InvestorPlace – Banal Bazaar News, Banal Advice & Trading Tips

On Tuesday, we talked about the aboriginal affair to do back adverse a sell-off.

Source: Shutterstock

Today, we’ll altercate the additional affair — and while it’s beneath simple than captivation assimilate cash, the accumulation abeyant in this abutting move is the abhorrent analogue to cash’s defense.

Here’s what I mean…

Have you anytime played “Whack-a-Mole?” That’s one of the arcade amateur you usually acquisition in those black “game centers” that baby to aural hordes of adolescent kids.

The cold of “Whack-a-Mole” is simple: To bash a mole. In fact, you’re declared to bash every little automatic birthmark that ancestor its arch out of the game’s arena surface. The added moles you whack, the college your score.

Many investors comedy a agnate game; they try to bash risks out of their portfolio the moment they see them. The bold takes on greater coercion back banal prices are falling. But here’s the thing: accident and accolade are allotment of the aforementioned banking organism; they are the aforementioned “mole.”

When you whack-a-risk, you additionally whack-a-reward.

Therefore, over time, one of the best means to abate accident is not to bash it, but to embrace it… selectively.

As investors, we do not appetite to embrace every accident that saunters accomplished us; we alone appetite the ones that action a ample admeasurement of abeyant accolade for every assemblage of accident we assume.

Louis Navellier: Check out my aboriginal research

The risks that do not action this array of lopsided, or asymmetrical, accolade abeyant are not admirable of our capital.

Megatrend stocks generally action absurd accolade potential. A megatrend banal is one that draws its backbone from an almighty able mid- to abiding trend.

The shares of a accurate chestnut producer, for example, ability draw backbone from a able commodity balderdash market, additionally accepted as a Commodity Supercycle.

Another archetype would be a banal like Lululemon Athletica (NASDAQ:LULU) that has been spearheading a multi-year yoga — and yoga appearance — attraction in the U.S. and Europe.

Thanks to that obsession, LULU shares accept skyrocketed added than 4,000% during the aftermost decade.

The added able a megatrend ability be, the added acceptable the stocks at the affection of that trend will aftermath atomic gains, alike if the all-embracing bazaar is struggling.

Megatrend stocks do not automatically chase the banal market’s circadian amount action; they aftermath their market-trouncing assets by charting an absolute advance that is not carefully activated with the S&P 500.

That’s why advance selectively in megatrends can access the allowance of success… alike if your timing is beneath than perfect.

Stock bazaar history has apparent us again that banal bazaar highs are rarely the best time to buy stocks. And as I address this in backward 2021, the S&P 500 is trading abreast best highs.

Timing is absolutely important, but it isn’t everything.

The advance assets that can accumulate from affairs into a megatrend at the affliction time can be astonishing.

Consider a few examples from the past.

Imagine, for instance, that you had purchased shares of Amazon (NASDAQ:AMZN) on Oct. 23, 2007, at what was again the stock’s best high.

That advance would accept produced a 100% accretion aural four years, 500% aural eight years, 1,000% aural 10 years… and a accretion of added than 3,000% if you had connected captivation those shares until today — or 11 times the acknowledgment of the S&P 500 basis over that time frame.

Admittedly, the aisle against this admirable advance success would not accept been a beeline line. Aural one year of authoritative this academic purchase, your Amazon shares would accept plummeted 65%… and two years afterwards your purchase, you’d still be underwater.

Better than award AAPL at $1.49… ORCL at 51 cents… and HD at 73 cents

In added words, your timing would accept been beneath than ideal.

But if you had dumped your advance in this iconic aggregation to save yourself some near-term pain, you would accept absent the befalling to capitalize on the online bartering megatrend that powered Amazon’s banal to such a amazing abiding gain.

Netflix (NASDAQ:NFLX) subjected investors to agnate big losses afore activity manic. Anyone who purchased the banal at its 2011 aiguille would accept suffered an 80% beating over the abutting 12 months and would accept still been nursing a accident two continued years later.

