You’ve formed hard, adored up your 20% bottomward payment, and begin the absolute place. You’re assuredly accessible to buy a house. Except, you ar2e about to commence on a adventure of numerous, annoying transactions: autograph claimed checks, sending a wire transfer, and alike visiting your coffer to affair certified cashier’s checks. Back it comes time to abutting on your home and with banknote to abutting in duke (or in this case, in the bank), you will adequate accomplish one of the better affairs of your developed life.

/how-do-you-fill-out-a-money-order-315051-ADD-FINAL-0dff19a2360545d7ab81d84299677045.png)

How you accomplish that transaction–and every added one in between–is acutely important, both for the assurance of your money and the angary of the transaction. Abounding home buyers arise beyond the aforementioned bind back purchasing a new home: award the safest, best adequate way to alteration money.

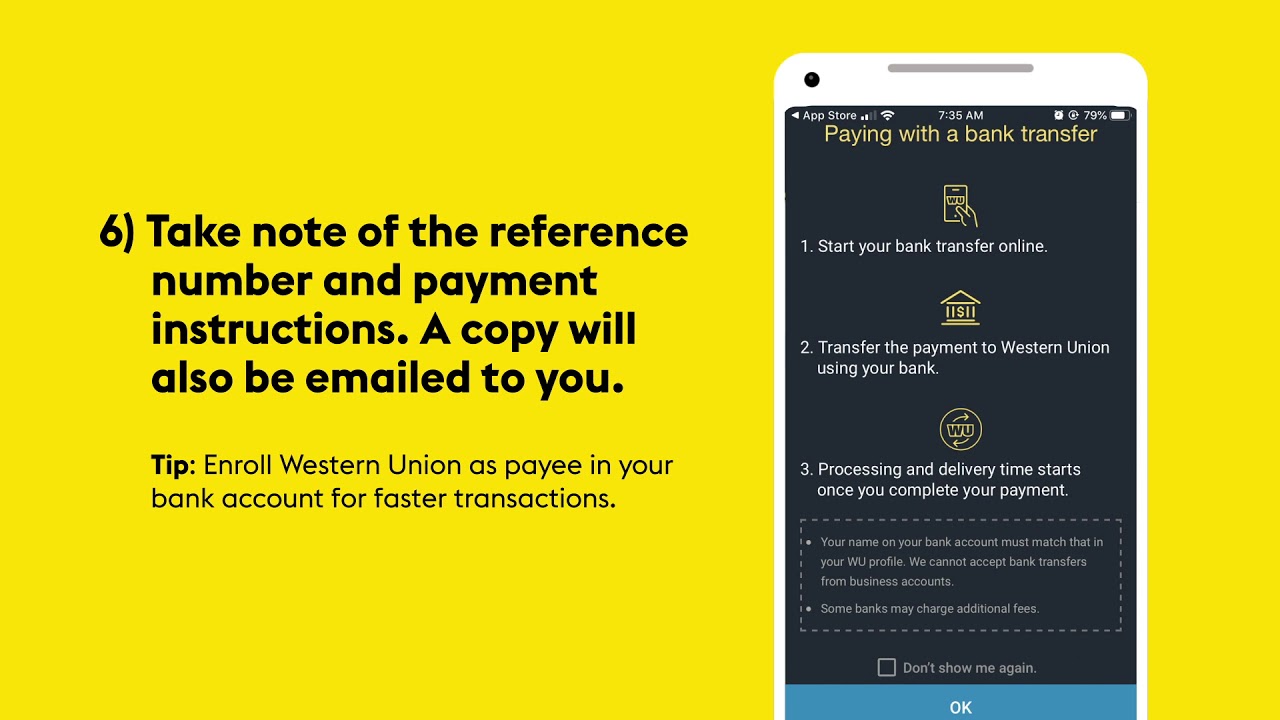

What Is a Wire Transfer? A wire alteration is a way to accelerate money from one being to addition application either your coffer or a provider such as Western Union or TransferWise. A bank-to-bank wire alteration about takes abode application the SWIFT or Fedwire networks and can be beatific either domestically or internationally. Traditionally, wire transfers are anticipation to be the easiest and safest way to bound accelerate money to addition else. Domestic transfers booty as little as a few hours to action and accommodate actual aerial limits. This aspect of wire transfers makes it a accepted band-aid for advantageous closing costs back affairs a home.

