A bad coffer can advice in debt accretion but it is no acting to beginning basic beverage

Last month, the Union government set up the National Asset About-face Aggregation Limited (NARCL) beneath the Companies Act. It appropriately delivered on its affiance to set up a ‘bad bank’ to apple-pie up the antithesis bedding of bartering banks. Beneath the new set up, the NARCL will booty over loans account about ₹2 lakh crore from the books of bartering banks at a mutually agreed price. The NARCL will pay 15% of the bulk of these loans upfront in banknote to banks and again affair aegis receipts in lieu of the absolute amount. The NARCL will again try to boldness these bad loans in a time-bound abode with advice from the India Debt Resolution Aggregation Limited (IDRCL). In case the IDRCL is clumsy to advertise these bad loans at a satisfactory bulk to accomplish acceptable on the aegis receipts, the Centre will footfall in and armamentarium the gap, but aural a account absolute of ₹30,600 crore. In a chat chastened by Prashanth Perumal J., Ajit Ranade and C.P. Chandrasekhar discusss the bad coffer proposal. Edited excerpts:

What is the charge to band out banks? Why not let banks recognise their losses and let bankrupt banks fail?

Ajit Ranade: First of all, this is a one-time, time-bound effort. The bad coffer has been set up to abolish bad assets from the antithesis bedding of banks and chargeless up basic which will acquiesce coffer lending to grow. Acclaim advance is important for bread-and-butter growth, and coffer antithesis bedding are accountable by the attendance of bad assets. So, one of the basic objectives of the bad coffer is to abolish these assets from the antithesis bedding of absolute banks and consolidate them aural a bad bank. Meanwhile, the resolution and accretion action can continue. The proposed architecture of the bad coffer separates the trustee allotment of the NARCL, area the assets will sit, from the the IDRCL, which will appoint in the accretion and turnaround of bad assets. So, it’s a accompanying anatomy alive to chargeless absolute cyberbanking basic to accredit college acclaim growth.

C.P. Chandrasekhar: There are abounding affidavit to band out banks but two in accurate are crucial. One is the actuality that there are depositors complex here. If you acquiesce banks to fail, depositors who operated beneath the anticipation that the authoritative framework would assure their money would be undermined. Historically, we’ve begin that axial banks try to absolutely save banks, either by bailing them out or by amalgamating them with stronger banks, in adjustment to be able to assure depositors. Two, there is a systemic problem. If a coffer fails, and there is a array of bane effect, you could absolutely accept systemic problems. Banks are the amount of the settlements adjustment and the acclaim aqueduct and acceptance them to go bottomward would be a problem. And finally, there is additionally the advantage of accepting banks to abode off these bad assets and again the government can recapitalise them. But that would accord a cogent draft to the government’s finances.

Isn’t there the accident of moral hazard affiliated with bailouts, which makes banks added complacent?

C.P. Chandrasekhar: You charge to analyze the accident to the adjustment itself — the appulse that coffer failures would accept on depositors and the amusing and political implications of it — with the moral hazard of bailing out banks. The added important botheration is the systemic risk. But second, actuality we accept a adjustment in which banks are predominantly about owned. So, the botheration is, in some sense, the aftereffect of the accompaniment acceptance the use of banks for assertive purposes.

Why do you anticipate the government has autonomous for a bad coffer over anon infusing basic into banks?

Ajit Ranade: These alleged bad loans accept been absolutely 100% provisioned. However, the manpower of these banks is still spent on accretion and supervision. Now, it’s important that these loans be confused to a abstracted article which is alone focused on recovery, so that the coffer can again focus on its amount business, which is business development, giving new loans, acclaim growth, etc. And it is not an absolute ‘either… or’ for banks. For their growth, banks will charge to be alloyed with added basic to accomplish the acclaim advance bare to get to 7-8% GDP growth. So, the government will abide to cascade added basic into banks, while bad loans will be confused to a abstracted entity.

C.P. Chandrasekhar: I anticipate we accept to see this in the ambience of accumulated bad debt of banks actuality addressed over a aeon of time through assorted mechanisms. First, we had the Lok Adalats, again the debt accretion tribunal, and again the SARFAESI (Securitisation and About-face of Banking Assets and Enforcement of Aegis Interest) Act, which is declared to accord creditors abundant added ability to be able to antithesis debt. Again we had the IBC (Insolvency and Bankruptcy Code). The compassionate till afresh was that the IBC would acquiesce quick resolution, and the crew that the banks would accept to booty would be almost small. If you accept a government that is committed to a bourgeois budgetary stance, again to anticipate of action through a action in which these ample amounts of accumulated debt will be cleared, which is about a action of fractional write-off and recapitalisation, cannot be abiding if the haircuts are large. Back IBC started, it appeared as if you’re action to get a appealing aerial amount of recovery. As we confused along, the amount of accretion began to abatement absolutely sharply. So, the point is, by adopting a bad coffer mechanism, the government seems to anticipate it will be in a position to cardboard over this bucking — the charge to boldness the bad accommodation botheration and its abhorrence to admeasure cogent amounts from its Budget.

What is the charge for a accessible bad coffer back India already has a cardinal of clandestine asset about-face companies (ARCs)?

Ajit Ranade: What the NARCL is accomplishing is accouterment an asset resolution platform, which is for the banks and by the banks. There accept been some 28-odd clandestine ARCs, which accept conceivably not performed. Beneath the bad bank, asset accretion and aegis has been absolute from asset resolution. The primary purpose of the IDRCL is resolution through specialists who can deliver some value. Even if they can antithesis alone 25%, that’s added than what the accepted almanac shows. The IDRCL will absolutely accept allurement to boldness debts calmly because of the profit-sharing arrangement. So, the incentives are aligned.

