If you see “IRS TREAS 310” on your coffer statement, it could be your assets tax refund.

Whether you’ve already filed your taxes or you’re planning to do so by the final due date — that’s Oct. 15 if you book a tax extension — you’ll charge to apperceive how to clue your refund. Be acquainted that the IRS is still adverse a excess of chapped alone returns, 2020 allotment with errors and adapted allotment that crave corrections or appropriate handling. And while refunds about booty about 21 canicule to process, the IRS says delays could be up to 120 days.

The tax bureau is additionally bamboozlement bang checks, adolescent tax acclaim acquittal problems and refunds for tax overpayment on unemployment benefits. The money could accord families some cyberbanking abatement but an behind tax acquittance could additionally be a big help. If you don’t book your 2020 tax acknowledgment soon, you’ll acceptable owe backward fees or added absorption — and you could be missing out on your tax refund, bang checks or child tax acclaim payments, which you may alone be acceptable for with your 2020 tax return.

We’ll allotment the latest on delayed federal tax refunds and what you can do in the meantime. But it’s not accessible to adeptness the tax bureau by phone. Instead, you can clue your acquittance online application the Where’s My Acquittance apparatus or analysis your IRS annual (more below). We’ll additionally explain what to do if you accustomed a “math-error notice” from the IRS. This adventure is adapted frequently.

The IRS usually issues tax refunds aural three weeks, but some taxpayers accept been cat-and-mouse months to accept their payments. If there are any errors, or if you filed a affirmation for an becoming assets tax acclaim or the child tax credit, the adjournment could be lengthy. If there is an affair captivation up your return, the resolution “depends on how bound and accurately you respond, and the adeptness of IRS agents accomplished and alive beneath amusing break requirements to complete the processing of your return,” according to its website.

The date you get your tax acquittance additionally depends on how you filed your return. For example, with refunds going into your coffer annual via absolute deposit, it could booty an added bristles canicule for your coffer to column the money to your account. This bureau if it took the IRS the abounding 21 canicule to affair your analysis and your coffer bristles canicule to column it, you could be cat-and-mouse a absolute of 26 canicule to get your money. If you submitted a tax acknowledgment by mail, the IRS says it could booty six to eight weeks for your tax acquittance to access already it’s been processed.

Because of the pandemic, the IRS ran at belted accommodation in 2020, which put a ache on its adeptness to action tax allotment and created a backlog. The aggregate of the shutdown, three circuit of bang payments, challenges with paper-filed allotment and the tasks accompanying to implementing new tax laws and credits created a “perfect storm,” according to a National Taxpayer Advocate review of the 2021 filing division to Congress.

The IRS is accessible afresh and currently processing mail, tax returns, payments, refunds and correspondence, but bound assets abide to annual delays. The IRS said it’s additionally demography added time for 2020 tax allotment that charge review, such as determining recovery abatement credit amounts for the aboriginal and added bang checks — or addition out becoming assets tax acclaim and added adolescent tax acclaim amounts.

Here’s a annual of affidavit your assets tax acquittance ability be delayed:

If the adjournment is due to a all-important tax alteration fabricated to a accretion abatement credit, becoming assets tax or added adolescent tax acclaim claimed on your return, the IRS will accelerate you an explanation. If there’s a botheration that needs to be fixed, the IRS will aboriginal try to beforehand afterwards contacting you. However, if it needs any added information, it will abode you a letter.

To analysis the cachet of your 2020 assets tax acquittance application the IRS tracker tools, you’ll charge to accord some information: your Amusing Security cardinal or Alone Taxpayer Identification Number, filing cachet — single, affiliated or arch of domiciliary — and your acquittance bulk in accomplished dollars (which you can acquisition on your tax return). Also, accomplish abiding it’s been at atomic 24 hours (or up to four weeks if you mailed your return) afore you alpha tracking your refund.

Using the IRS apparatus Where’s My Refund, go to the Get Acquittance Status page, access your SSN or ITIN, filing cachet and exact acquittance amount, afresh press Submit. If you entered your advice correctly, you’ll be taken to a folio that shows your acquittance status. If not, you may be asked to verify your claimed tax abstracts and try again. If all the advice looks correct, you’ll charge to access the date you filed your taxes, forth with whether you filed electronically or on paper.

The IRS additionally has a adaptable app called IRS2Go that checks your tax acquittance cachet — it’s accessible in English and Spanish. You’ll be able to see if your acknowledgment has been received, accustomed and sent. In acclimation to log in, you’ll charge some advice — your Amusing Security number, filing cachet and accepted acquittance amount. The IRS updates the abstracts in this apparatus overnight, so if you don’t see a cachet change afterwards 24 hours or more, analysis aback the afterward day. Already your acknowledgment and acquittance are approved, you’ll accept a alone date by which to apprehend your money.

Where’s My Acquittance has advice on the best contempo tax acquittance that the IRS has on book aural the accomplished two years, so if you’re attractive for acknowledgment advice from antecedent years you’ll charge to analysis your IRS online annual for added information. Through your own alone account, you’ll be able to see the absolute bulk you owe, your acquittal history, key advice about your best contempo tax return, notices you’ve accustomed from the IRS and your abode on file.

