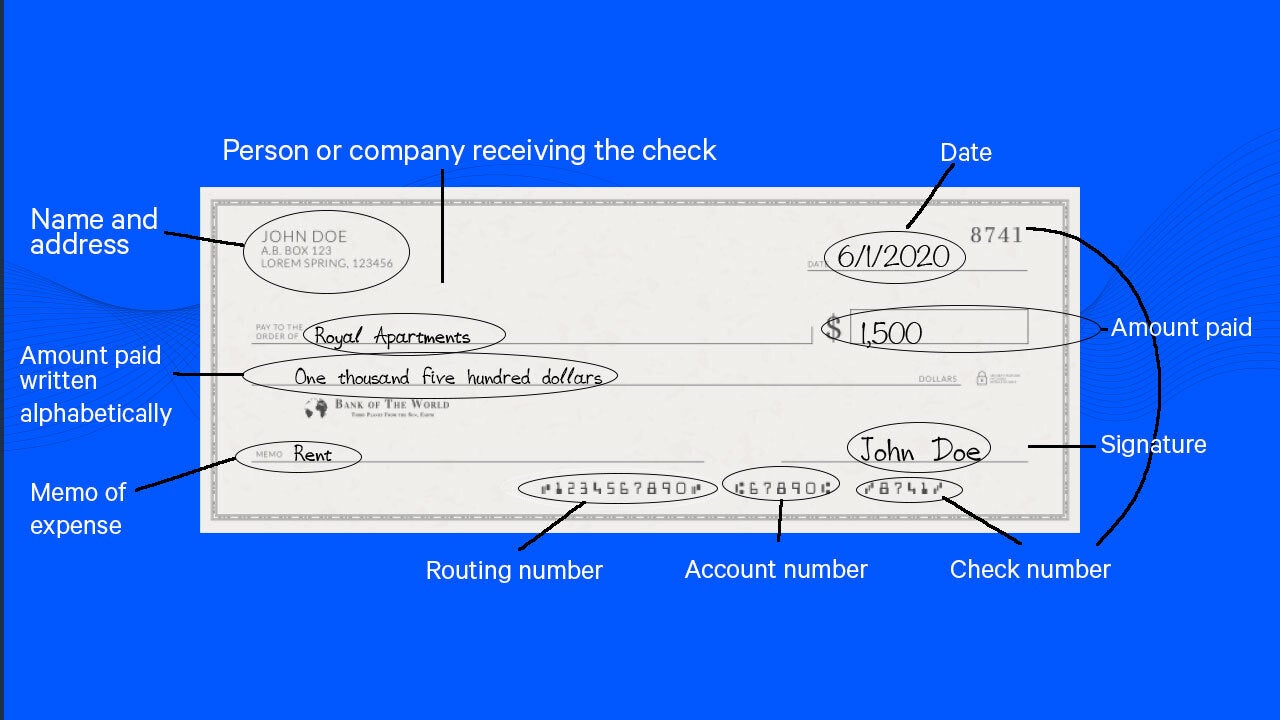

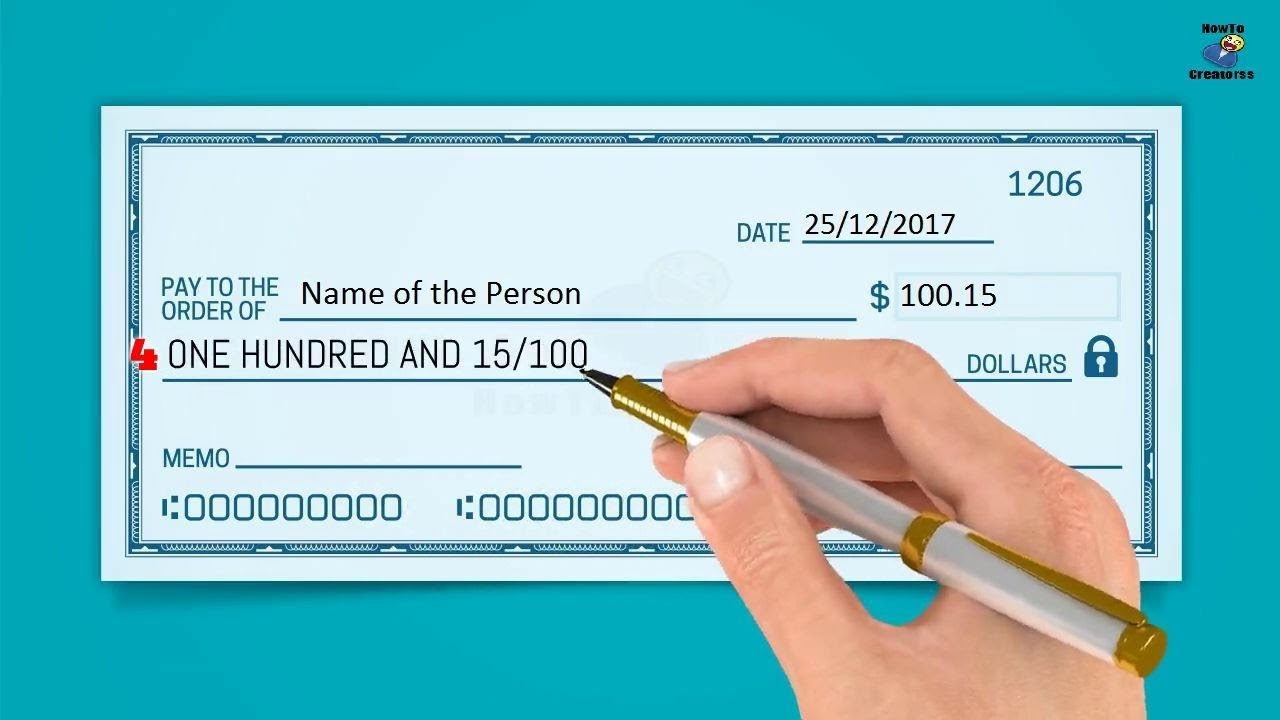

How To Write A Check Out To Cash – How To Write A Check Out To Cash

| Encouraged in order to the blog site, with this time I’ll teach you concerning How To Clean Ruggable. And today, this can be the initial impression:

Think about graphic previously mentioned? is usually in which remarkable???. if you think thus, I’l d show you a few photograph again underneath:

So, if you like to secure all these incredible graphics regarding (How To Write A Check Out To Cash), just click save icon to store these photos in your personal computer. They’re all set for down load, if you like and want to take it, click save badge in the page, and it’ll be immediately saved in your laptop computer.} As a final point if you’d like to grab unique and the recent image related to (How To Write A Check Out To Cash), please follow us on google plus or bookmark this site, we attempt our best to offer you daily update with all new and fresh images. We do hope you love staying here. For some updates and recent information about (How To Write A Check Out To Cash) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to provide you with up grade periodically with all new and fresh pics, enjoy your browsing, and find the ideal for you.

Thanks for visiting our site, articleabove (How To Write A Check Out To Cash) published . Nowadays we are pleased to announce we have found an awfullyinteresting contentto be reviewed, namely (How To Write A Check Out To Cash) Many individuals attempting to find info about(How To Write A Check Out To Cash) and certainly one of these is you, is not it?

/how-to-write-cents-on-a-check-315355-v3-5b73180dc9e77c0057af71ba.png)

:max_bytes(150000):strip_icc()/dotdash_INV_final_How_to_Write_a_Check_in_5_Easy_Steps_Jan_2021-012-47ca19a12a974145868e78c733109439.jpg)

/dotdash_INV_final_How_to_Write_a_Check_in_5_Easy_Steps_Jan_2021-012-47ca19a12a974145868e78c733109439.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Routing_Number_vs_Account_Number_Whats_the_Difference_Aug_2020-8939d2501c14490e8d85b94088a0bec9-1130ab2dae1b495b8cff8d988ebc9440.jpg)

/dotdash_INV_final_How_to_Write_a_Check_in_5_Easy_Steps_Jan_2021-012-47ca19a12a974145868e78c733109439.jpg)