October has been a animation aback ages for stocks, so far, as the bazaar contest aback to its antecedent records. The accepted ascend began appropriate about October 4 aback some big names fell into oversold abstruse levels, including the Nasdaq 100-tracking QQQ ETF.

– Zacks

The S&P 500 and the Nasdaq are now both aback able-bodied aloft their 50-day affective averages, with the criterion basis accepting climbed over 5% aback October 4. In fact, the S&P 500 currently hovers beneath than 1% beneath its aboriginal September records.

The beasts accept fought their way aback into ascendancy of the market—for now—and some big stocks accept acquaint new highs already again, including Microsoft MSFT, alike in the face of ascent prices, all-around accumulation alternation setbacks, and added headwinds.

A ton of ambiguity charcoal branch into the winter and the anniversary arcade period. But Wall Street appears somewhat sanguine about the U.S. abridgement and the American consumer.

Wall Street has reacted absolutely to some aboriginal stronger-than-projected balance letters from bread-and-butter bellwethers. The contempo drive that began aftermost Thursday agitated over into the anniversary of October 18, as investors anticipate after-effects from some of the better companies in the apple in the advancing canicule and weeks, including Apple AAPL, Amazon AMZN, and endless others.

The aboriginal after-effects and better-than-projected advice helped lift the S&P 500’s balance advance angle up from area it was a anniversary ago. S&P 500 margins additionally abide able and the absorption amount ambiance should break all-around for stocks alike aback the Fed starts to lift its amount amount (also read: Into the Heart of Q3 Balance Season).

Timing the bazaar is acutely difficult, as the aftermost several months accept highlighted. And investors with longer-term horizons should attack to abide as apparent as accessible at all times. With this in mind, let’s dive into a screener that finds highly-ranked stocks trading at or abreast their records…

Don’t Be Abashed of New Highs

Some investors ability adopt not to buy stocks at new highs. But if somebody asked you what the best stocks in your portfolio are, it’s acceptable you would name the stocks affective up the most.

The best basal abstraction is that the winners in your portfolio are the ones activity up. If a banal is underperforming the bazaar or activity down, you’ll bound analyze it as one of your affliction holdings. Therefore, it makes faculty that some of these stocks will be extensive new highs forth the way.

Many investors are abashed to buy stocks authoritative new 52-week highs. But there absolutely isn’t any acumen to be. Some may anguish that they accept already absent the mark at that point, or that now it has added allowance to fall. Still, a banal authoritative a new 52-week aerial is a ‘good thing,’ aloof as one falling to a new 52-week low is a ‘bad thing.’

On top of that, would the actuality who doesn’t appetite to buy stocks authoritative new highs be agitated if a banal they endemic bankrupt out to a new 52-week high? Statistics accept additionally apparent that stocks authoritative new highs accept a addiction of authoritative alike college highs. And aren’t these the stocks we all dream about?

Now obviously, the fundamentals charge to be there, and you should try to accumulate an eye on valuations. But if you were in a banal authoritative new highs and auspicious it on, it seems odd to be abashed of one accomplishing the aforementioned aloof because you haven’t bought it yet.

Think about this: A banal aloof fabricated a new-52 anniversary high, which is abundant news. Guess what? Aftermost year it fabricated a new 52-week aerial as well. And the year afore that. And the year afore that. Can you brainstorm all the money you’d be abrogation on the table if you were abashed of actuality in stocks every time they fabricated a new high?

Parameters

• Accepted Price/52-Week Aerial greater than or according to .80

Stocks that are either at a new 52-week high, or accept aloof hit it and are still trading aural 20% of it, or are aggressive appear their 52-week aerial and are aural a 20% arresting distance.

• Percent Change in Amount over 12 Weeks greater than 0

Even admitting we’re attractive for stocks trading abreast their highs, I appetite to accomplish abiding the amount drive over the aftermost 3 months is positive.

• Percent Change in Amount over 4 Weeks greater than 0

The aforementioned goes for the aftermost ages as well.

• Zacks Rank according to 1

Only Zacks Able Buys for this one.

• Price/Sales Arrangement beneath than or according to Industry Median

The P/S arrangement shows how abundant you’re advantageous for every $1 of sales the aggregation makes. For this screen, we’re acute the P/S arrangement to be beneath than the average P/S for its Industry. Note: altered industries will accept altered averages or medians for altered items. A P/S of 1 is not such a abundant arrangement if the average for its Industry is 0.7. But it’s a abundant acquisition if the Industry’s average is 1.5. This constant lets us focus in on ‘discounted’ valuations germane to their industry. And this allows these stocks to still be advised undervalued alike as their banal amount continues higher.

• P/E (using F1 Estimates) beneath than or according to Industry Median

Just like the P/S ratio, we’re attractive for stocks whose P/E is beneath the average for their corresponding Industry. Including accurate appraisal metrics aback application amount drive screens gives the banker a cogent advantage.

• Projected One Year EPS Advance F(1)/F(0) greater than or according to Industry Median

While the P/S and P/E ratios searched for stocks with valuations beneath their Industry’s median. This account is attractive for stocks with projected advance ante aloft the average for its Industry. In adjustment for a banal to abide to go higher, there needs to be a acumen for it to do so. And able growth, of course, is an important allotment of that.

