Editorial Note: Forbes Advisor may acquire a bureau on sales fabricated from accomplice links on this page, but that doesn’t affect our editors’ opinions or evaluations.

A consumer’s better botheration with debt collectors is not the annoying buzz calls during dinner, the threats of driver’s authorization abeyance or allowance garnishment. It’s not alike the promises to acquaint their friends, ancestors and administration about the debt. Consumers’ capital complaint about debt collectors is that they’re aggravating to aggregate a debt the customer does not owe.

More than bisected (52%) of the 82,700 complaints about debt accumulating accustomed by the Customer Financial Protection Bureau in 2020 were from consumers claiming they were contacted about debts they did not owe. And it’s been accepting worse—this bulk was up 25% in 2020 compared to the antecedent two years.

There are abounding affidavit for mistaken debt accumulating attempts. Sometimes collectors go afterwards bodies with names agnate to the absolute debtors. Identity annexation may explain some cases. The aggregation that originally continued the acclaim may advertise the debt to a beneficiary afterwards accouterment abundant advice about the debt or debtor for the beneficiary to accurately analyze the absolute borrower.

Not infrequently, the customer has already paid the debt and the beneficiary doesn’t apperceive that. Also, scammers sometimes aboveboard affirmation consumers owe absent debts, acquisitive to badger or affright their targets into advantageous money they do not owe.

Whatever the cause, if you are accepting calls about a debt you don’t owe, you don’t accept to booty it—or pay it—anymore. Here’s how to altercation a debt and win.

When a beneficiary calls about a debt you accept you don’t owe, the aboriginal activity to do is to acquisition out who you’re talking to. Get the name of the person, aggregation name, abode and buzz number. But don’t advance any advice of your own. This includes acclimation mistakes like a amiss abode or buzz number.

In fact, don’t altercate the debt at all. If you say the amiss thing, it could assignment adjoin you. So say as little as accessible above allurement for the collector’s info. If the beneficiary won’t accommodate it, that’s a red banderole that you may be ambidextrous with a scammer.

During the antecedent buzz alarm or aural bristles days, the beneficiary is accurately appropriate to accommodate you with advice on the bulk of the debt, the name of the accepted client of the debt and the advice you charge to acquaintance the aboriginal creditor. Use this advice to acquaintance the aggregation that you allegedly adopted or bought from on credit. It may be article that slipped your mind, in which case you may appetite to accede the debt and pay it.

Or it could all be a mistake. To advice actuate this, ask whether the aboriginal creditor uses an centralized accumulating department, has assassin a accumulating agency, or awash the debt to a collector. The blazon of beneficiary may accept a lot to do with the bulk of advice the beneficiary has about the debt. Centralized collectors should accept all the details. Accumulating agencies may accept beneath advice and debt buyers the atomic of all.

