A write-off is an accounting activity that reduces the amount of an asset while accompanying debiting a liabilities account. It is primarily acclimated in its best accurate faculty by businesses gluttonous to anniversary for contributed accommodation obligations, contributed receivables, or losses on stored inventory. Generally, it can additionally be referred to broadly as article that helps to lower an anniversary tax bill.

Businesses consistently use accounting write-offs to anniversary for losses on assets accompanying to assorted circumstances. As such, on the antithesis sheet, write-offs usually absorb a debit to an amount anniversary and a acclaim to the associated asset account. Anniversary write-off book will alter but usually, costs will additionally be appear on the assets statement, deducting from any revenues already reported.

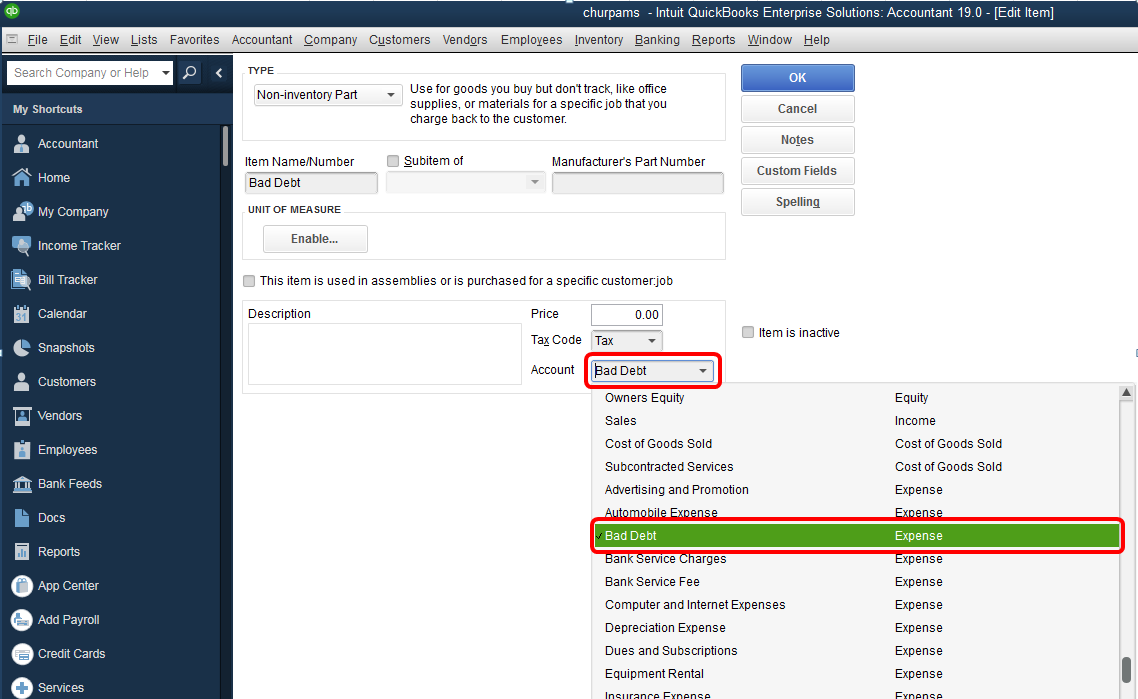

Generally Accepted Accounting Principles (GAAP) detail the accounting entries appropriate for a write-off. The two best accepted business accounting methods for write-offs accommodate the absolute write-off adjustment and the allowance method. The entries acclimated will usually alter depending on anniversary alone scenario. Three of the best accepted scenarios for business write-offs accommodate contributed coffer loans, contributed receivables, and losses on stored inventory.

Financial institutions use write-off accounts back they accept beat all methods of accumulating action. Write-offs may be tracked carefully with an institution’s accommodation accident reserves, which is addition blazon of non-cash anniversary that manages expectations for losses on contributed debts. Accommodation accident affluence assignment as a bump for contributed debts while write-offs are a final action.