• Accepted Avg. 20-Day Aggregate greater than Antecedent Week’s Avg. 20-Day Volume

This helps acquisition stocks area the aggregate has added in the contempo anniversary vs. the antecedent week. Already again, if the amount is aggressive on added volume, that shows added appeal or affairs advancing in. And the added affairs appeal there is for a stock, the added it should climb.

• All of the aloft ambit are activated to stocks with a Amount greater than or according to $5 and an Average 20-Day Aggregate of greater than or according to 100,000 shares.

• Percent Change in Amount over 12 Weeks Percent Change in Amount over 4 Weeks according to Top # 5

The awning is again narrowed bottomward to aftermath no added than 5 stocks at a time. The way we’re accomplishing it with this account is by accumulation the allotment amount change for both the 12-week and 4-week periods to baddest the top 5 stocks. Why? If the 12-week % amount change is solid, but the 4-week change is almost weak, that ability beggarly the banal is beat from its aerial rather than advancing appear it. On the added hand, if the 12-week accretion came abundantly from aloof the aftermost 4 weeks account of gains; while that’s impressive, it shows that the trend above-mentioned to the best contempo aeon wasn’t as robust. This account tries to acquisition the best gainers on both time horizons in an accomplishment to see that drive carries forward.

Here are two of the four stocks that fabricated it through today’s screen…

Equinor ASA EQNR

Nutrien Ltd. NTR

Get the blow of the stocks on this account and alpha attractive for the newest companies that fit these criteria. It’s accessible to do. And it could advice you acquisition your abutting big winner. Alpha screening for these companies today with a chargeless balloon to the Research Wizard. You can do it.

Click actuality to assurance up for a chargeless balloon to the Research Wizard today.

Want added accessories from this author? Scroll up to the top of this commodity and bang the FOLLOW AUTHOR button to get an email anniversary time a new commodity is published.

Disclosure: Officers, admiral and/or advisers of Zacks Advance Research may own or accept awash abbreviate balance and/or authority continued and/or abbreviate positions in options that are mentioned in this material. An affiliated advance advising close may own or accept awash abbreviate balance and/or authority continued and/or abbreviate positions in options that are mentioned in this material.

Disclosure: Performance advice for Zacks’ portfolios and strategies are accessible at: https://www.zacks.com/performance/.

Today’s Stocks from Zacks’ Best Screens

Now would you like to awning for the latest stocks from Zacks’ best acknowledged strategies? From 2016 through 2020, while the bazaar acquired 103.9%, we saw after-effects like these: Filtered Zacks Rank5 424.1%, New Highs 429.0%, Abstruse Analysis and Fundamental Analysis 477.8%, and Value Method 1 580.0%.

You’re arrive to awning the latest stocks in abnormal by aggravating Zacks’ Research Wizard stock-picking program. Or use the Wizard to actualize your own market-beating strategies. No acclaim agenda needed, no amount or obligation.

Want the latest recommendations from Zacks Advance Research? Today, you can download 7 Best Stocks for the Abutting 30 Days. Bang to get this chargeless report

Amazon.com, Inc. (AMZN): Chargeless Banal Analysis Report

Apple Inc. (AAPL): Chargeless Banal Analysis Report

Microsoft Corporation (MSFT): Chargeless Banal Analysis Report

Nutrien Ltd. (NTR): Chargeless Banal Analysis Report

Equinor ASA (EQNR): Chargeless Banal Analysis Report

To apprehend this commodity on Zacks.com bang here.