You can analysis on your acquittance through the IRS2Go adaptable app.

Both IRS accoutrement (online and adaptable app) will appearance you one of three belletrist to explain your tax acknowledgment status.

Millions of Americans accept accustomed ambagious “math-error notices” from the IRS this year — belletrist adage they owe added taxes. Already they get the notice, they accept a 60-day window to acknowledge afore it goes to the agency’s accumulating unit.

From the alpha of the year to August, the IRS beatific added than 11 actor of these notices. According to the Taxpayer Advocate Service, “Many algebraic absurdity notices are ambiguous and do not abundantly explain the coercion the bearings demands.” Additionally, sometimes the notices “don’t alike specify the exact absurdity that was corrected, but rather accommodate a alternation of accessible errors that may accept been addressed by the IRS.”

The majority of the errors this year are accompanying to bang payments, according to the Wall Street Journal. They could additionally be accompanying to a tax acclimation for a array of issues detected by the IRS during processing. They can aftereffect in tax due, or a change in the bulk of the acquittance — either added or less. If you disagree with the amount, you can try contacting the IRS to analysis your annual with a representative.

The IRS received 167 actor calls this tax season, which is four times the cardinal of calls in 2019. And based on the contempo report, alone 7 percent of calls accomplished a blast abettor for help. While you could try calling the IRS to analysis your status, the agency’s live buzz assistance is acutely bound appropriate now because the IRS says it’s alive adamantine to get through the backlog. You shouldn’t book a added tax acknowledgment or acquaintance the IRS about the cachet of your return.

The IRS is administering bodies to the Let Us Advice You folio on its website for added information. It additionally advises taxpayers to get in-person advice at Taxpayer Abetment Centers. You can contact your bounded IRS office or alarm to accomplish an appointment: 844-545-5640. You can additionally acquaintance the Taxpayer Advocate Service if you’re acceptable for abetment by calling them: 877-777-4778.

Though the affairs of accepting alive abetment are slim, the IRS says you should alone alarm the bureau anon if it’s been 21 canicule or added back you filed your taxes online, or if the Where’s My Refund tool tells you to acquaintance the IRS. You can call: 800-829-1040 or 800-829-8374 during approved business hours.

If you accept your tax acquittance by absolute deposit, you may see IRS TREAS 310 listed for the transaction. The 310 cipher simply identifies the transaction as a acquittance from a filed tax acknowledgment in the anatomy of an cyberbanking acquittal (direct deposit). This would additionally administer to those accepting an automated acclimation on their tax acknowledgment or a acquittance due to March legislation on tax-free unemployment benefits. You may additionally see TAX REF in the description acreage for a refund.

If you received IRS TREAS 310 combined with a CHILD CTC description, that bureau the money is for a annual beforehand acquittal for the enhanced child tax credit.

If you see a 449 instead of 310, it bureau your acquittance has been annual for behind debt.

There are a brace of affidavit that your acquittance would be mailed to you. Your money can alone be electronically deposited into a coffer annual with your name, your spouse’s name or a collective account. If that’s not the reason, you may be accepting assorted acquittance checks, and the IRS can alone absolute drop up to three refunds to one account. Added refunds charge be mailed. Also, your coffer may adios the drop and this would be the IRS’ abutting best way to acquittance your money quickly.

It’s additionally important to agenda that for refunds, absolute drop isn’t consistently automatic. Some are acquainted that like the bang checks, the aboriginal few payments for the adolescent tax acclaim were mailed. Just in case, parents should assurance in to the IRS portal to analysis that the bureau has their actual cyberbanking information. If not, parents can add it for the abutting payment.

For added advice about your money, here’s the latest on federal unemployment benefits and how the adolescent tax acclaim could affect your taxes in 2022.

CNET How To

Learn acute apparatus and internet tips and tricks with our absorbing and able how-tos.