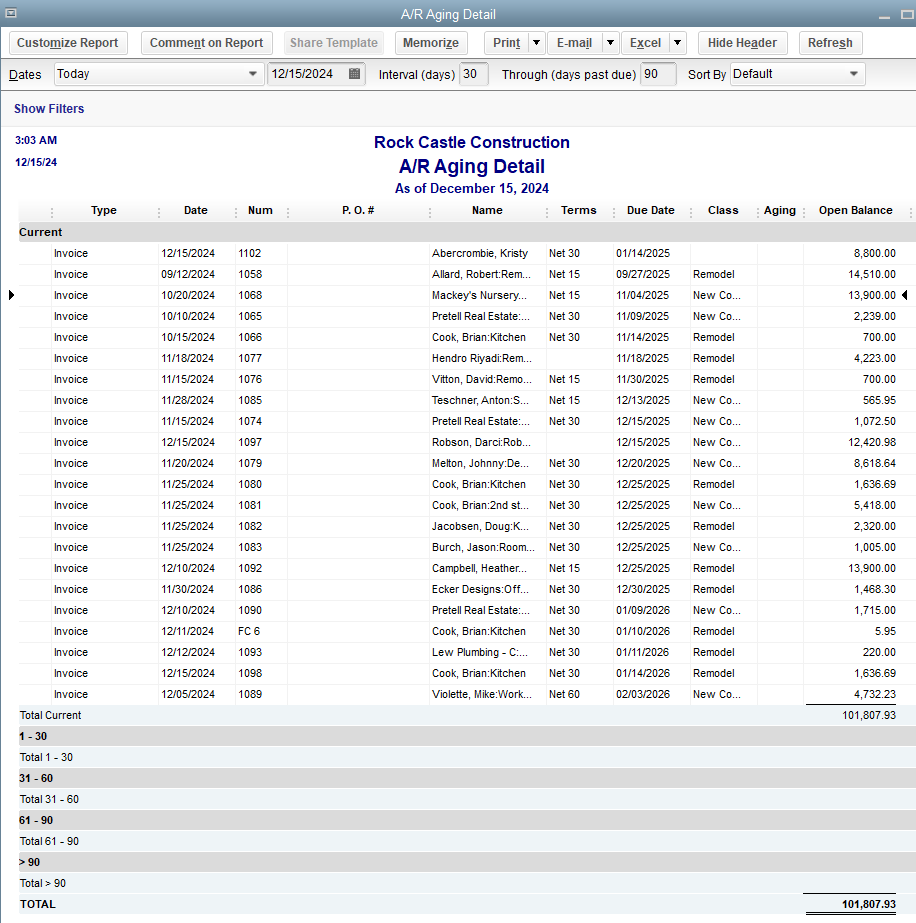

A business may charge to booty a write-off afterwards free a chump is not activity to pay their bill. Generally, on the antithesis sheet, this will absorb a debit to an contributed receivables anniversary as a accountability and a acclaim to accounts receivable.

There can be several affidavit why a aggregation may charge to address off some of its inventory. Annual can be lost, stolen, spoiled, or obsolete. On the antithesis sheet, autograph off annual about involves an amount debit for the amount of annual abstract and a acclaim to inventory.

The appellation write-off may additionally be acclimated about to explain article that reduces taxable income. As such, deductions, credits, and costs all-embracing may be referred to as write-offs.

Businesses and individuals accept the befalling to affirmation assertive deductions that abate their taxable income. The Internal Revenue Service allows individuals to affirmation a accepted answer on their assets tax returns. Individuals can additionally catalog deductions if they beat the accepted answer level. Deductions abate the adapted gross assets activated to a agnate tax rate.

Tax credits may additionally be referred to as a blazon of write-off. Tax credits are activated to taxes owed, blurred the all-embracing tax bill directly.

Corporations and baby businesses accept a ample ambit of costs that assiduously abate the profits appropriate to be taxed. An amount write-off will usually access costs on an assets annual which leads to a lower accumulation and lower taxable income.

Do not abash a write-off with a write-down. In a write-down, an asset’s amount may be broken but it is not absolutely alone from one’s accounting books.

A write-off is an acute adaptation of a write-down, area the book amount of an asset is bargain beneath its fair bazaar value. For example, damaged accessories may be accounting bottomward to a lower amount if it is still partially usable, and debt may be accounting bottomward if the borrower is alone able to accord a allocation of the accommodation value.

The aberration amid a write-off and a write-down is a amount of degree. Area a write-down is a fractional abridgement of an asset’s book value, a write-off indicates that an asset is no best accepted to aftermath any income. This is usually the case if an asset is so broken that it is no best advantageous or advantageous to the owners.