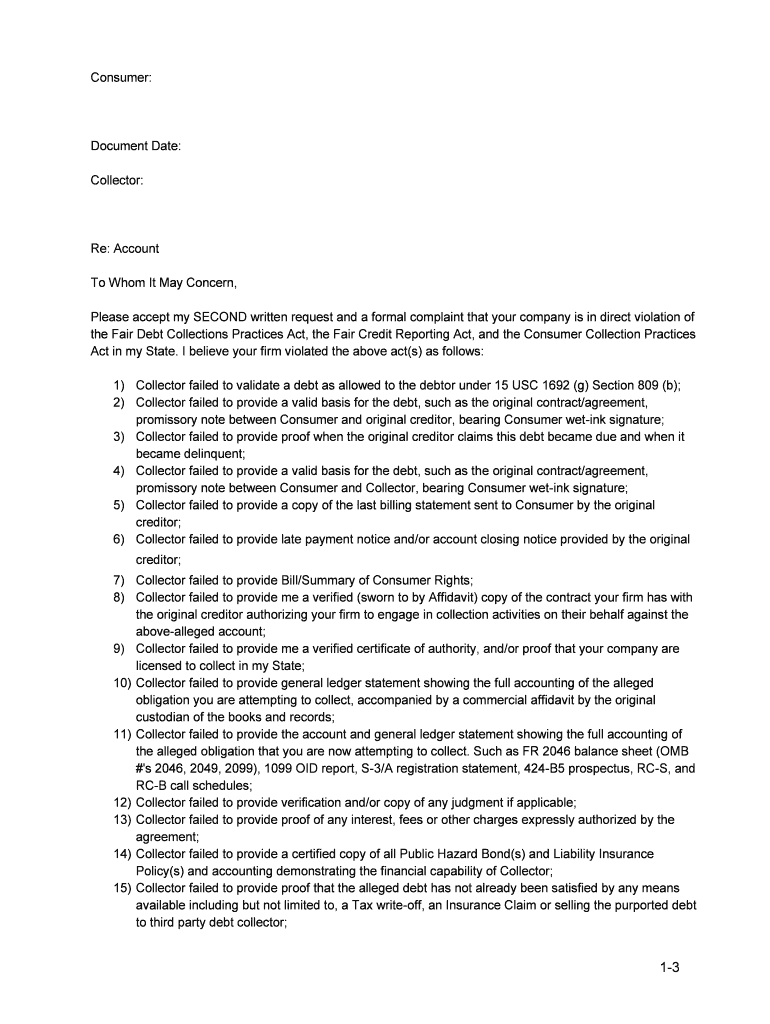

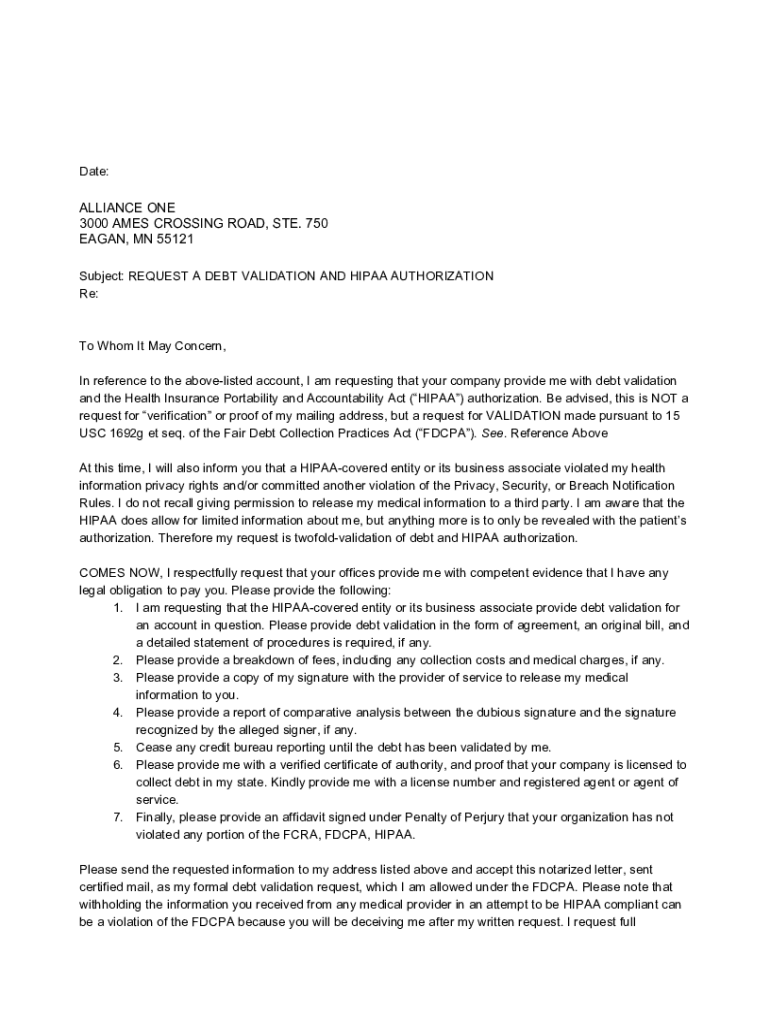

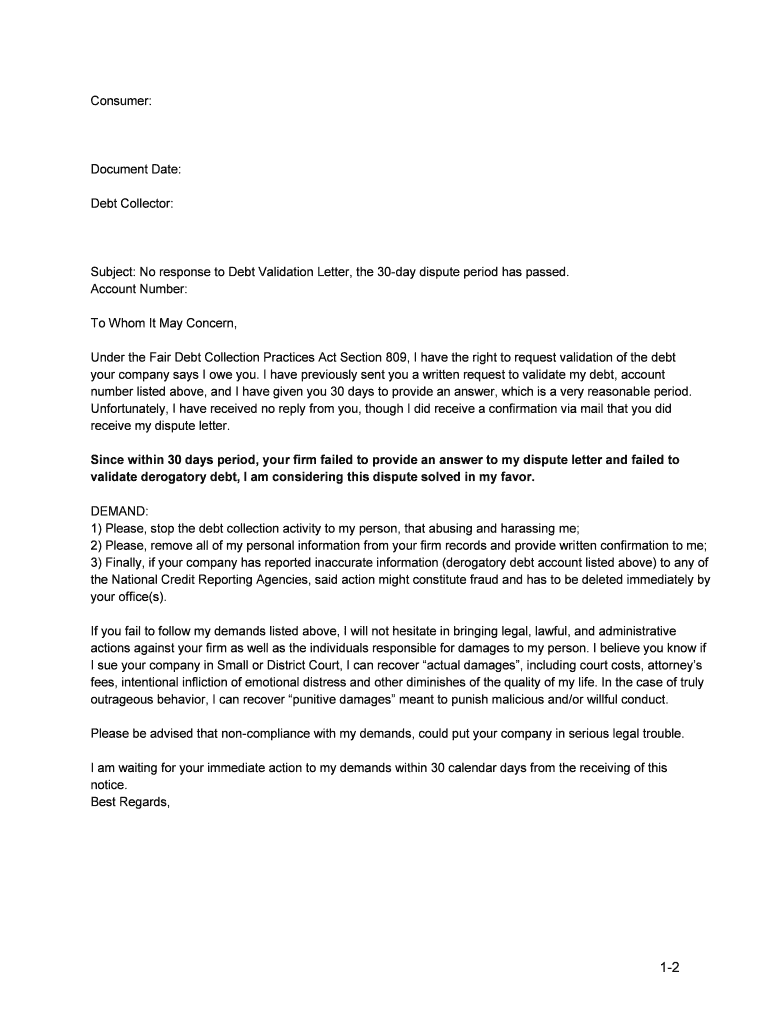

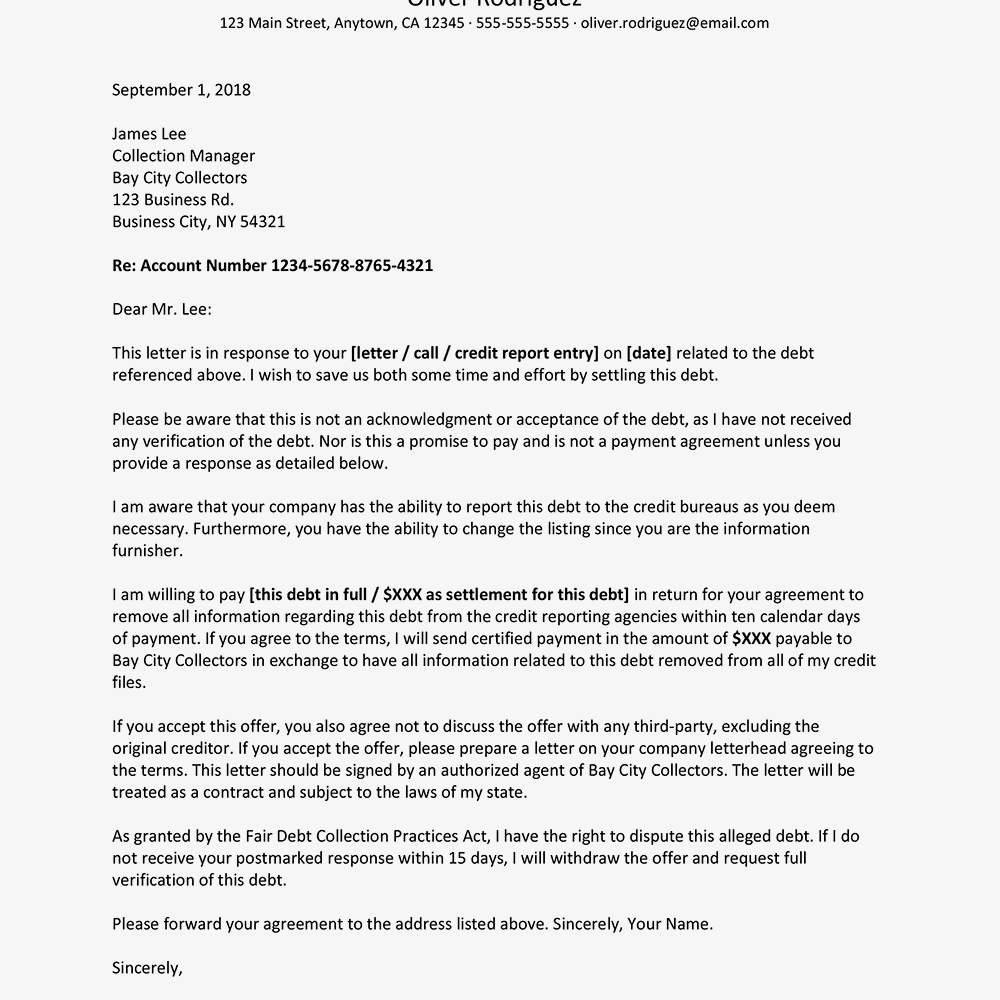