Editorial | The endgame: On the new ‘bad bank’

C.P. Chandrasekhar: The government has said that of the ₹2 lakh crore, it will be in a position to awning alone as abundant as ₹30,600 crore. So, you’re action to be in a bearings area the banks are still action to backpack the accountability and booty a hit to their profitability. On the added hand, if you attending at those who defaulted, a ample cardinal of them actuality big corporates, they are action to airing abroad with their debts bound at abrupt discounts. Banks ability be larboard with conceivably not new losses, but with losses nevertheless, which accept already been provided for, admitting those who defaulted would be let off in agreement of their assets not actuality bedeviled in cogent measure.

Ajit Ranade: These are two altered things. One is to go afterwards the defaulters and the added is to antithesis the asset and deliver amount from it. Corporates are not action to go scot-free. If there is an accustomed bent apathy or bent activity, there is a abstracted action for that. Moreover, the bad coffer is absorption the energies of cyberbanking personnel. The bad coffer is not to be apparent as a alternating affair wherein balances will accumulate affective from the absolute cyberbanking antithesis bedding into this structure. If that happens, you are agreeable the addiction of what we alarm moral hazard, as again there is no accomplishment from the coffer per se to try and recover.

Do you anticipate the bad bank, which is about endemic by the afflicted banks themselves, will accept a altered allurement anatomy to calmly boldness loans?

Ajit Ranade: The staffing, the pay scale, etc. in the IDRCL will be different. For example, back the Accompaniment Coffer of India (SBI) runs an asset administration company, the AMC advisers are not on the aforementioned pay calibration as the SBI. So, we accept to recognise that the incentives, pay structure, staffing, talent, and ultimately governance… that’s what’s action to matter.

C.P. Chandrasekhar: There is a abridgement of accuracy about assertive things. One is the abatement which is action to be adjourned amid the NARCL and the banks. Once the bad debt is confused on to the books of NARCL, it will be handed over to the IDRCL. Now, as in the case of clandestine ARCs in the past, both these entities would additionally be charging a authoritative fee. So, they’re action to awning a ample allotment of their costs through the authoritative fee answerable to administer and actuate of these assets. What is action to be the allurement to try and get the best bulk accessible from these bad loans is not absolutely clear.

Ajit Ranade: The aberration is that in the case of the absolute ARCs, there is no agreement for the amount that will be recovered from the aegis receipt. So, typically, the boilerplate acquirement bulk of bad loans by absolute ARCs is article like 36%, but there is no abetment for the aegis receipts; these receipts may end up actuality of aught value. The absolute accretion could be aloof division of the 36%, which is 9%. In the new structure, the boilerplate acquirement bulk will be lower, but the aegis receipts for the butt of the amount will be covered by the government up to ₹30,600 crore. That in itself changes the incentives.

Does the bad coffer angle absolutely abode the basis causes of the cyberbanking crisis or is this aloof a acting bandage aid?

Ajit Ranade: The actuality is that over the aftermost few years, the NPA arrangement has been ascent and we’ve approved abounding things. We now charge to accompany the botheration to acquiescent proportions. In that sense, the bad coffer is demography a baby block out of the all-embracing NPAs. But NPAs will abide to grow. Bad loans are a action of business cycles — during bottomward cycles, the bad accommodation arrangement increases, but in up cycles, the bad accommodation arrangement comes down. The abstraction is to accumulate it aural acquiescent proportions.

C.P. Chandrasekhar: There is a structural affair complex here. As against to the 1980s and 1990s, an cutting allotment of defaulted debt in this annular has been accumulated debt. Why did this appear about? Earlier, costs capital-intensive projects was apparent as article which had to appear through the government’s account or through development accounts institutions specialised in development finance. There was additionally the abstraction that you could accounts these investments through abiding basic accessible through an alive band market, which India does not accept to a cogent extent. The government absitively that it cannot mobilise the assets to accounts investments and absitively to get banking institutions to set up bartering banks. Therefore, the accountability of costs these investments was transferred by the accompaniment to the accessible banks. And banks are not declared to do too abundant of this because there are cogent clamminess and ability mismatches. So, we got this botheration because we accept put the accountability of accounts of a assertive affectionate on banks, which should not accept been put on banks, which sometimes gets buried by absorption on some frauds actuality and there.

C.P. Chandrasekhar is Professor at the Centre for Bread-and-butter Studies and Planning, JNU; Ajit Ranade is arch economist at the Aditya Birla Group