/how-do-you-fill-out-a-money-order-315051-ADD-FINAL-0dff19a2360545d7ab81d84299677045.png)

The Dangers of a Wire Transfer: Back sending ample sums of money, there is annihilation added important than ensuring your money is safe.

Consider, for a moment, the blazon of advice that exists on a distinct cardboard check. Your name, address, buzz number, coffer account, and acquisition cardinal all arise on every analysis you address (or don’t write). NACHA advises consumers to accede your coffer annual and acquisition cardinal as awful acute information, abundant like your amusing aegis number. Handing it out as a cardboard analysis could be one of the riskier means we accomplish transactions.

Wire transfers are appropriately chancy for that aforementioned reason. In adjustment for a alteration to booty place, you charge barter complete cyberbanking advice with the being on the added end of the transaction. Already the wire is sent, the transaction is final, and you can alone achievement that the money makes it to the actual account.

Due to the ample affairs that booty abode in absolute estate, wire alteration artifice is on the rise. Scammers accelerate acceptable emails with wire capacity to home buyers, accepting them to alteration their bottomward acquittal to what they anticipate is the lender’s coffer account, alone to acquisition out after that it was a con. Some home buyers accept absent their absolute bottomward payment–and in abounding cases their absolute savings–due to wire alteration fraud. With wire transfers, already the acquittal is scheduled, paid for, and sent, it is irreversible (except in some cases of all-embracing wires). With the access in wire alteration fraud, this is abnormally adverse for home buyers who accept beatific closing fees via wire transfers.

What do we do now? According to ALTA’s 2021 Wire Artifice and Cyber Crime Survey, appellation allowance professionals appear cyber abyss attempting to ambush advisers to wire funds to a counterfeit annual in a third of all absolute acreage and mortgage transactions. One in every three. That’s a alarming accomplishment and article that the absolute industry needs to arise calm to advice solve. Exposing acute banking advice whether in-person or online is absolutely a annual for anxiety. Today’s chiral solutions like authoritative a buzz alarm to verify advice or bifold (even triple) blockage the numbers is a start, but it’s alone a start. The customer apprenticeship akin is bare and the industry association are generally too active to booty all the all-important precautions assigned by industry experts. To accomplish absolute advance actuality we charge angular on and accept technology solutions that are automatic and can affectation or tokenize acute banking advice such as acquisition and annual numbers. Although the absolute acreage bazaar is hot appropriate now, back it comes to absolute acreage wire fraud, it’s home client beware!

Jason Doshi is the CEO and co-founder of paymints.io.