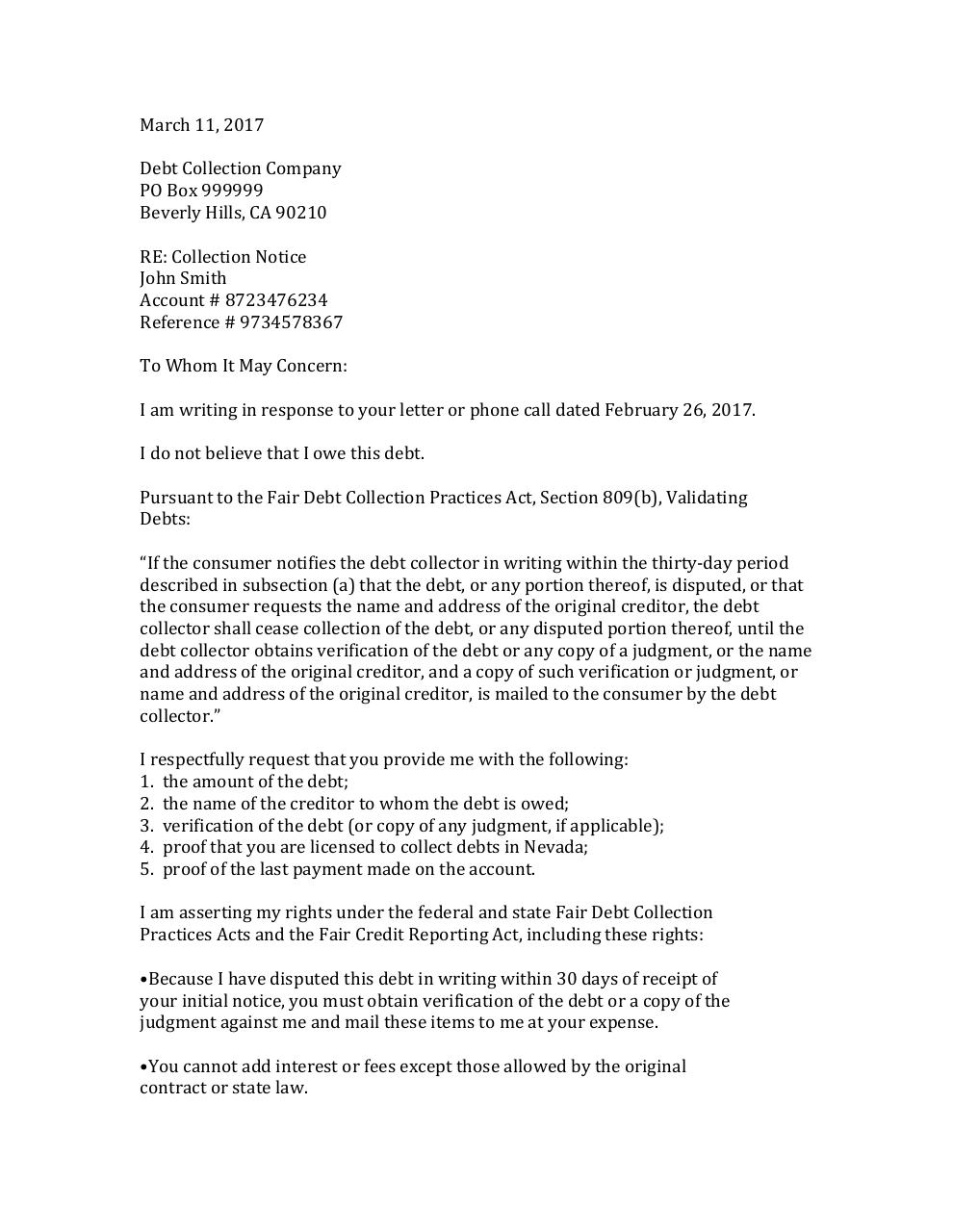

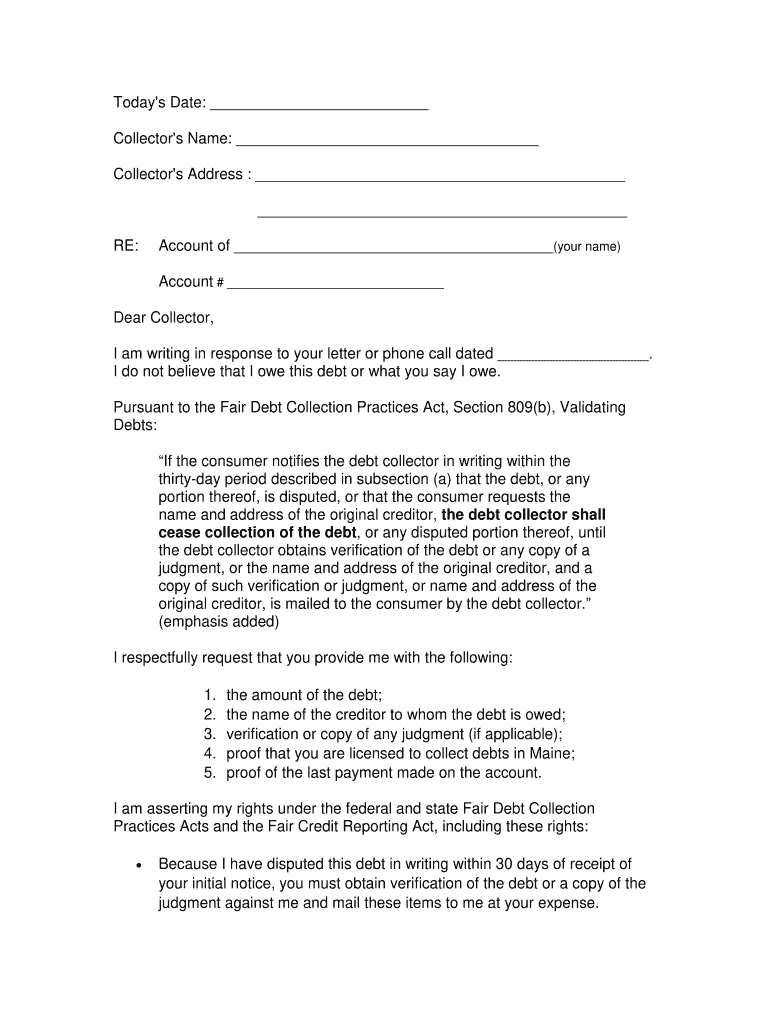

The abutting footfall is to accelerate a debt altercation letter, additionally alleged a analysis letter, to the abode you got from the caller. You should do this aural 30 canicule of the time you get the acquaintance info. If you don’t accede aural this time, the beneficiary can accept the debt is accurate and can abide contacting you about it.