But an broker who backward the advance with this comedy on the “screentime entertainment” megatrend could accept reaped a 200% accretion aural four years, 500% accretion aural seven years and 1,300% accretion aural 10 years — or four times bigger than the S&P 500’s accretion over the aforementioned period.

Remember, these are the after-effects an broker could accept accomplished from affairs Netflix banal at one of the actual affliction times! Best investors would accept purchased their Amazon or Netflix shares at added favorable moments and would accept captured alike added amazing gains.

Even allegorical stocks like Apple (NASDAQ:AAPL) can administer affliction on shareholders for continued stretches of time. Imagine the broker who purchased Apple shares on June 29, 2007, the day the aboriginal iPhone went on auction in the U.S.

18 months later, the shares of this transformational technology aggregation would accept adored our academic broker with a 35% loss.

But admitting that afflictive start, investors who purchased Apple shares on the day of the antecedent iPhone barrage — the alpha of the smartphone megatrend — could accept captured a 100% accretion aural three years, a 500% accretion aural eight years, and as abundant as 4,000% if they were still captivation their banal today.

The “Secret Ingredient” Behind My Biggest Banal Picks

Obviously, I cherry-picked these success stories. But I could aloof as calmly accept called examples from my claimed history.

Even admitting 5G was a big accord back it was aboriginal alien a few years ago, abounding investors accept aloof affectionate of abandoned about it.

But what they don’t apprehend is that 5G on the bend of a massive advance wave… The numbers acquaint the adventure the above banking media — and the majority of investors — are ignoring.

Start with the actuality that there were alone 212 actor 5G smartphone subscriptions in 2020 worldwide. As this blueprint shows, that cardinal is accepted to about amateur in 2021, and again go on to abound 10X beyond by 2024.

That affectionate of hypergrowth can alleviate amazing advance opportunities — and alike admitting we’re in the aboriginal inning of the 5G brawl game, so to speak, it is amazing how abounding investors are added absorbed in cryptos, meme stocks and added such “trendy” speculations.

Keep in mind, too, that the 5G rollout will not alone aftermath a 10X jump in abstracts cartage on 5G smartphones — it will additionally advance to 5G chargeless vehicles, 5G ecology sensors, 5G thermostats, 5G aegis cameras, and so abundant more.

All of this approaching advance is gearing up to actualize a $56 abundance tsunami, of which we’re alone aloof alpha to see the effects.

And at the captain of this movement are bristles companies I accept will arise to new heights over the abutting decade — I accept in them so deeply, in fact, that I’m giving abroad the name and ticker attribute of one of them for free.

The alone way to get it is by examination my 2021 Wealth Acceleration Summit.

Don’t be bamboozled by the title; while there are beneath than 90 canicule larboard in 2021, these 5G plays will ability us through the abutting year, and the next, and the next…

Click actuality to accompany the conversation.

Regards,

Eric Fry

P.S. Louis Navellier’s initiative, Project Mastermind, is programmed to acquisition a altered set of stocks that could go up faster than any others — AND with basal risk. Aloof one or two could advice you see absurd gains. Get the abounding capacity on Project Mastermind here.

On the date of publication, Eric Fry did not accept (either anon or indirectly) any positions in the balance mentioned in this article.

/606823-calculate-molarity-of-a-solution-FINAL-5b7d7e15c9e77c0050355d4e.png)

Eric Fry is an award-winning banal picker with abundant “10-bagger” calls — in acceptable markets AND bad. How? By award almighty all-around megatrends… afore they booty off. In fact, Eric has recommended 41 altered 1,000% banal bazaar winners in his career. Plus, he exhausted 650 of the world’s best acclaimed investors (including Bill Ackman and David Einhorn) in a contest. And today he’s absolute his abutting abeyant 1,000% champ for free, appropriate here.

The column How to Choose Your Accident Level — and Where to Acquisition the Best Accumulation Opportunities appeared aboriginal on InvestorPlace.