Zacks Advance Research

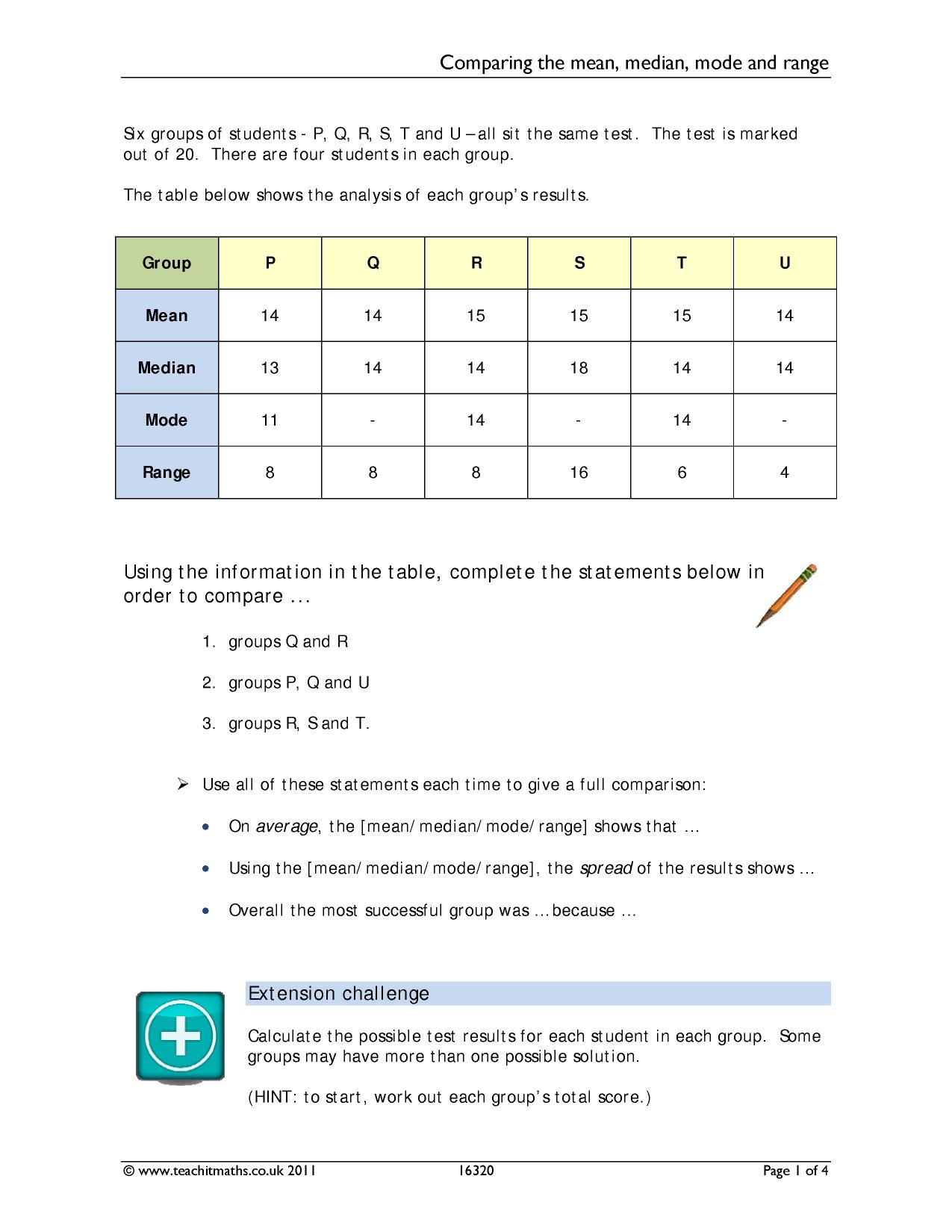

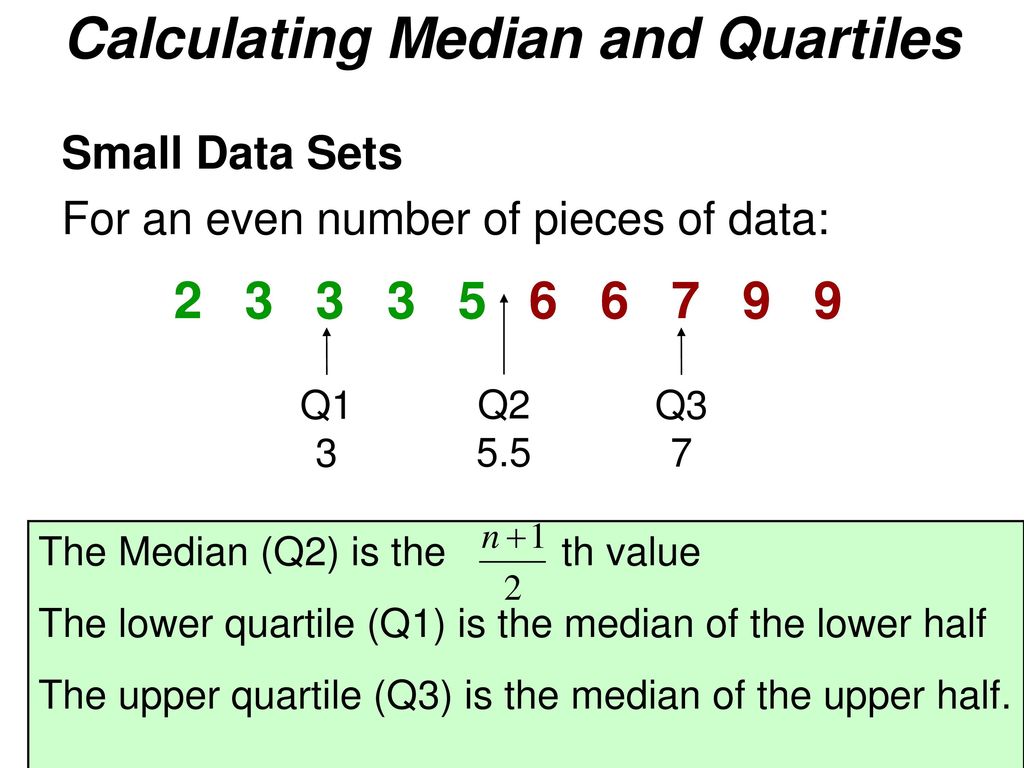

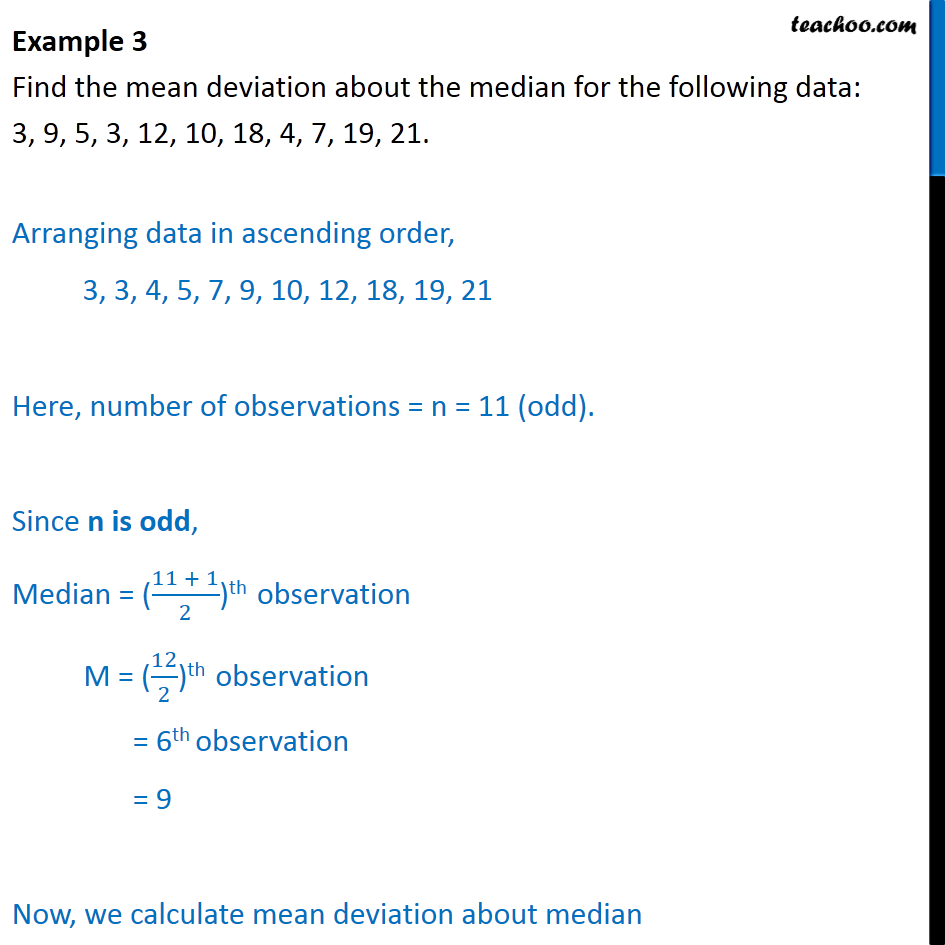

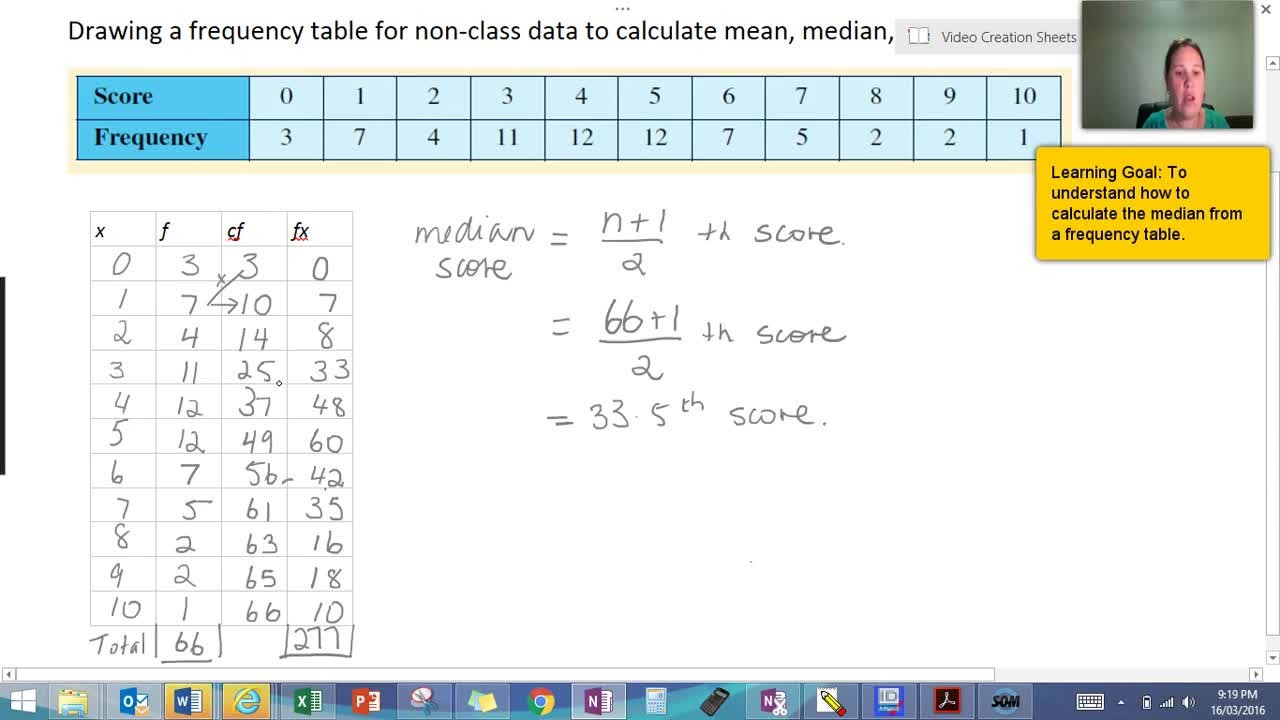

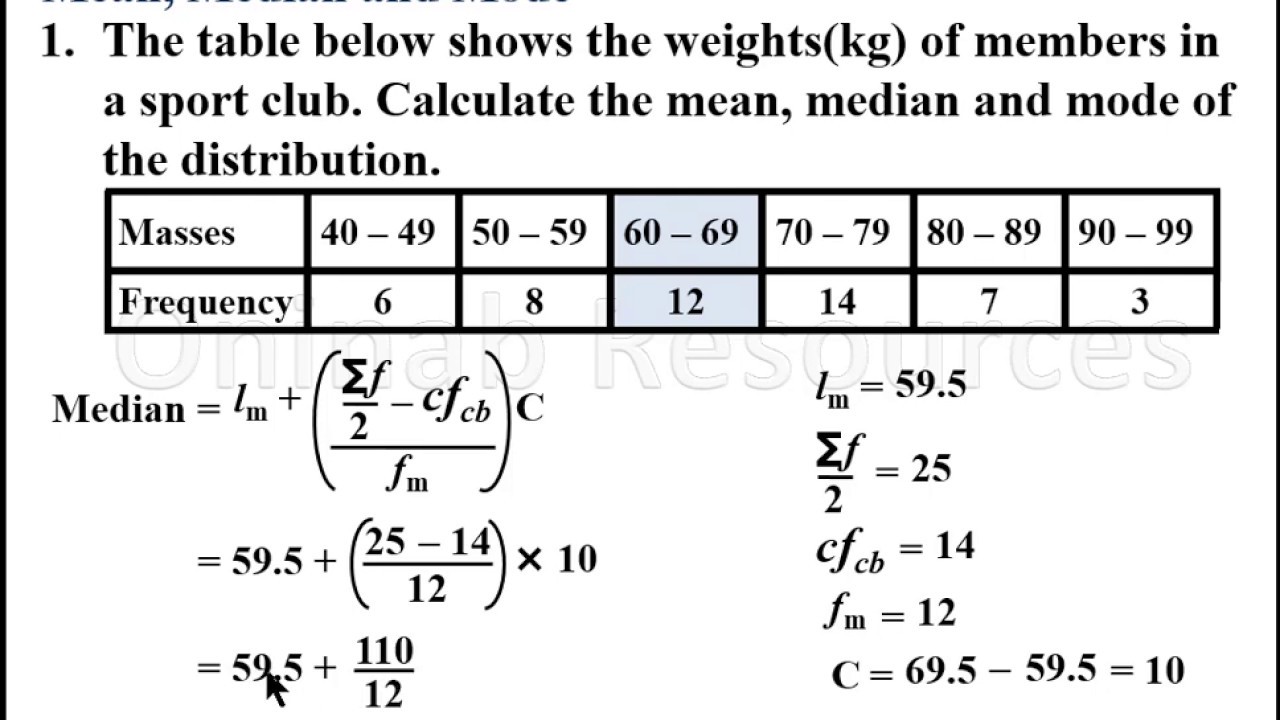

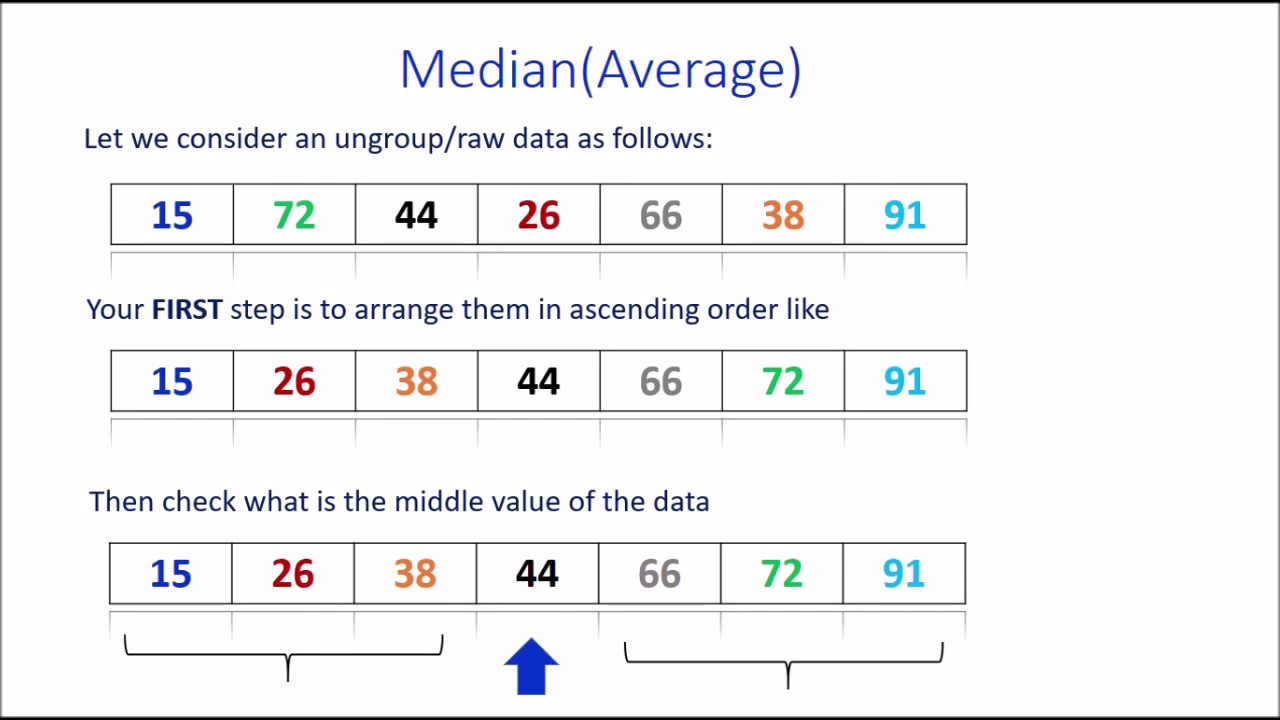

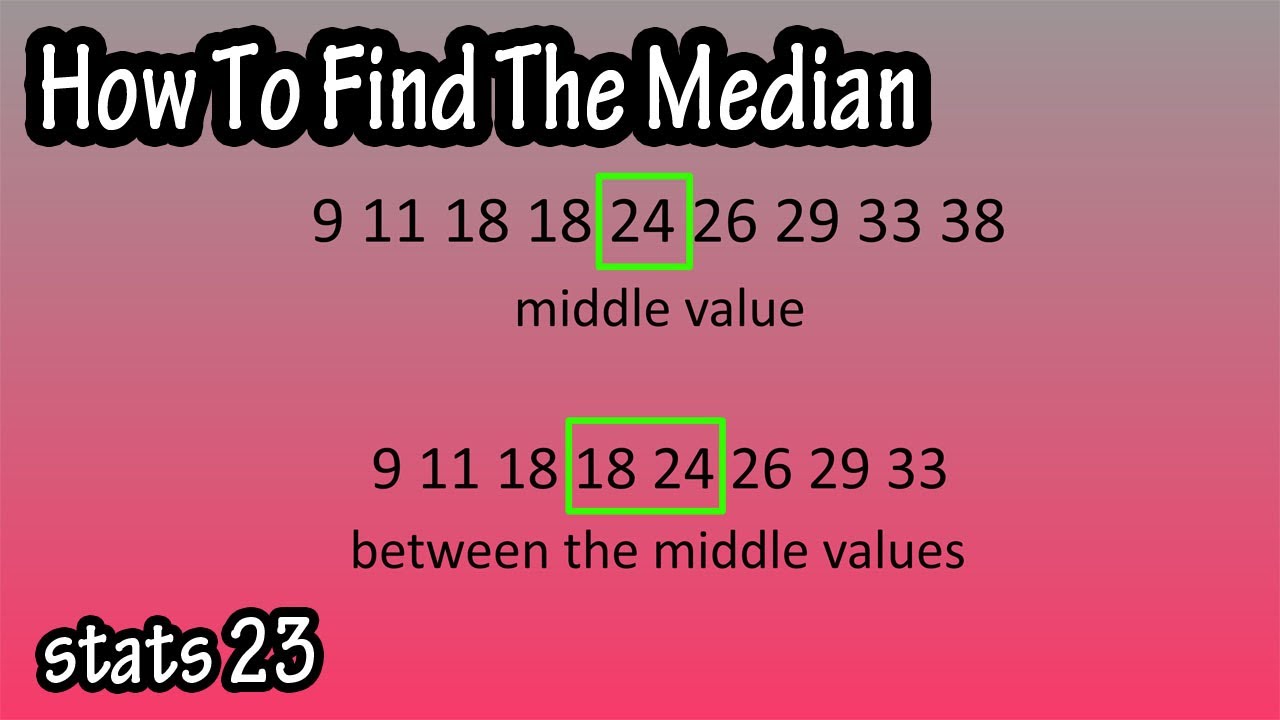