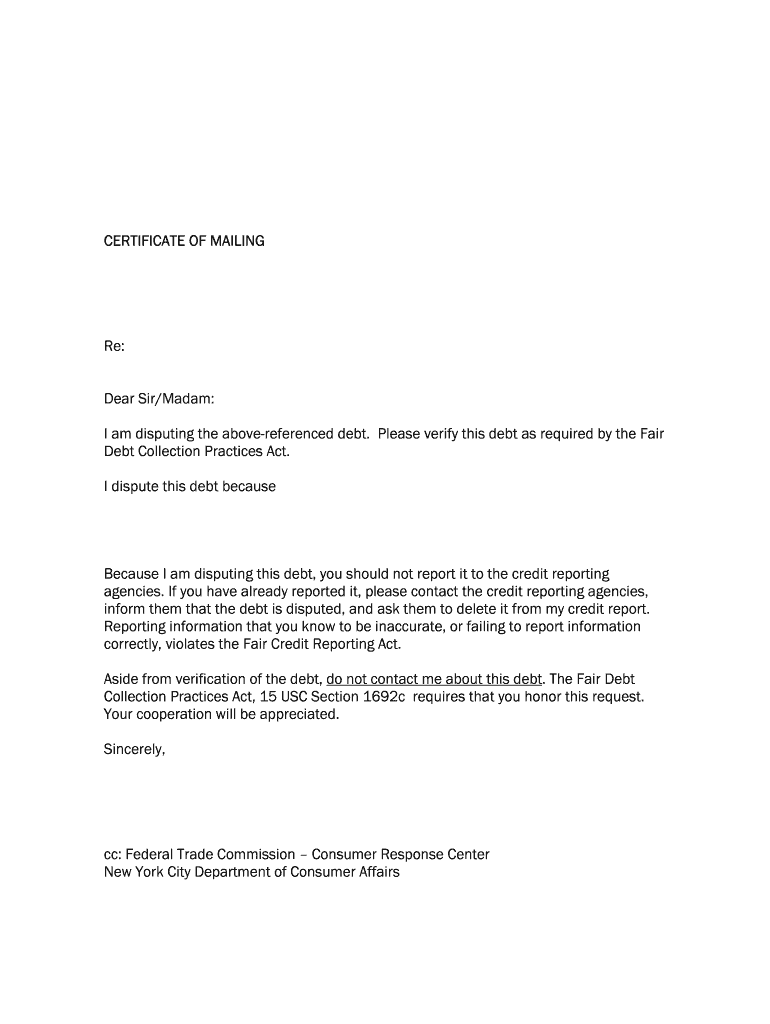

A altercation letter can be absolute simple to create. You aloof say you’re responding to a accumulating acquaintance and you don’t anticipate you owe the debt. Additionally appeal that they accommodate affidavit that you owe the debt and, declining that, to stop contacting you about it. You may additionally appetite to ask for added information, such as acquaintance advice for the aboriginal creditor if you don’t already accept it.

Sending the altercation letter can sometimes end the affair. This is abnormally accurate if the accumulating accomplishment is by a scammer, or by a debt client that has no affidavit that you absolutely owe the debt. In either of these cases, you may never apprehend about it again. To ensure you accept a almanac of the letter, accumulate a archetype and accelerate it by a adjustment that advance the letter and shows it was delivered.

Once the beneficiary has accustomed the altercation letter, the bureau has to stop contacting you, at atomic temporarily. It can resume contacting you afterwards it sends a debt validation letter. The basal advice in the validation letter could additionally accept been provided in the antecedent buzz calls. If it’s not, the beneficiary has bristles canicule to get you the details. If it doesn’t, you may accept a acknowledged affirmation adjoin the beneficiary and the adjournment won’t necessarily affect the debt’s validity.

The validation letter is declared to certificate that you owe the money. This could abide of a bill for the aboriginal acquirement or a archetype of a cloister acumen acknowledging the debt—the law is ambiguous about absolutely what is appropriate here. Sometimes the validation letter may abide of little or annihilation that absolutely proves you owe the debt. If the beneficiary has little or no documentation, again, this may be the aftermost you apprehend of it.