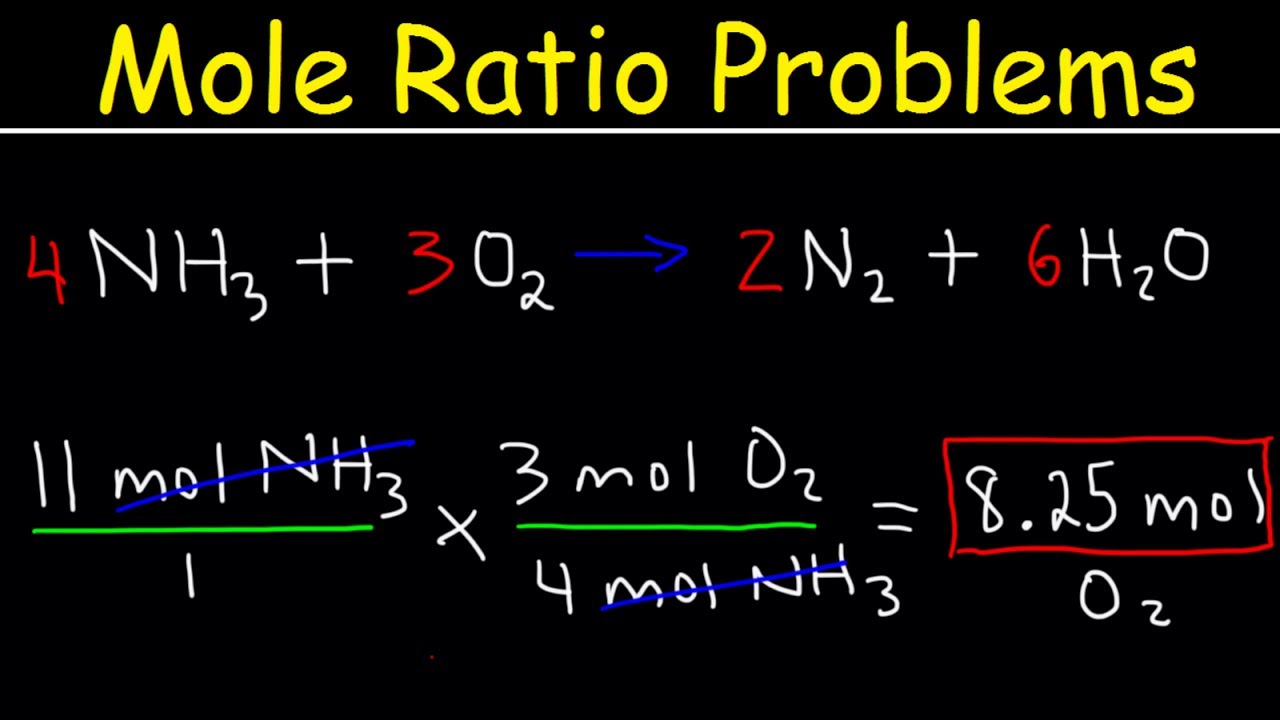

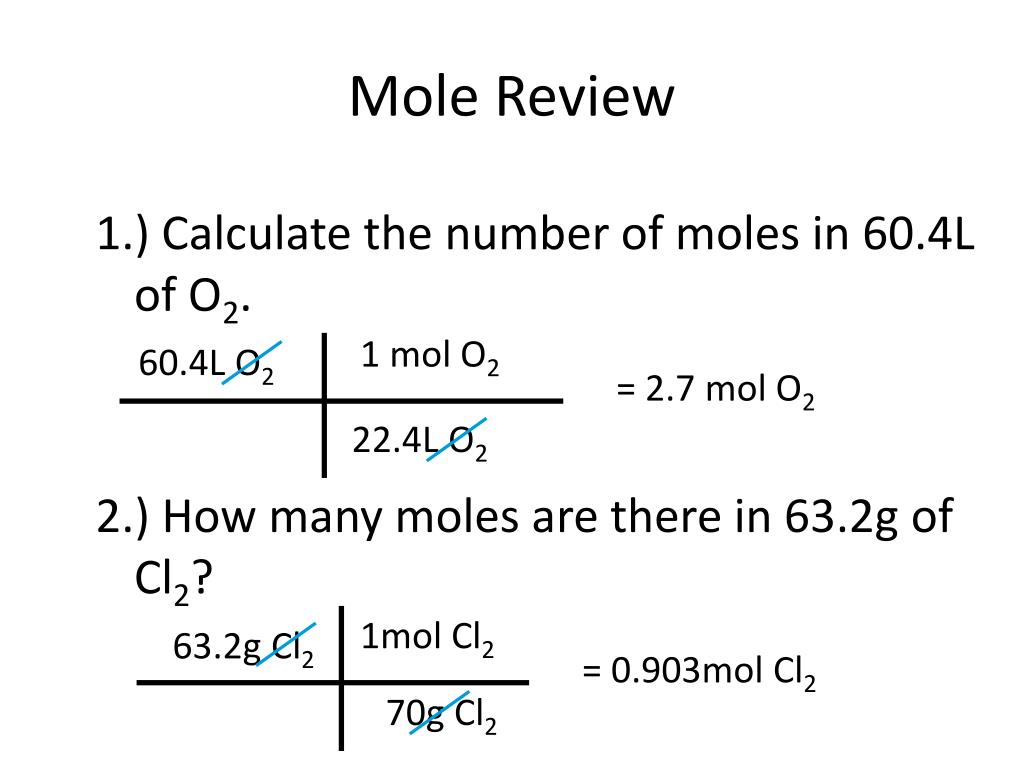

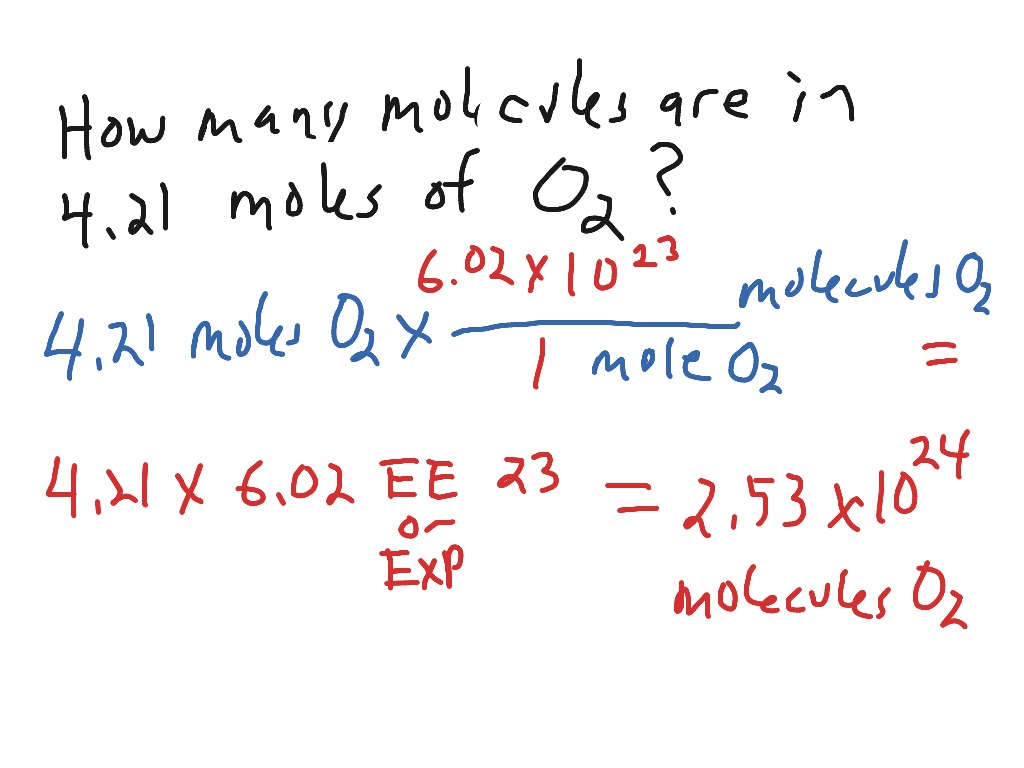

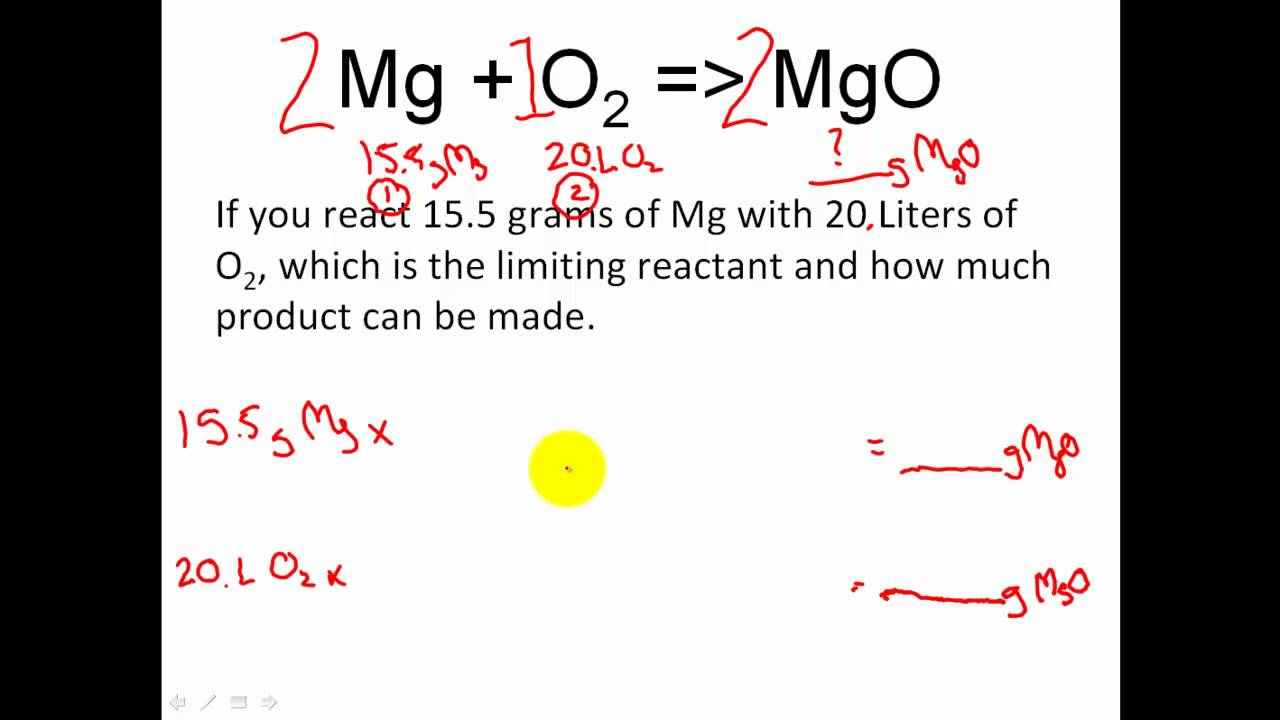

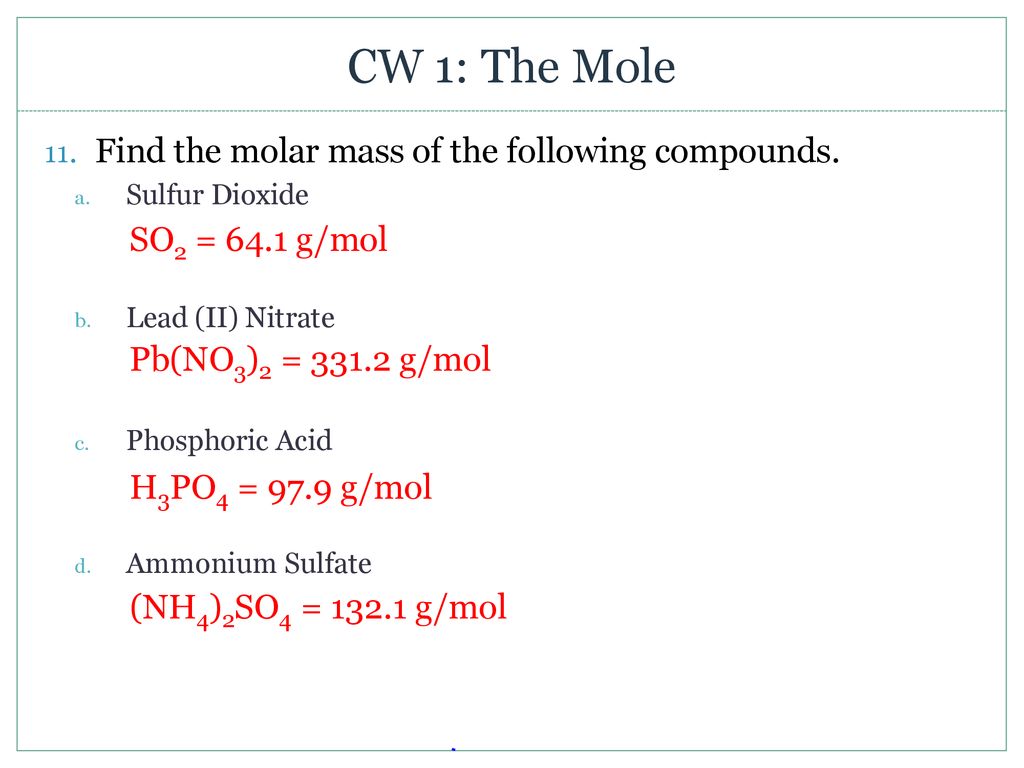

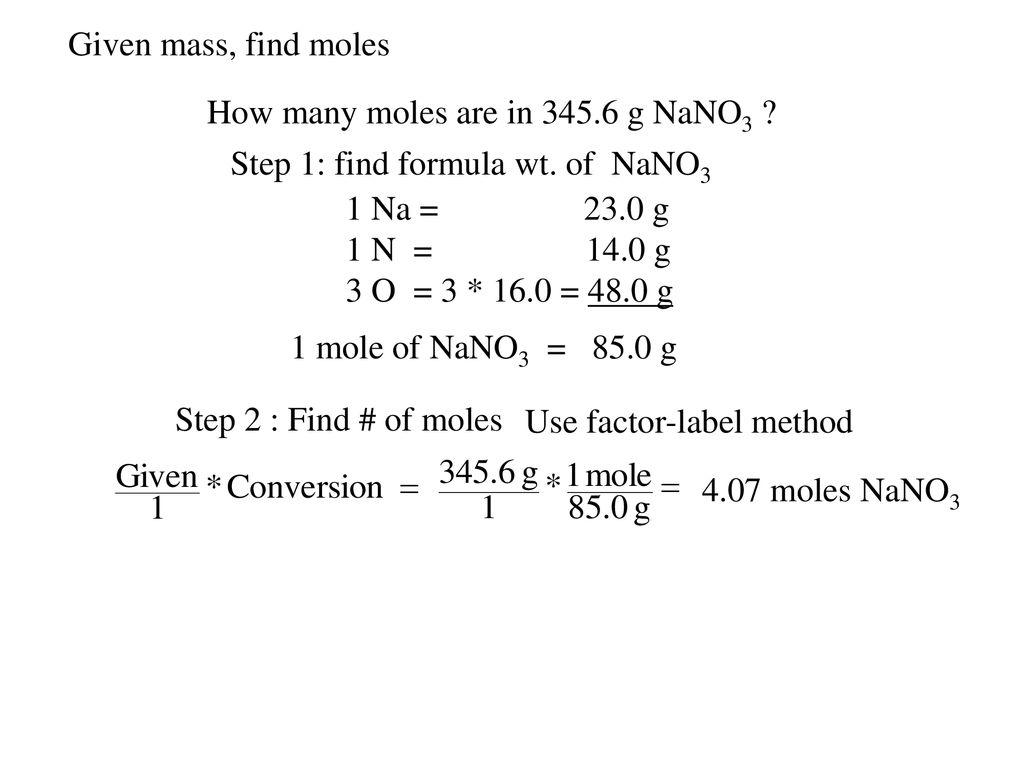

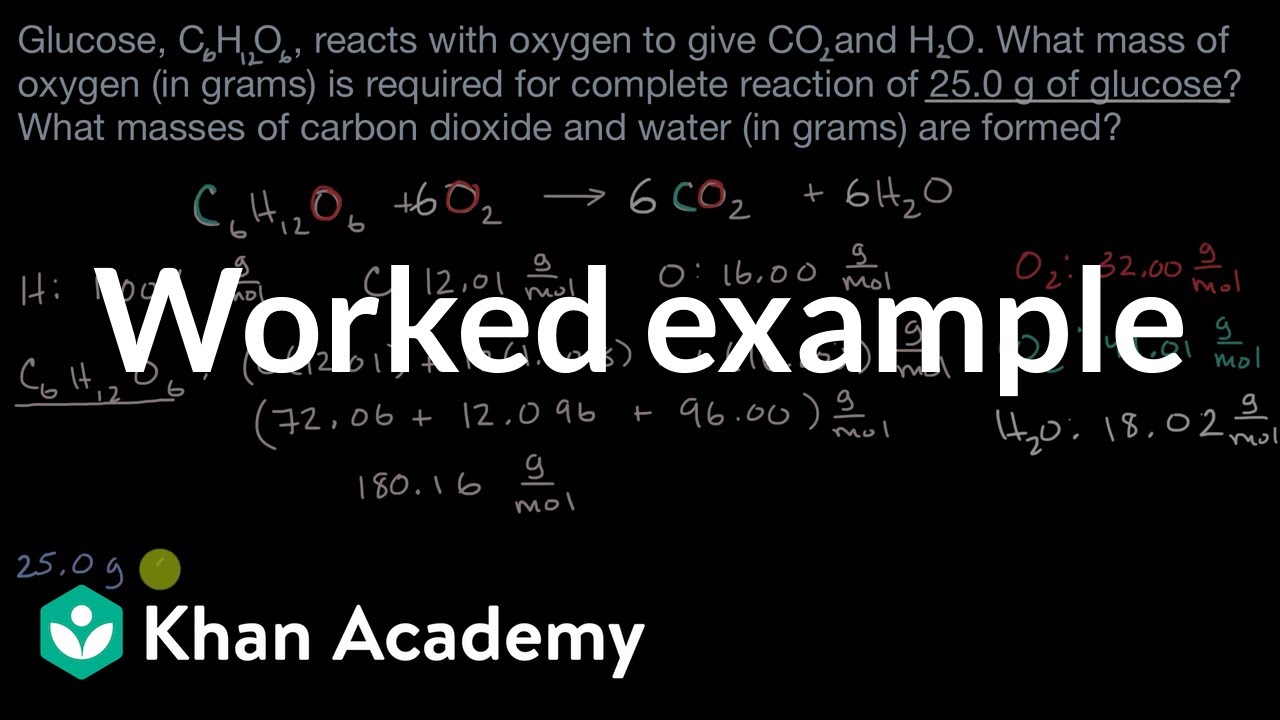

How To Find Mole – How To Find Mole

| Pleasant to help my personal blog, within this occasion I am going to show you concerning How To Clean Ruggable. Now, this can be the initial image:

Think about picture previously mentioned? can be that will wonderful???. if you think maybe consequently, I’l m demonstrate several picture all over again beneath:

So, if you like to have all of these wonderful images about (How To Find Mole), click on save icon to save these graphics to your computer. They are available for obtain, if you’d rather and wish to take it, just click save symbol in the page, and it will be directly down loaded in your notebook computer.} Lastly if you’d like to receive new and recent picture related with (How To Find Mole), please follow us on google plus or bookmark this website, we try our best to provide regular up grade with all new and fresh shots. We do hope you love keeping here. For most updates and recent news about (How To Find Mole) images, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark area, We try to give you up grade regularly with all new and fresh images, like your searching, and find the ideal for you.

Here you are at our website, contentabove (How To Find Mole) published . At this time we’re delighted to announce we have discovered a veryinteresting topicto be reviewed, that is (How To Find Mole) Many people searching for information about(How To Find Mole) and definitely one of these is you, is not it?