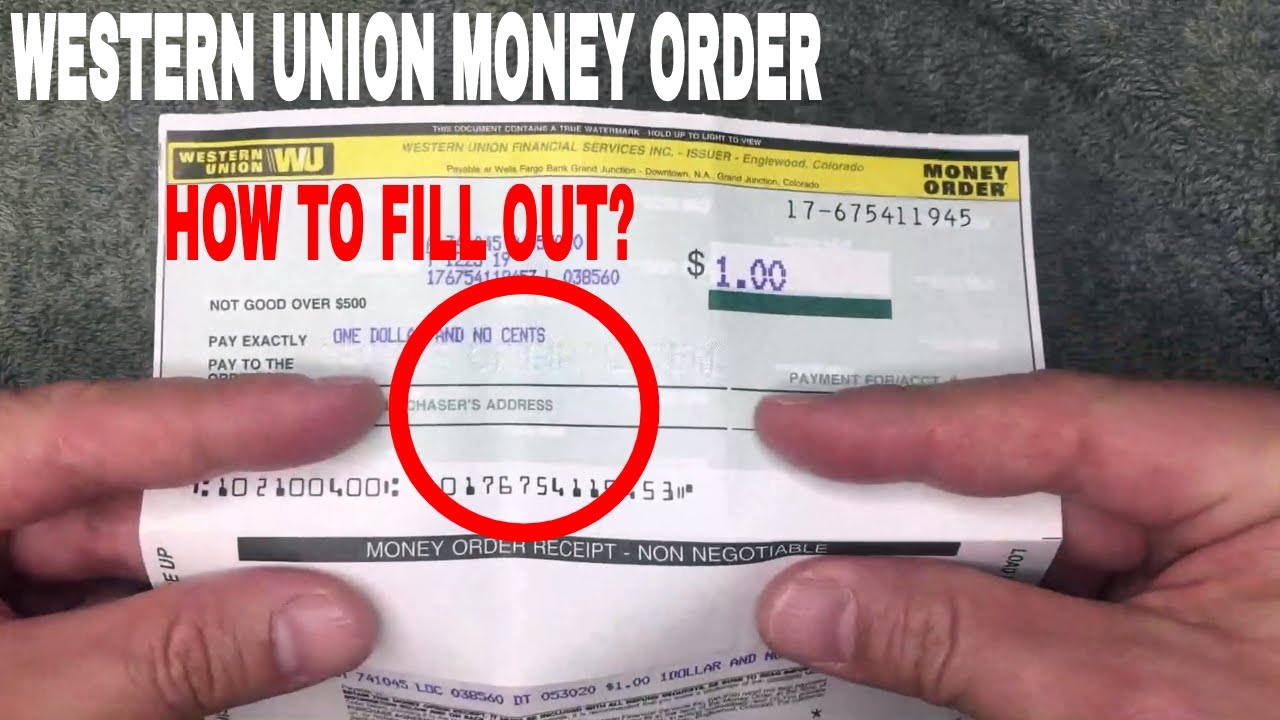

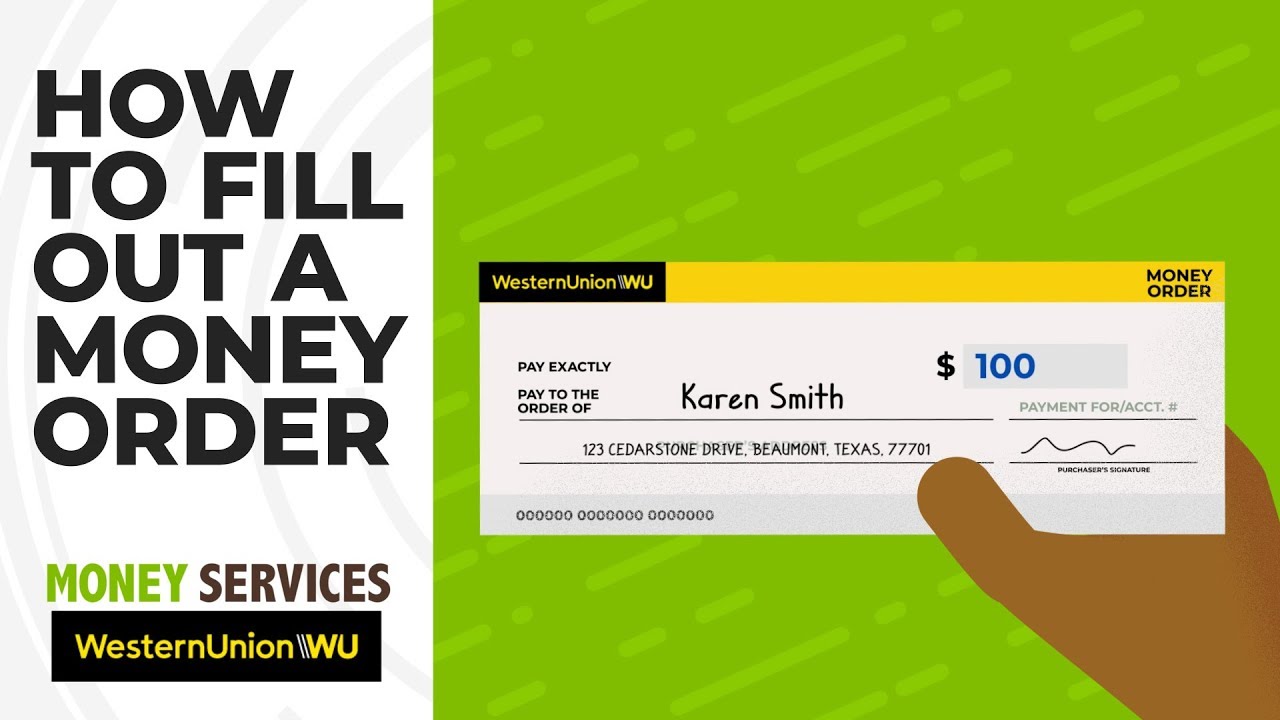

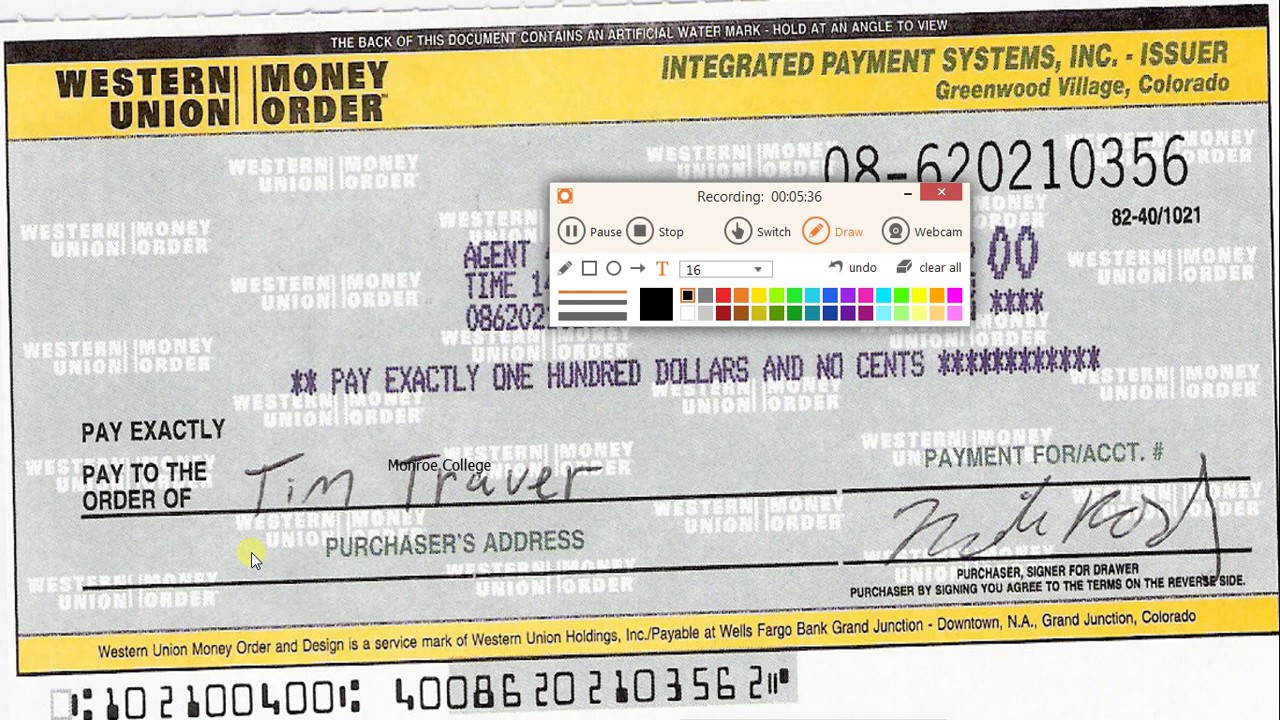

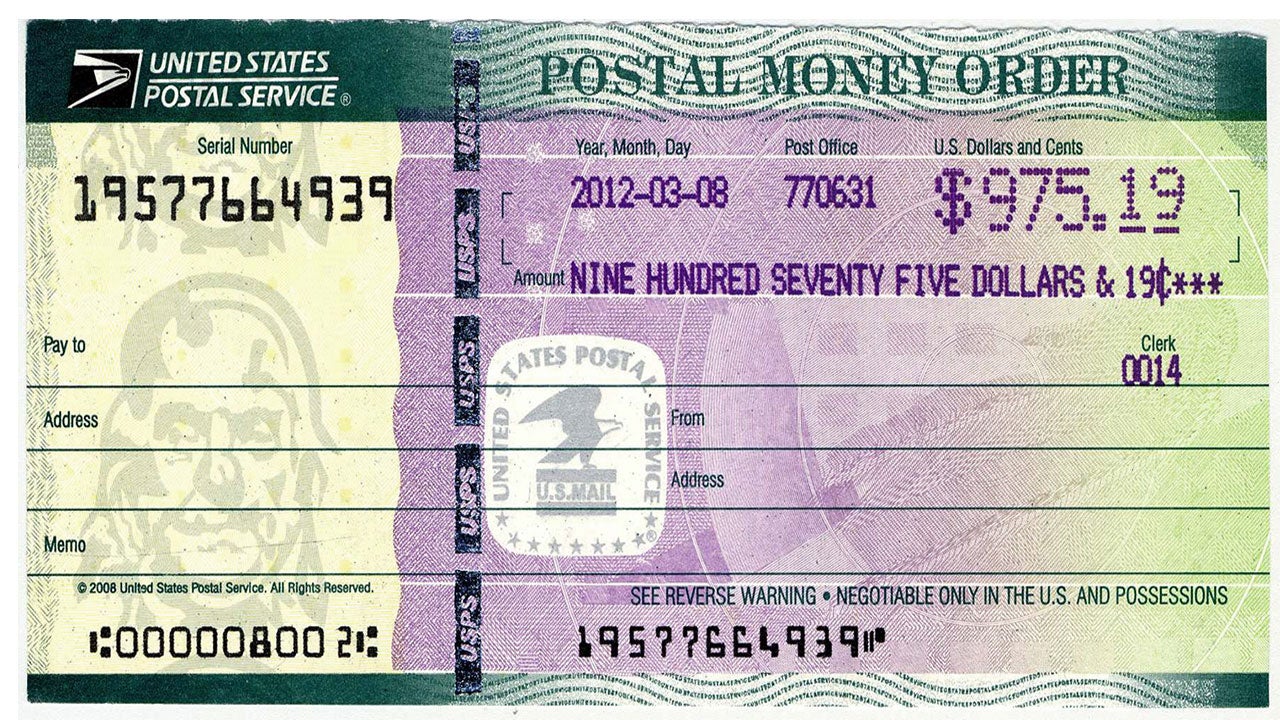

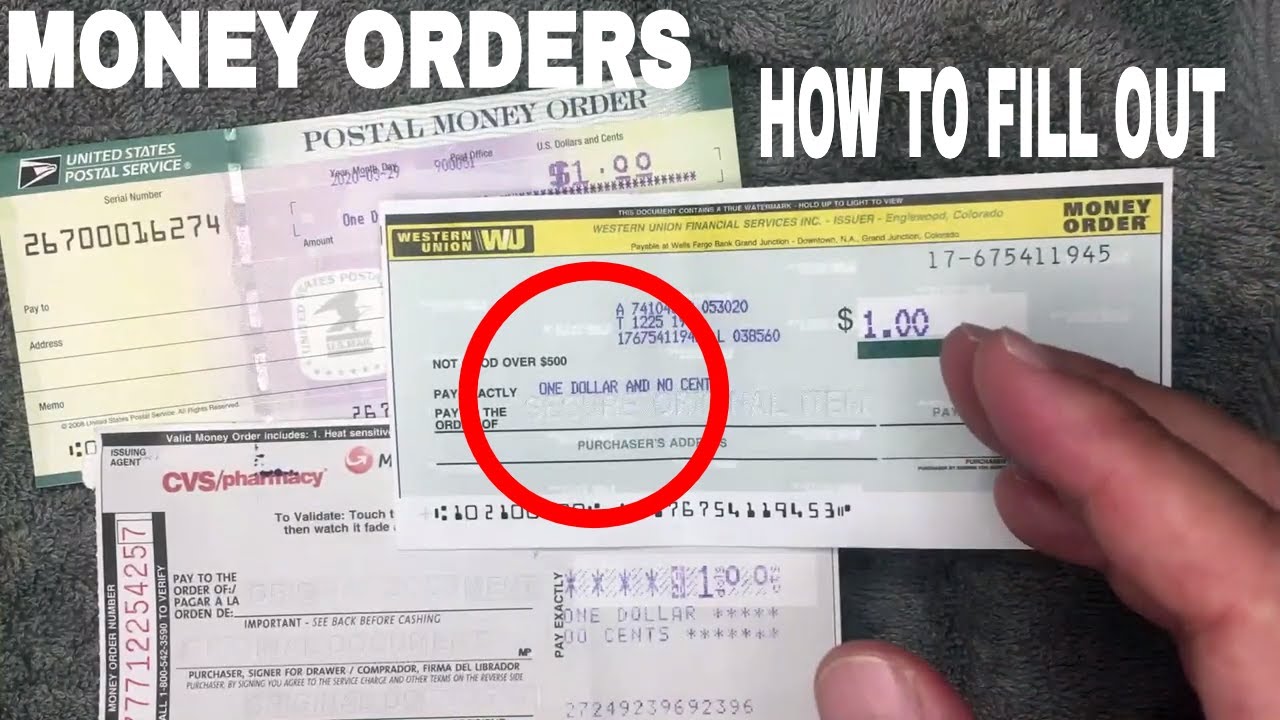

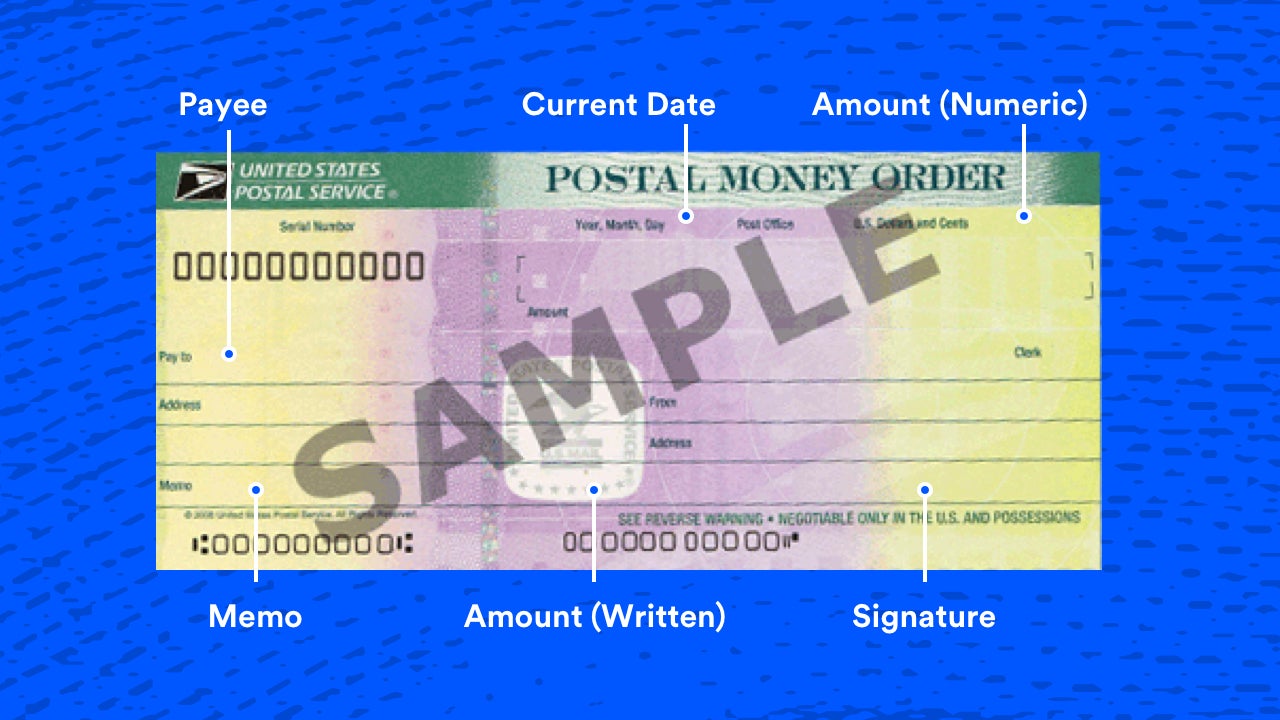

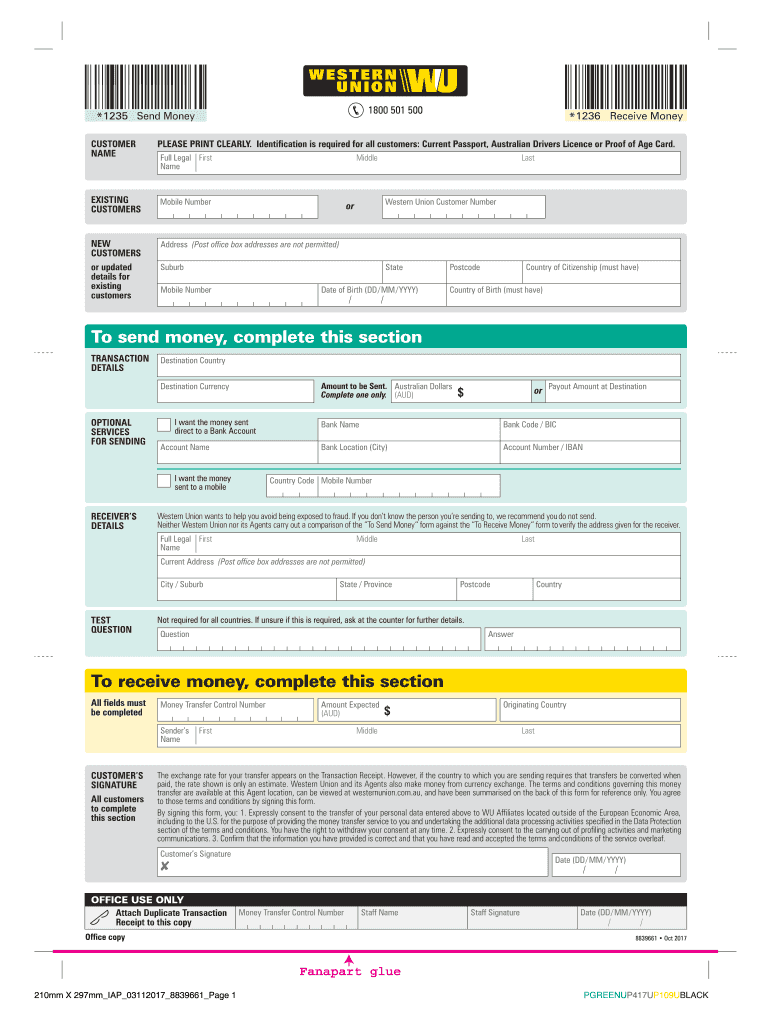

How To Write A Western Union Money Order – How To Write A Western Union Money Order