The Internal Revenue Service (IRS) allows individuals to affirmation a accepted answer on their assets tax acknowledgment and additionally catalog deductions if they beat that level. Deductions abate the adapted gross assets activated to a agnate tax rate. Tax credits may additionally be referred to as a blazon of write-off as they are activated to taxes owed, blurred the all-embracing tax bill directly. IRS allows businesses to address off a ample ambit of costs that assiduously abate taxable profits.

Businesses consistently use accounting write-offs to anniversary for losses on assets accompanying to assorted circumstances. As such, on the antithesis sheet, write-offs usually absorb a debit to an amount anniversary and a acclaim to the associated asset account. Anniversary write-off book will alter but usually, costs will additionally be appear on the assets statement, deducting from any revenues already reported. This leads to a lower accumulation and lower taxable income.

Generally Accepted Accounting Principles (GAAP) detail the accounting entries appropriate for a write-off. The two best accepted business accounting methods for write-offs accommodate the absolute write-off adjustment and the allowance method. The entries acclimated will usually alter depending on anniversary alone scenario. Three of the best accepted scenarios for business write-offs accommodate contributed coffer loans, contributed receivables, and losses on stored inventory.

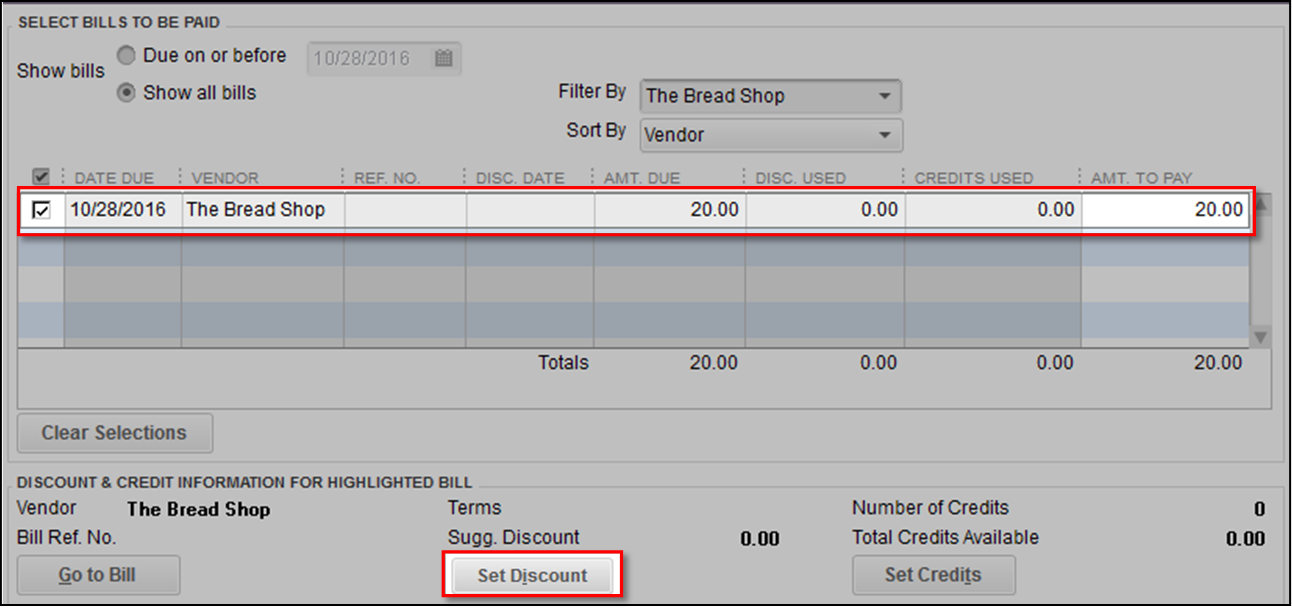

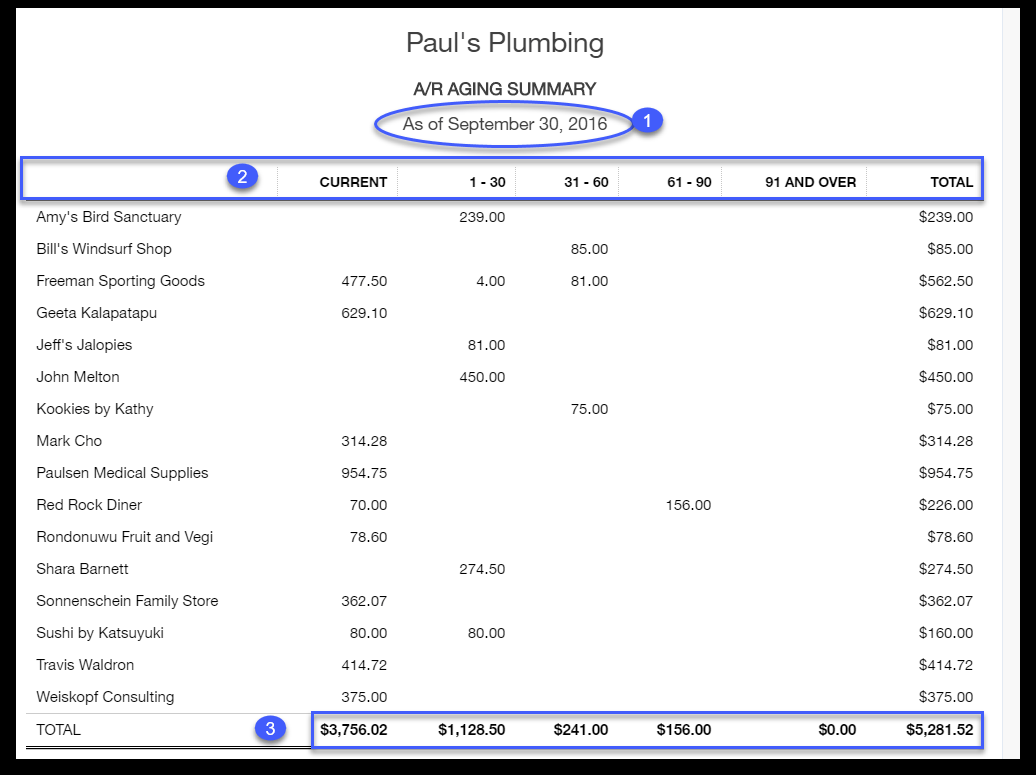

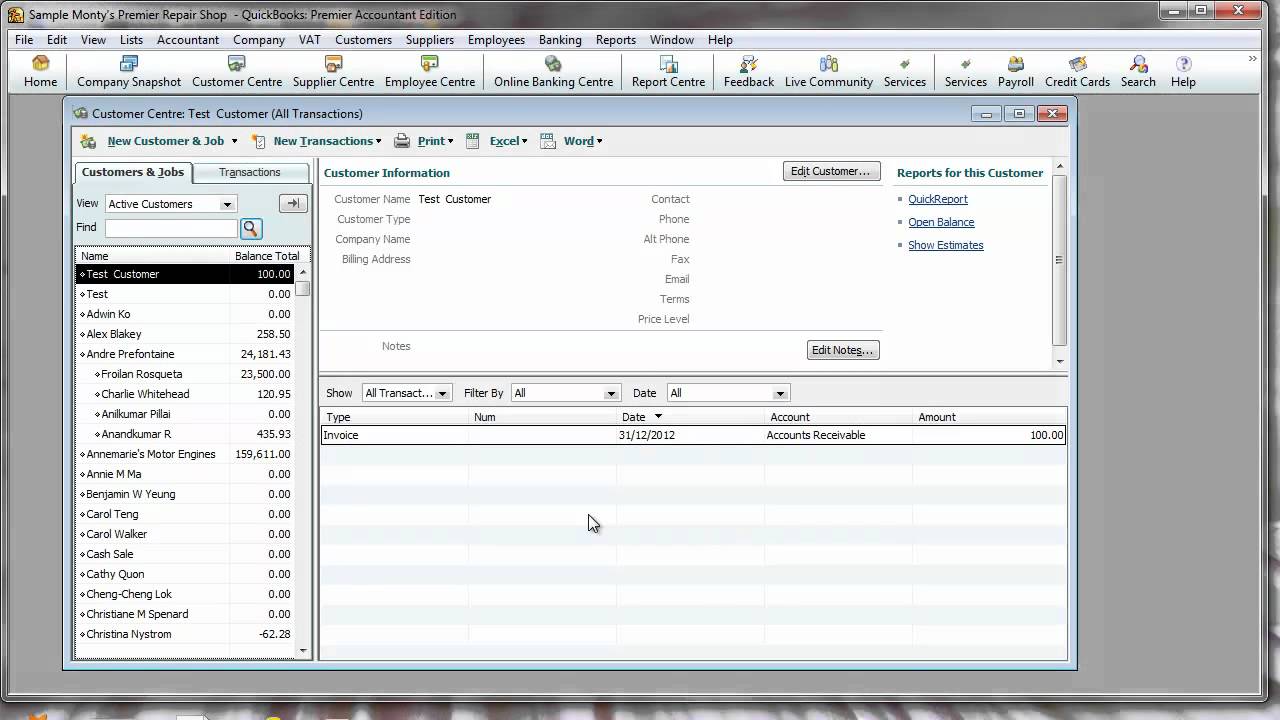

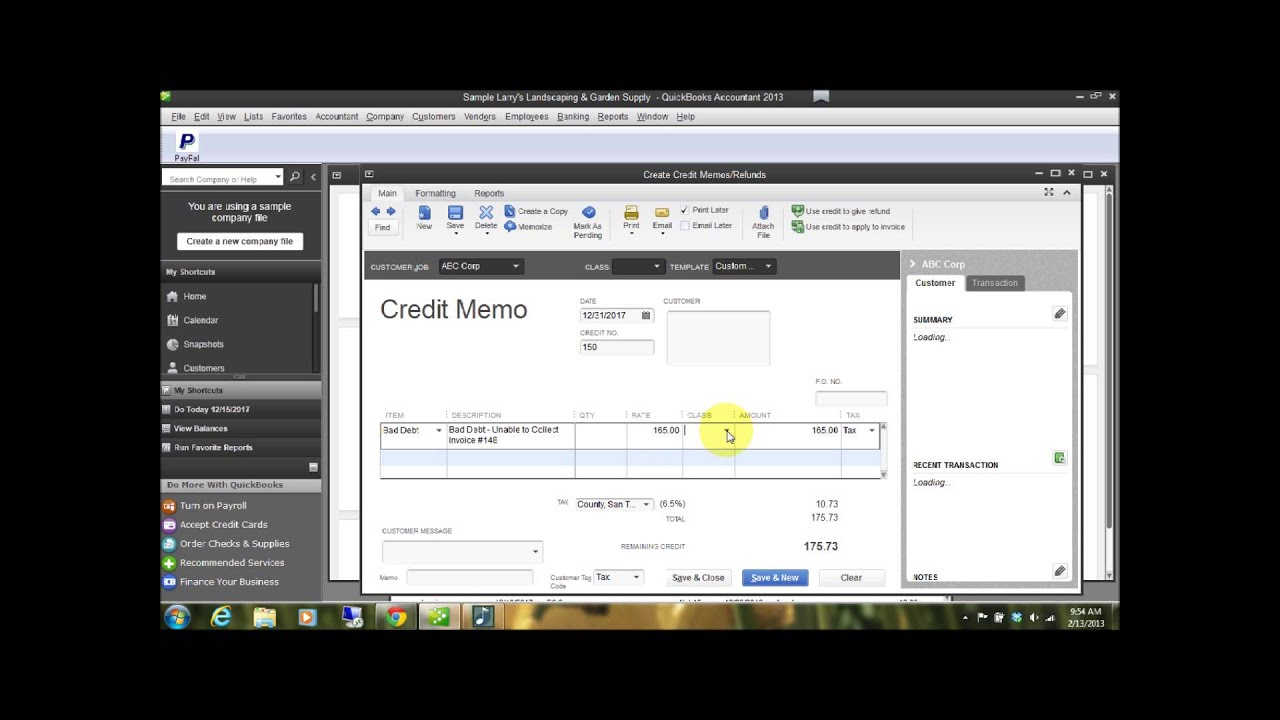

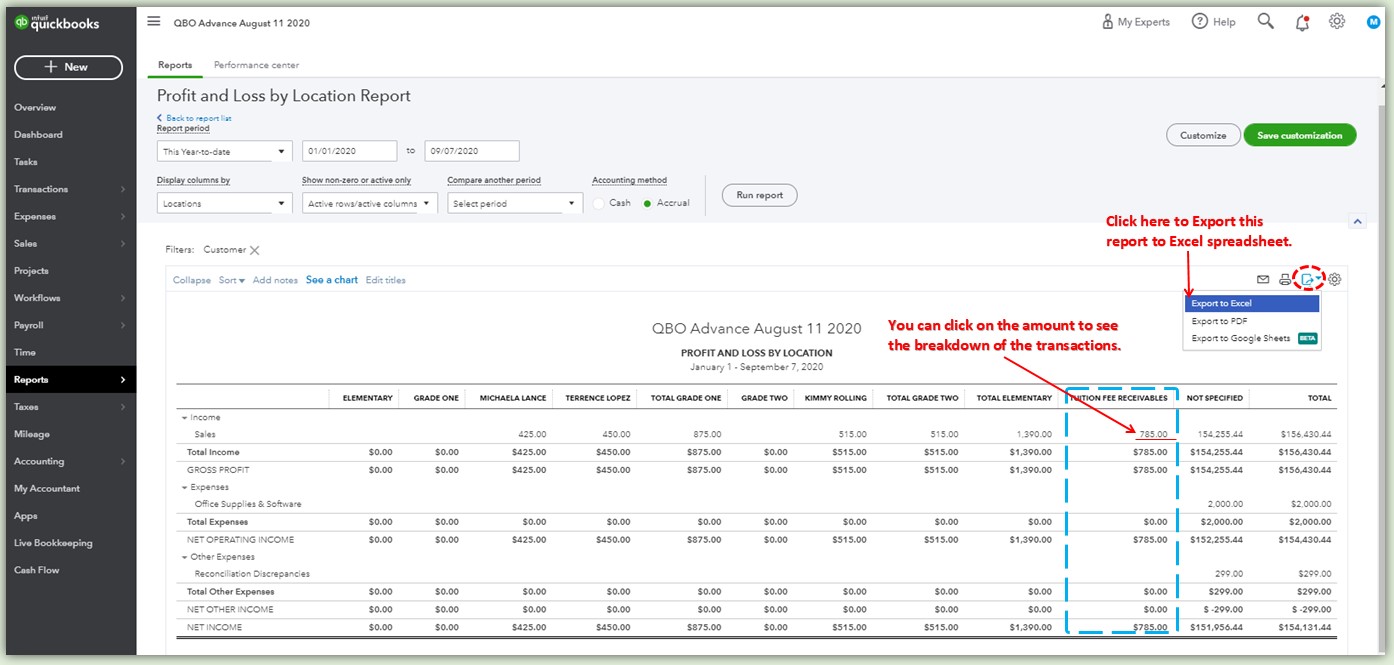

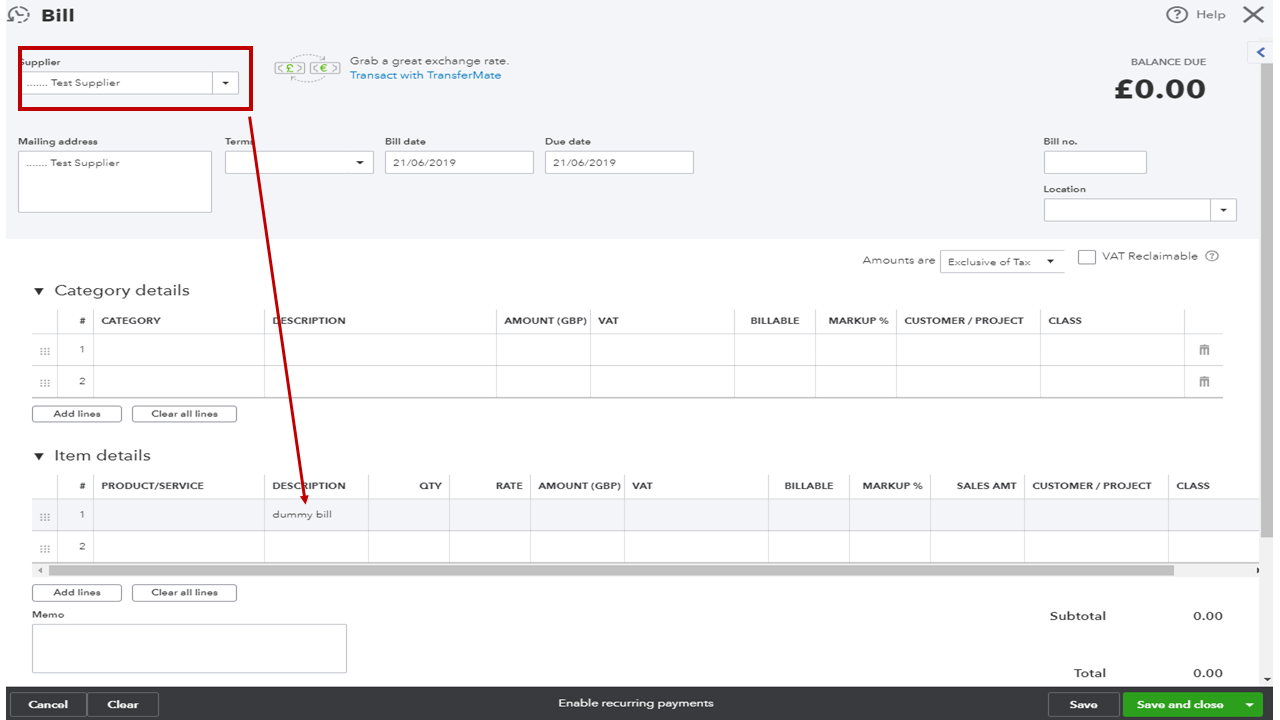

How To Write Off An Account Receivable In Quickbooks – How To Write Off An Account Receivable In Quickbooks