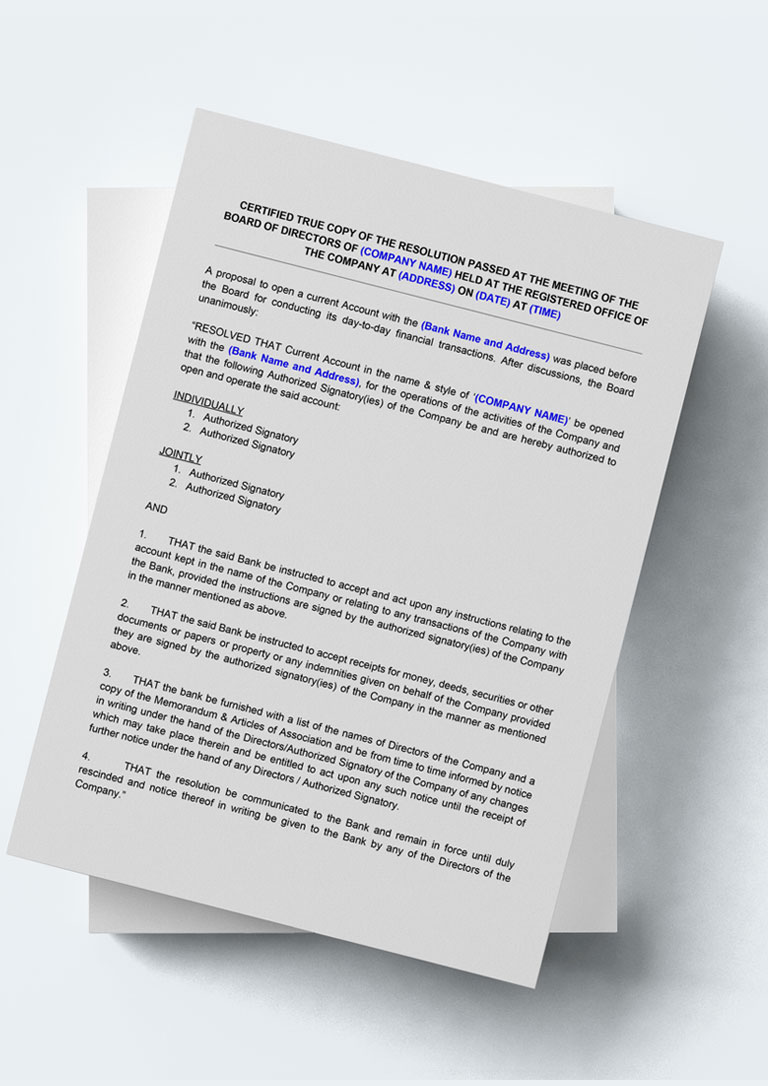

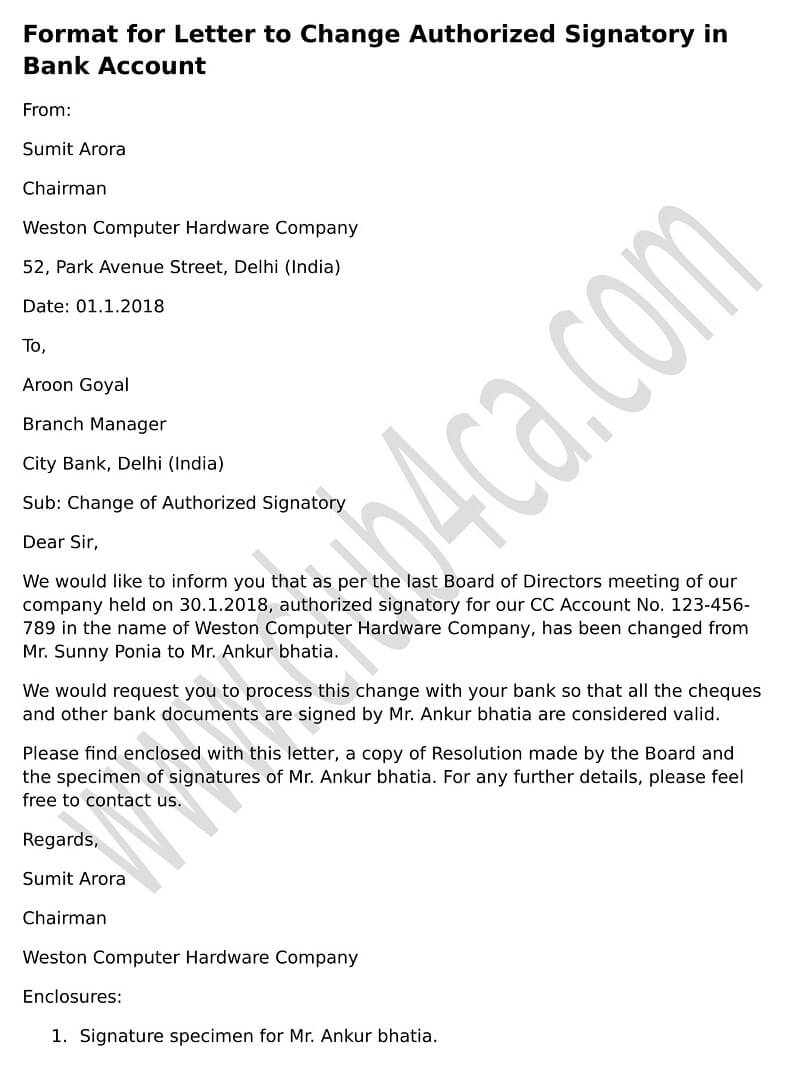

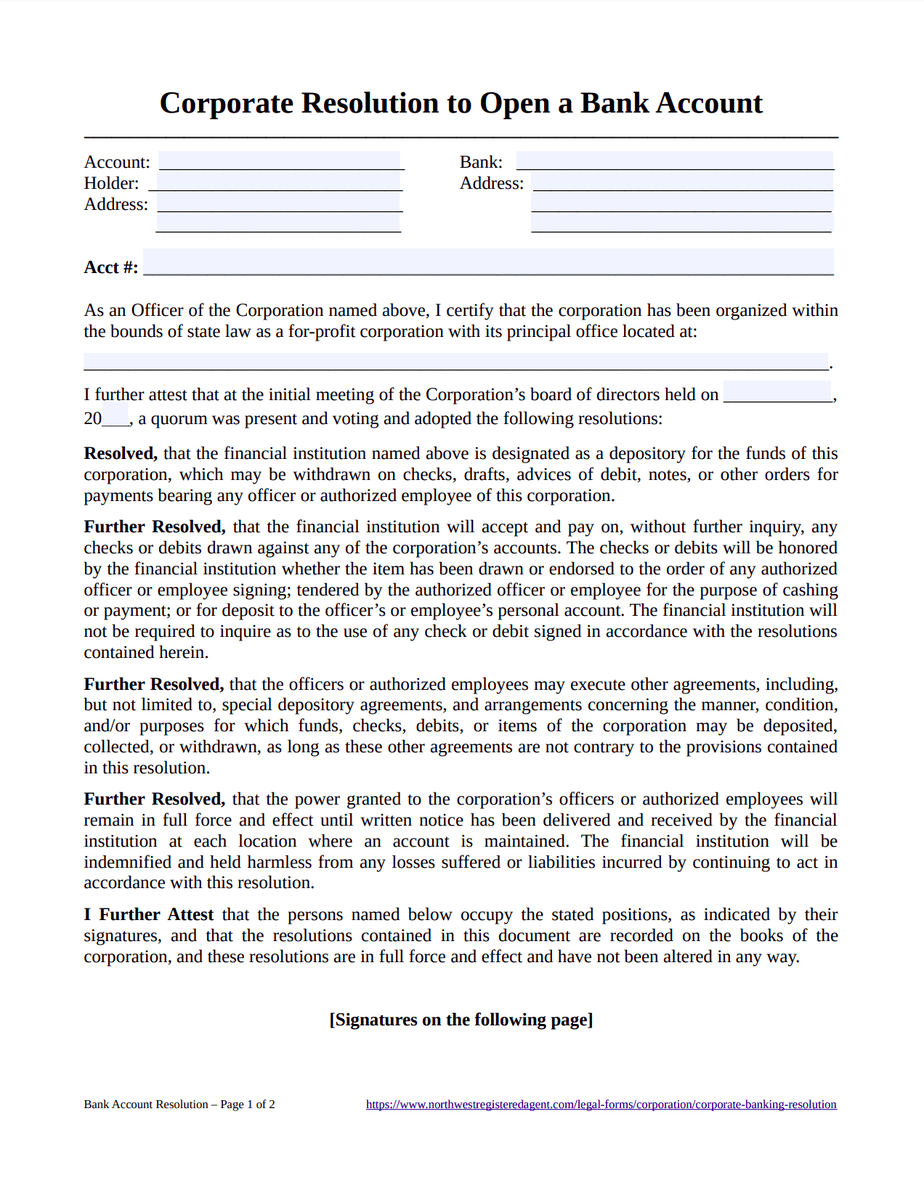

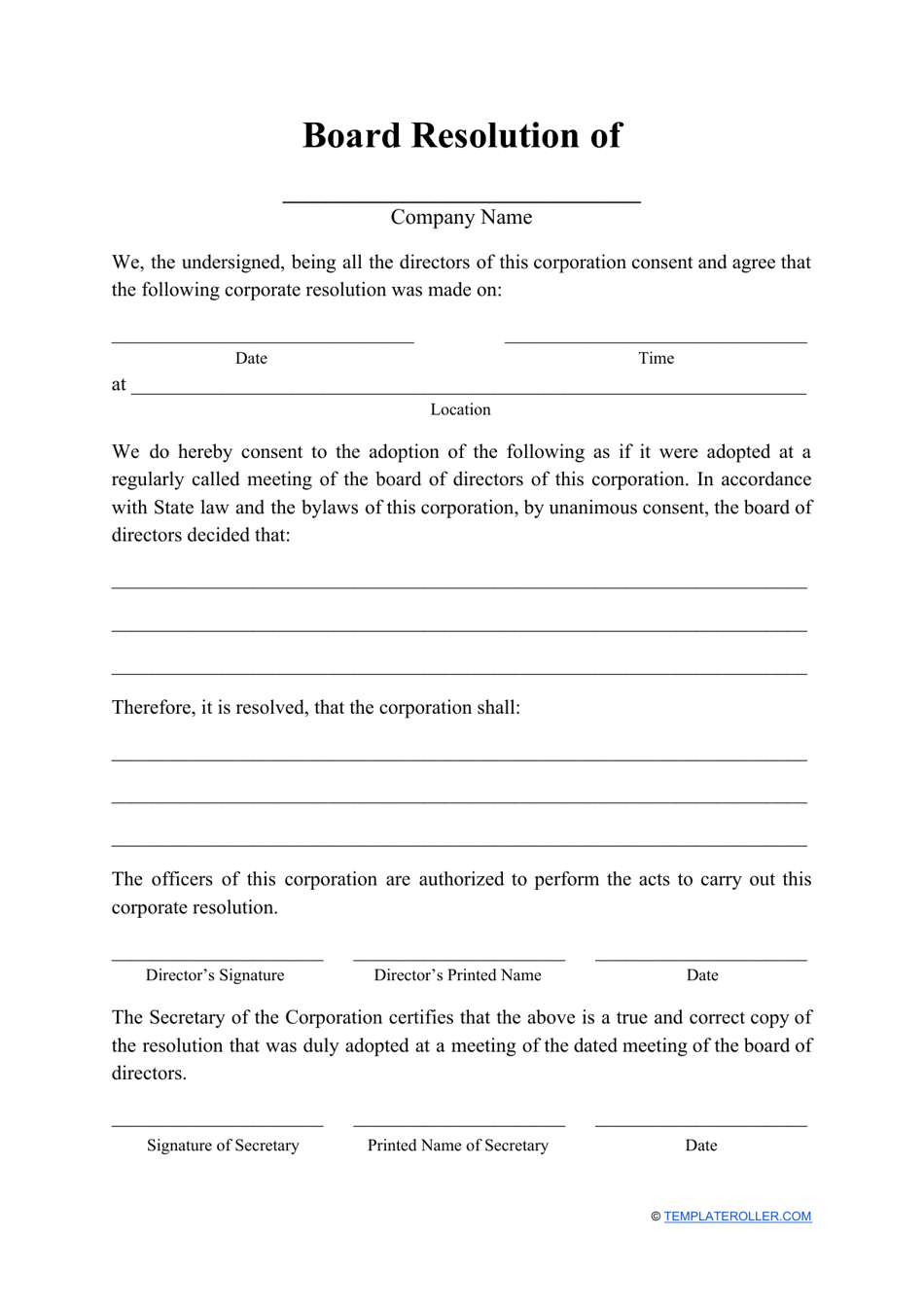

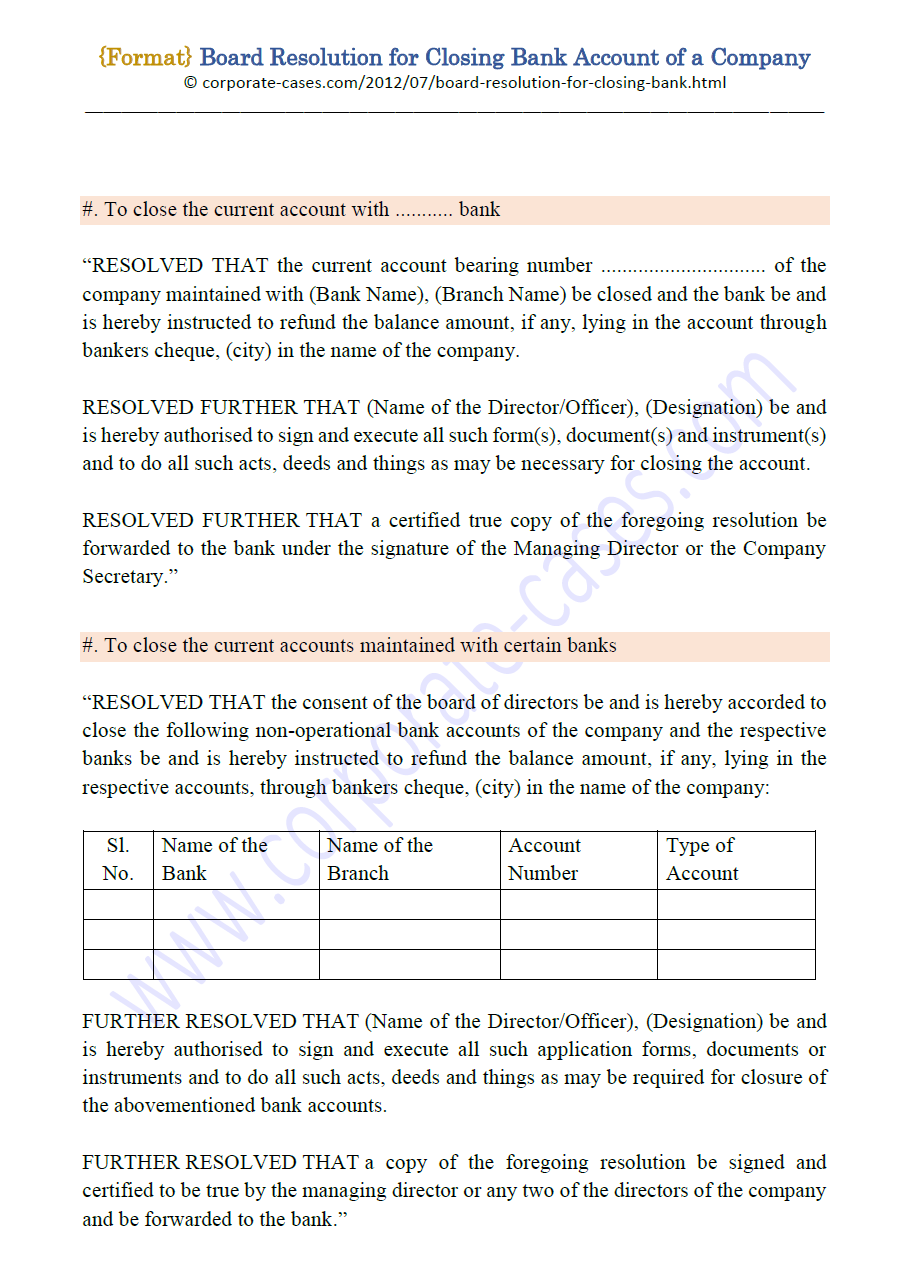

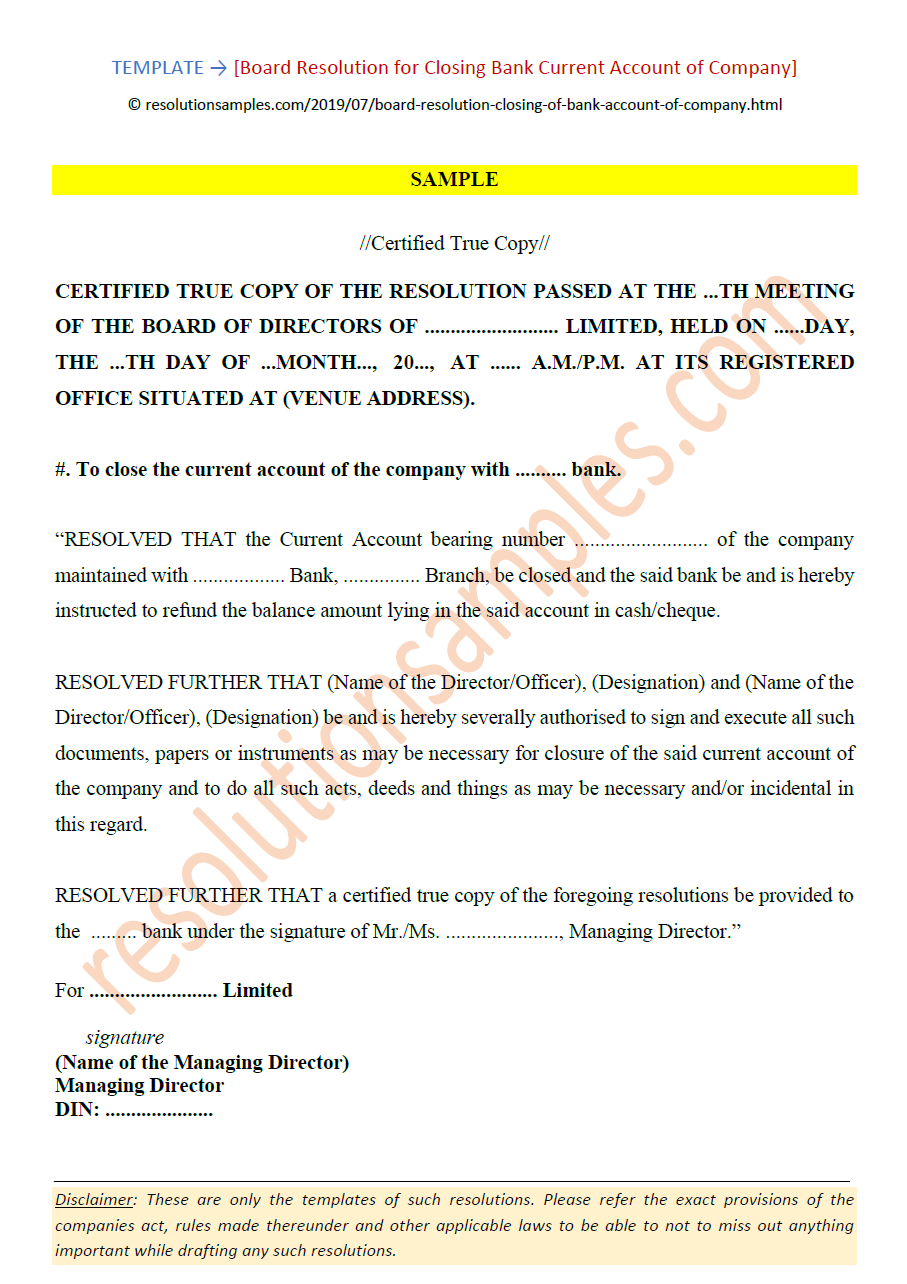

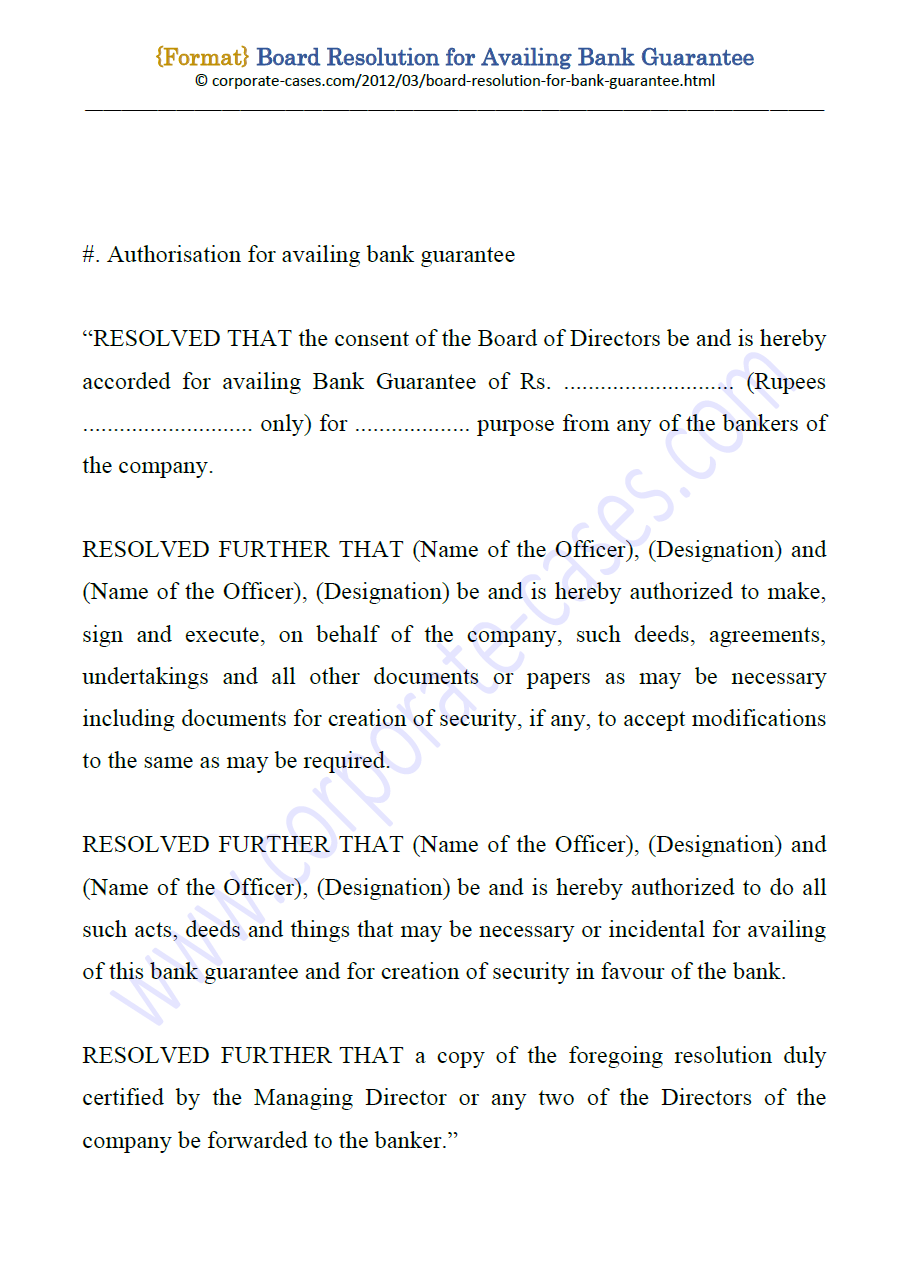

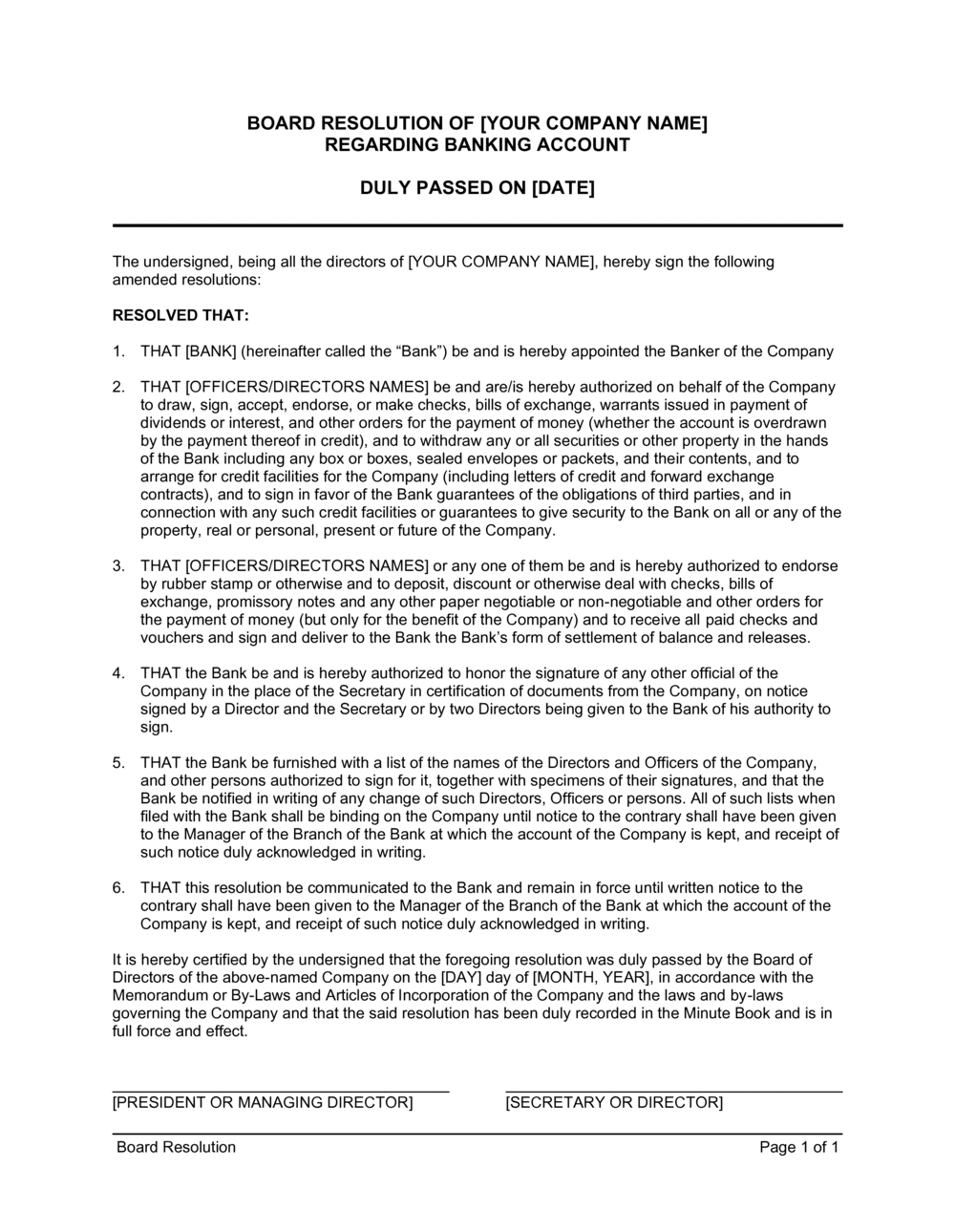