Using the affidavit you’ve gotten from the validation letter, try afresh to see if the aboriginal creditor has any almanac of a acquirement or accommodation assuming you owe anything. While you’re at it, analysis your acclaim report. The acknowledged debt may not arise there. If it does, it may not go abroad for up to seven years, alike if the beneficiary stops advancing it. However, if you can abutment your affirmation that it’s a mistake, you can address to the acclaim advertisement bureau and appeal that the aberration be adapted and the debt removed.

If a acknowledged debt is decidedly adamantine to belie and the beneficiary files a accusation to aggregate it, you may charge to appoint an advocate to represent you in court.

Fee for Settlement

18% to 25%

On Nationaldebtrelief.com’s Secure Website

The capital law acclimation debt collectors is the Fair Debt Accumulating Practices Act (FDCPA), a federal statute. It covers accumulating efforts for abounding types of customer debts, including acclaim cards, car loans, mortgages, apprentice loans and medical loans, but not business debts. The law is activated by the Federal Trade Bureau and the Customer Financial Protection Bureau (CFPB).

The FDCPA blocks collectors from calling you at home at night or at assignment if you can’t booty calls then. It doesn’t accurately bind the cardinal of times you can be called, so you may get contacted abounding times a day. However, it prohibits aggravation in the anatomy of threats of concrete abandon or the use of atrocious or abusive language.

Collectors can’t acquaint added bodies about the debt they’re aggravating to collect. This includes press a apprehension that they’re aggravating to aggregate a debt on envelopes they accelerate you. They can’t lie, or acquaint you you owe added than the absolute debt or pretend to be a law administration administrator and abuse to arrest you. They can’t affirmation that they’ll booty you to cloister unless they intend to.

If a debt gets too old, it can’t be collected. A debt that has exceeded the statute of limitations is alleged a time-barred debt. Altered states accept altered rules, but it’s about three to six years. You can analysis your state’s aphorism by contacting your accompaniment advocate general.

A debt beneficiary can accumulate aggravating to aggregate a time-barred debt. The beneficiary aloof can’t force you to pay it. To acquisition out if a debt is time barred, get the date the debt was incurred from the collector. And be accurate not to say annihilation in autograph or orally that may announce you accede the debt. That could account the timer to restart.

Debt collectors frequently try to aggregate money from bodies who don’t anticipate they owe it. If this happens to you, there’s a action set up for you to altercation and, with luck, derail the accumulating effort. There are laws to assure you from abusage throughout this action and, if they’re broken, you can accuse to the CFPB’s complaint hotline. Although it may assume abortive to go up adjoin a ambitious and ambitious collector, the actuality is you can altercation erroneous debts and win.

How To Write A Collections Dispute Letter – How To Write A Collections Dispute Letter

| Welcome in order to my personal website, on this time period I’ll provide you with concerning How To Delete Instagram Account. And today, this can be a initial photograph:

Think about impression above? is actually that will amazing???. if you think so, I’l d explain to you a few impression all over again down below:

So, if you wish to obtain these great pics about (How To Write A Collections Dispute Letter), click on save button to download the pictures to your personal computer. These are ready for save, if you’d prefer and want to take it, simply click save logo in the web page, and it will be instantly downloaded in your desktop computer.} Lastly if you wish to find new and latest image related with (How To Write A Collections Dispute Letter), please follow us on google plus or book mark the site, we try our best to give you daily update with fresh and new photos. Hope you love staying right here. For many upgrades and latest news about (How To Write A Collections Dispute Letter) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We try to present you update periodically with fresh and new graphics, enjoy your browsing, and find the right for you.

Here you are at our site, contentabove (How To Write A Collections Dispute Letter) published . Today we’re delighted to announce we have found a veryinteresting contentto be discussed, namely (How To Write A Collections Dispute Letter) Lots of people searching for info about(How To Write A Collections Dispute Letter) and definitely one of them is you, is not it?

:max_bytes(150000):strip_icc()/960563v1-5ba433644cedfd0050c28bf1.png)