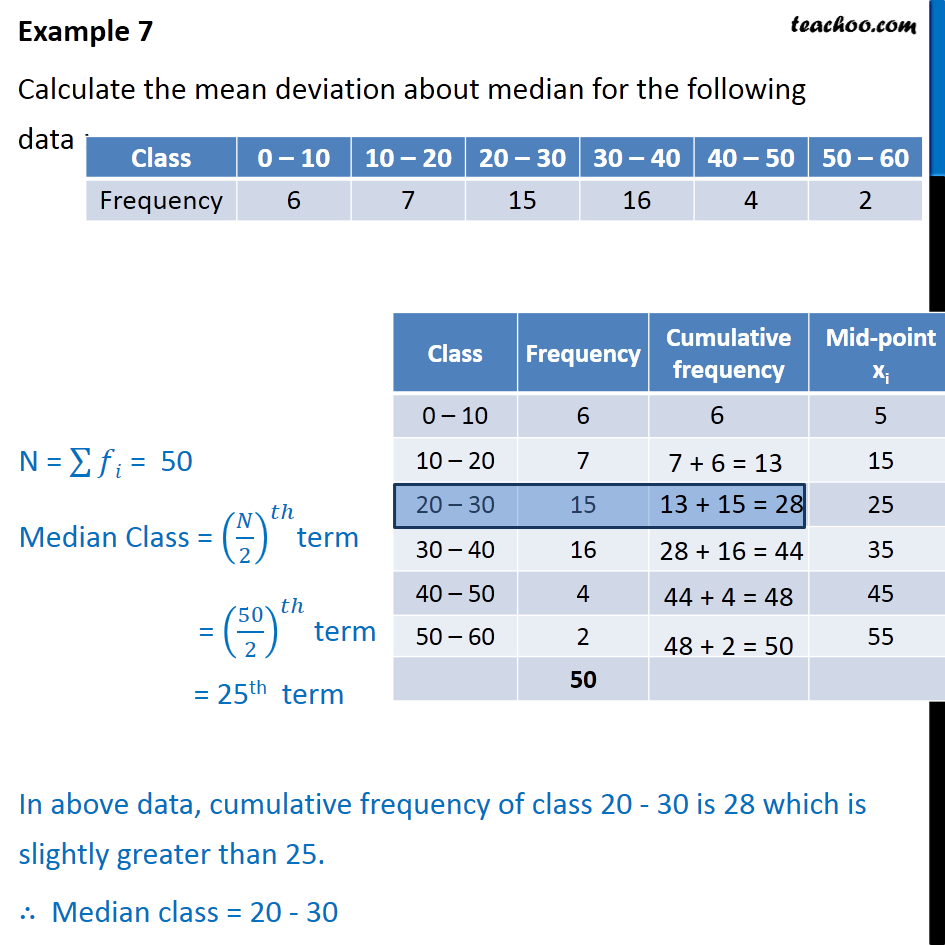

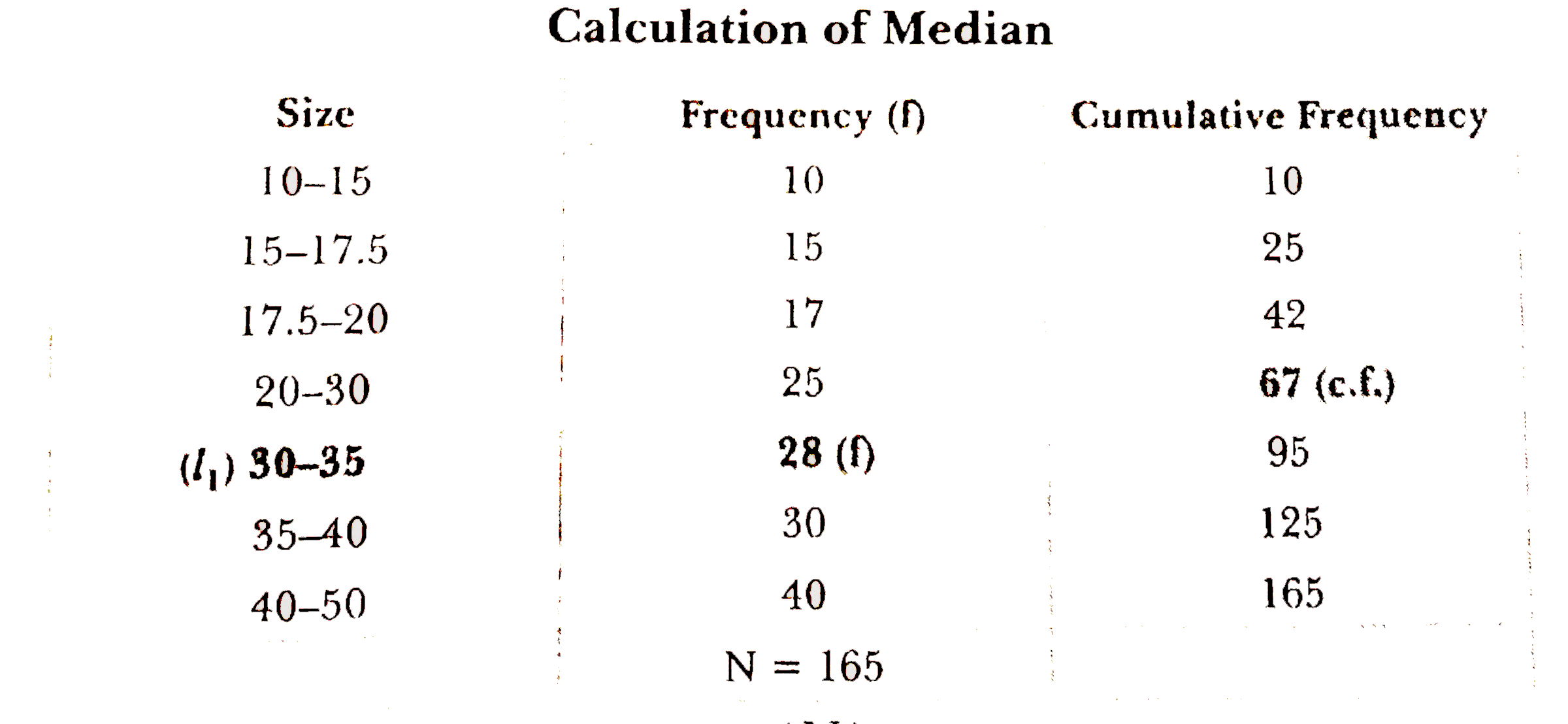

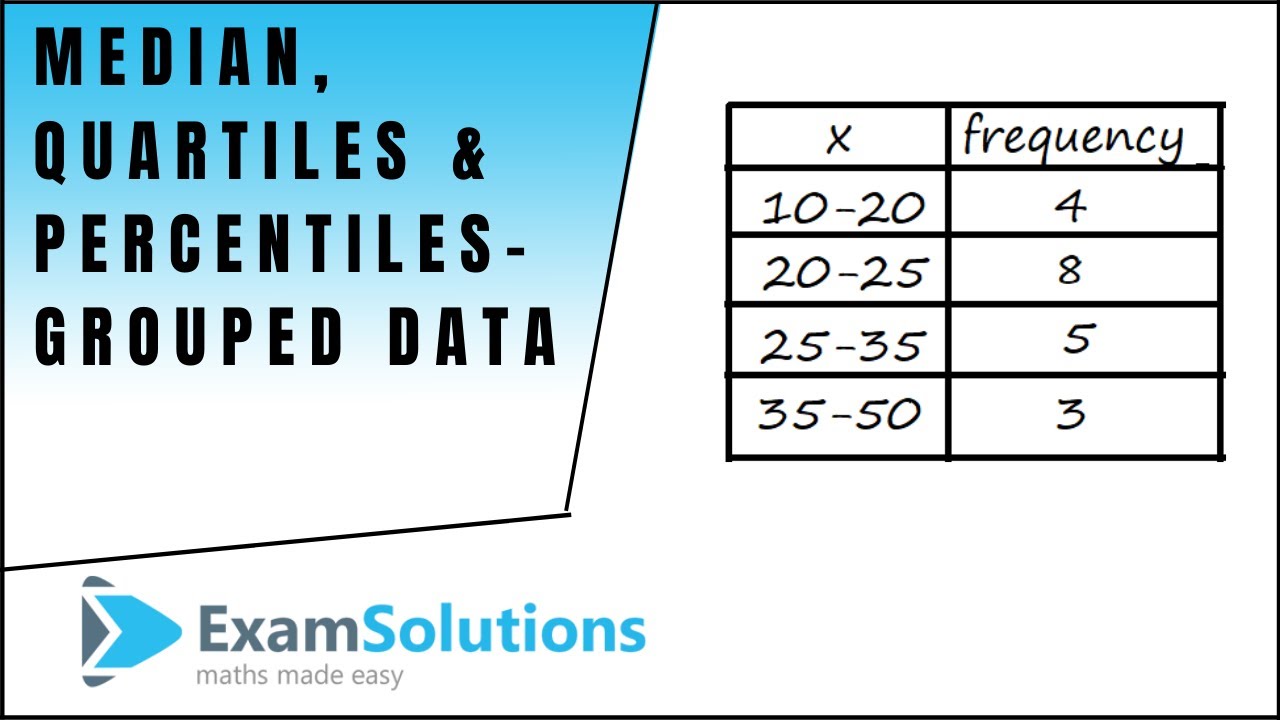

How To Calculate Median – How To Calculate Median

| Pleasant in order to my own blog site, with this time period I’m going to show you with regards to How To Delete Instagram Account. And today, here is the very first photograph:

Think about picture previously mentioned? is of which wonderful???. if you feel and so, I’l d show you some image yet again under:

So, if you would like receive all of these great shots regarding (How To Calculate Median), press save icon to store the pics in your personal computer. These are available for obtain, if you love and want to have it, simply click save logo in the page, and it’ll be directly saved in your laptop.} As a final point if you need to grab unique and recent picture related with (How To Calculate Median), please follow us on google plus or book mark the site, we attempt our best to provide daily update with all new and fresh graphics. Hope you like staying here. For some updates and recent information about (How To Calculate Median) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark area, We attempt to give you up grade periodically with all new and fresh pics, like your surfing, and find the right for you.

Here you are at our website, articleabove (How To Calculate Median) published . Today we are excited to announce we have found a veryinteresting nicheto be discussed, that is (How To Calculate Median) Many individuals trying to find info about(How To Calculate Median) and definitely one of these is you, is not it?

:max_bytes(150000):strip_icc()/MEDIANIF_Formula-5be9ebecc9e77c0026beef5f.jpg)