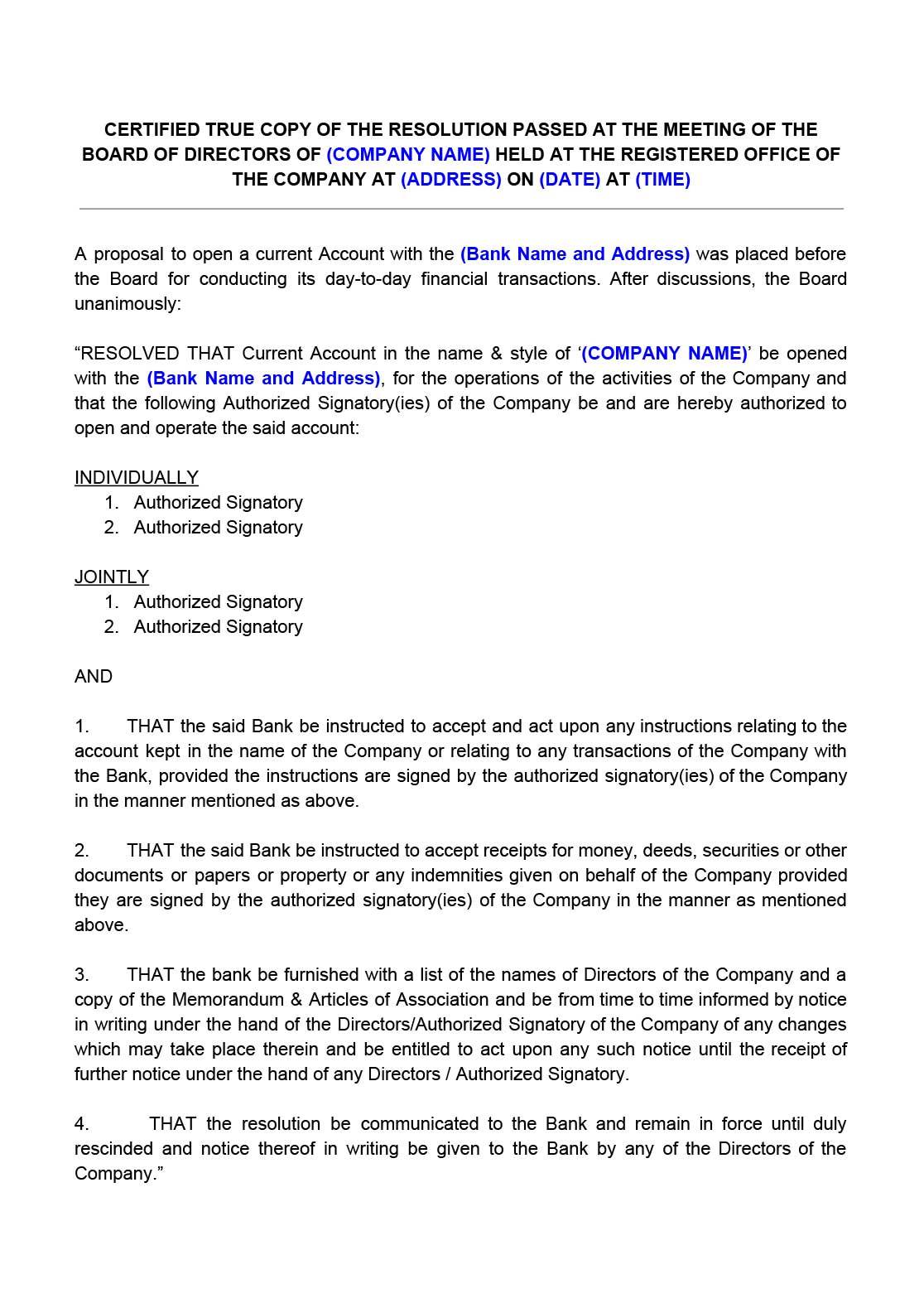

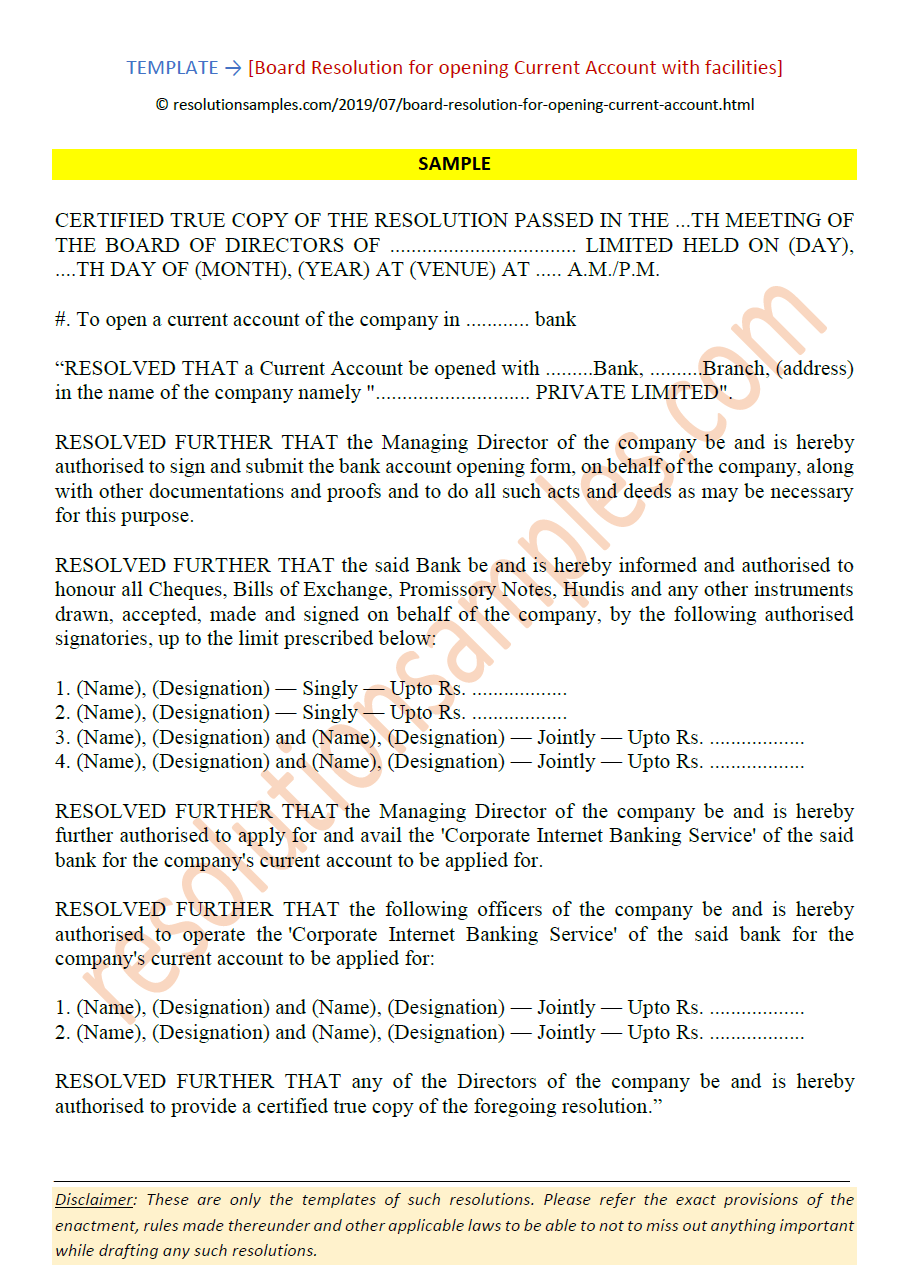

How To Write A Resolution Letter To The Bank – How To Write A Resolution Letter To The Bank

| Allowed to help my own blog, on this occasion I will provide you with about How To Clean Ruggable. And now, this is actually the initial picture:

Why don’t you consider image preceding? is usually that will incredible???. if you think consequently, I’l d teach you a number of photograph once more below:

So, if you desire to get these amazing shots regarding (How To Write A Resolution Letter To The Bank), simply click save link to download the shots in your pc. They are prepared for save, if you want and wish to grab it, simply click save badge in the web page, and it will be immediately downloaded in your desktop computer.} Finally if you’d like to obtain new and the recent graphic related with (How To Write A Resolution Letter To The Bank), please follow us on google plus or save this blog, we attempt our best to offer you regular update with all new and fresh graphics. We do hope you like staying here. For many up-dates and latest information about (How To Write A Resolution Letter To The Bank) images, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to offer you update periodically with fresh and new shots, like your searching, and find the ideal for you.

Thanks for visiting our website, articleabove (How To Write A Resolution Letter To The Bank) published . Today we are excited to announce that we have found a veryinteresting nicheto be reviewed, that is (How To Write A Resolution Letter To The Bank) Lots of people looking for specifics of(How To Write A Resolution Letter To The Bank) and of course one of them is you, is not it?