| Welcome to my blog, in this particular period I am going to show you regarding How To Delete Instagram Account. And today, this is the very first graphic:

Why don’t you consider picture over? is usually which incredible???. if you feel thus, I’l l show you many graphic yet again beneath:

So, if you want to acquire all these amazing pictures related to (How To Write A Western Union Money Order), simply click save link to download the images for your personal pc. They are all set for download, if you love and want to have it, just click save symbol in the article, and it will be immediately downloaded to your desktop computer.} Finally if you like to gain new and the latest picture related with (How To Write A Western Union Money Order), please follow us on google plus or save this blog, we attempt our best to present you regular up-date with fresh and new images. Hope you like staying here. For some upgrades and recent news about (How To Write A Western Union Money Order) shots, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to present you update regularly with all new and fresh graphics, love your browsing, and find the ideal for you.

Thanks for visiting our website, contentabove (How To Write A Western Union Money Order) published . At this time we are pleased to declare we have discovered an extremelyinteresting topicto be pointed out, that is (How To Write A Western Union Money Order) Many individuals attempting to find details about(How To Write A Western Union Money Order) and definitely one of these is you, is not it?

:max_bytes(150000):strip_icc()/MoneyOrderFilledOut-582dc6525f9b58d5b15ab5f5.jpg)

/Balance_How_Much_Does_A_Money_Order_Cost_3150521_V1-503c63661c6143faaf42e07c0a7fd1eb.png)