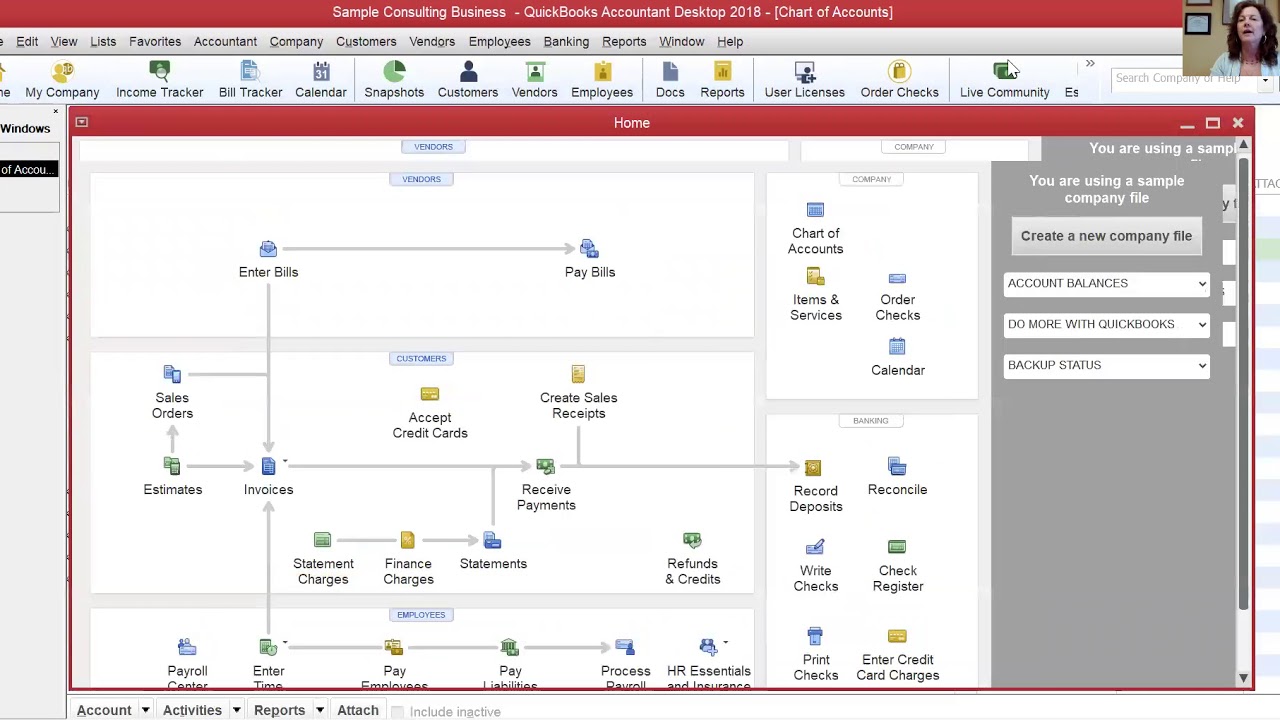

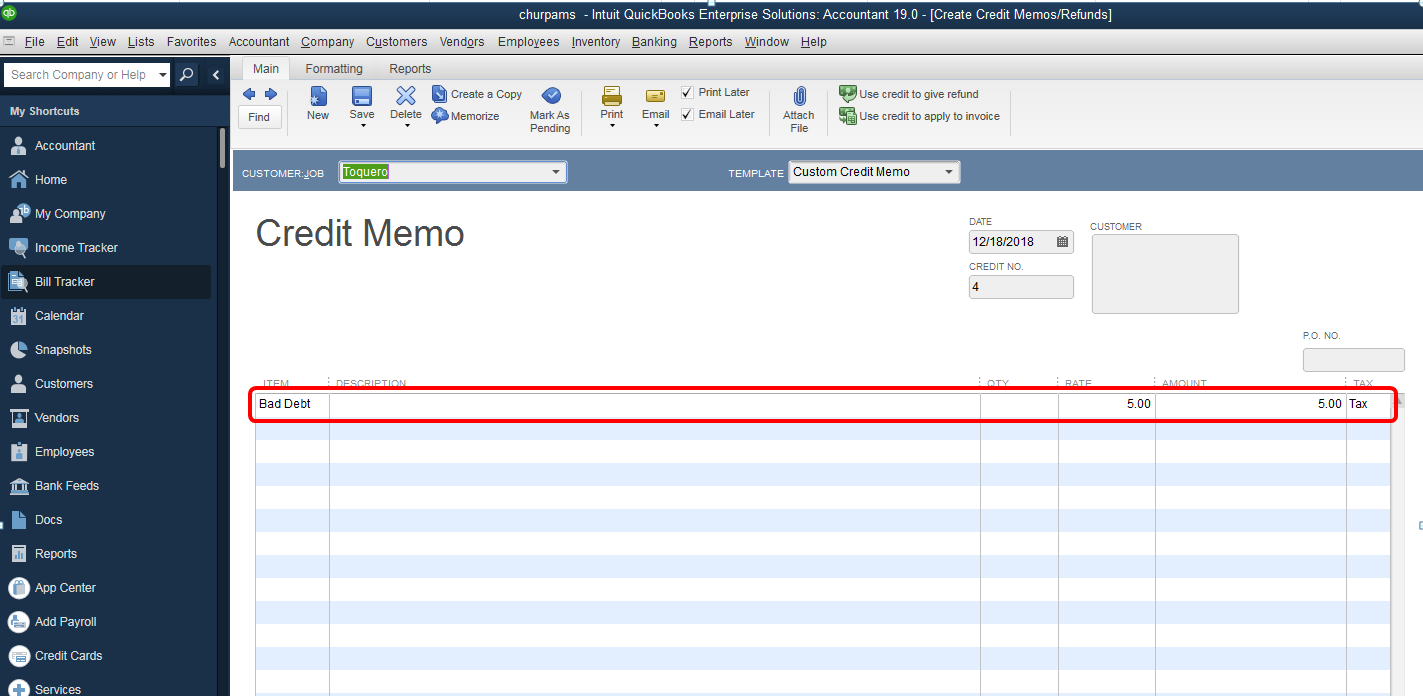

| Encouraged to help my website, in this period I will explain to you concerning How To Delete Instagram Account. And after this, this is the first image:

Think about photograph over? will be that awesome???. if you think maybe consequently, I’l t explain to you some impression yet again underneath:

So, if you want to obtain all of these wonderful graphics about (How To Write Off An Account Receivable In Quickbooks), click on save button to save these photos in your personal computer. They are all set for transfer, if you want and wish to own it, just click save logo on the web page, and it’ll be instantly saved in your notebook computer.} Lastly in order to receive unique and latest image related to (How To Write Off An Account Receivable In Quickbooks), please follow us on google plus or book mark this website, we try our best to provide daily update with fresh and new pictures. Hope you enjoy staying right here. For most up-dates and latest information about (How To Write Off An Account Receivable In Quickbooks) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to present you up grade regularly with all new and fresh photos, love your searching, and find the perfect for you.

Here you are at our website, contentabove (How To Write Off An Account Receivable In Quickbooks) published . Nowadays we are delighted to announce that we have found an extremelyinteresting nicheto be discussed, namely (How To Write Off An Account Receivable In Quickbooks) Many people searching for details about(How To Write Off An Account Receivable In Quickbooks) and of course one of them is you, is not it?