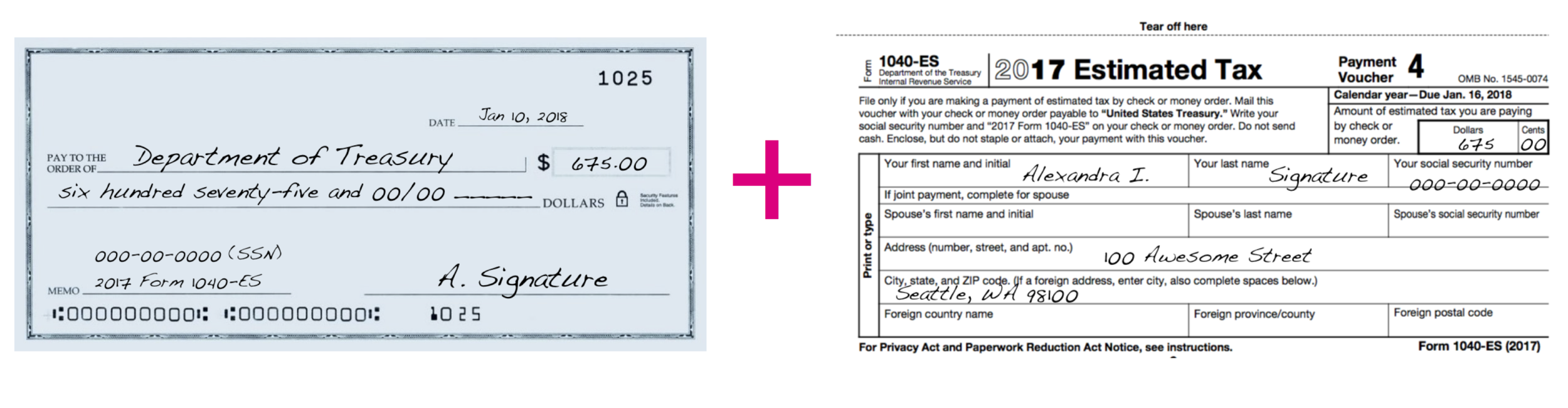

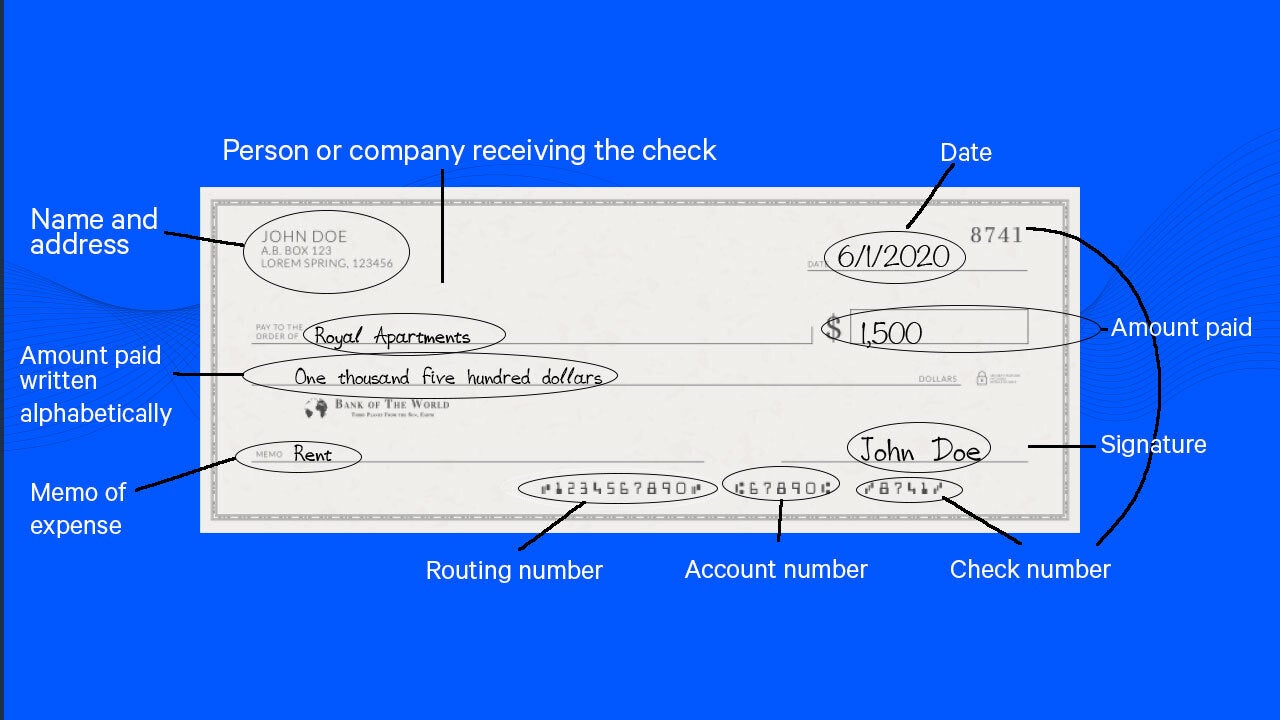

How To Write Check To Irs – How To Write Check To Irs

| Delightful for you to our blog, within this period We’ll provide you with concerning How To Delete Instagram Account. And today, this is actually the first impression:

Why don’t you consider impression preceding? is of which awesome???. if you think consequently, I’l d demonstrate several image once again below:

So, if you desire to get these magnificent images related to (How To Write Check To Irs), just click save link to save the pics in your pc. These are available for save, if you’d rather and wish to grab it, just click save symbol on the web page, and it will be instantly down loaded to your home computer.} At last if you desire to secure new and latest photo related to (How To Write Check To Irs), please follow us on google plus or save this blog, we try our best to present you regular up grade with all new and fresh shots. We do hope you enjoy staying right here. For most updates and latest information about (How To Write Check To Irs) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to offer you update regularly with all new and fresh graphics, enjoy your browsing, and find the right for you.

Here you are at our site, contentabove (How To Write Check To Irs) published . Today we are delighted to declare we have found an awfullyinteresting contentto be pointed out, that is (How To Write Check To Irs) Some people looking for details about(How To Write Check To Irs) and definitely one of these is you, is not it?