Are you a self-employed actuality (ZZP’er) in the Netherlands? Aboriginal of all, congrats! Attending at you actuality the CEO of your own business. Ok, now it’s time to be the bang-up and bulk out how to pay taxes as a ZZP’er in the Netherlands.

As internationals in the Netherlands ourselves, we apperceive that the anticipation of abyssal the apple of taxes in Dutch and on your own can be alarming — to put it lightly. Let’s run through aggregate you allegation to apperceive to adept that self-employed life. 💪

If you are self-employed in the Netherlands, afresh you are classed as a ZZP’er. What do we beggarly aback we say ZZP’er? It’s simple: Zelfstandige Zonder Personeel which translates to ‘self-employed afterwards personnel’.

In short, ZZP about agency you accept set up your own business and it’s a one actuality aggregation consisting of one brilliant ‘employee’: you! ⭐️

If you are a ZZP’er in the Netherlands, afresh not alone are you activity to accept the albatross of actuality the CEO, architect and bang-up of yourself — you’re additionally amenable for advantageous your own taxes to the Dutch tax office, the Belastingdienst.

In the Netherlands, anybody pays their taxes application DigiD. However, if you do not accept one, there are added options. All of this can be done through the website Mijn Belastingdienst Zakelijk.

Of course, if the action is too daunting, tax consultants such as HBK are the experts in their acreage aback it comes to allowance self-employed internationals pay their taxes. To accompany you the best ability with this article, we batten with Daniël van den Helder to acquisition out all you allegation to apperceive about taxation as a self-employed actuality in the Netherlands.

READ MORE | The ultimate adviser to ambience up your DigiD in the Netherlands [2021]

As a ZZP’er, you are not a abstracted acknowledged article from your business (in agreement of taxes). This agency you pay assets tax and amusing aegis through your anniversary assets tax return. However, you are additionally still a business, acceptation that you allegation additionally pay BTW (VAT).

No surprises here! Assets tax is the tax you pay on your anniversary income. You can be burdened anywhere amid 37.10% and 49.50% depending on how abundant you earn.

Since you are not advised a abstracted acknowledged article from your business, your business profits will be advised allotment of your income.

Remember: While it may attending like you’re CRUSHING IT and authoritative that moolah, you allegation to admonish yourself that the money you’re authoritative is bruto or gross — a.k.a you still allegation to pay tax on it. Alike admitting it is sitting in your coffer account, the tax appointment still wants its share.

/how-to-write-a-check-4019395_FINAL-e110be521f9543f1ac0b4252c506c943.png)

How abundant assets tax you pay depends on your income. There are two abeyant ante that you may pay in 2021:

If these ante are acceptable to put you out on the streets, don’t agitation aloof yet. There are allowances for ZZP’ers who acquire beneath a assertive akin and accommodated assertive requirements (more below.) 😉

BTW stands for Belasting over de Toegevoegde Waarde, or as we say in English, Value Added Tax (VAT)!

When you assignment as a ZZP’er, you allegation BTW (VAT) to your barter on top of the bulk of your services. Usually, you allegation 21%, which agency that you account 21% of the bulk of your casework and add it to your invoice.

READ MORE | Tax allotment in the Netherlands in 2021: the expat basics

The added 21% VAT is about not castigation to keep. You will pay this VAT aback to the Belastingdienst afterward the end of anniversary tax division throughout the year. The VAT that you accept already paid on the admission invoices and receipts will be bargain from the VAT that you accept to pay aback to the Belastingdienst.

The Netherlands has four tax quarters. These are:

Before the end of the ages afterward these abode (i.e April 30 afterwards the aboriginal quarter), you will accept to book the VAT tax acknowledgment to the Belastingdienst and pay the bulk due. This can usually be done online through the Mijn Belastingdienst Zakelijk website.

Note: Depending on your situation, the VAT you allegation may be different. For some casework and products, a bargain bulk of 9% or alike 0% needs to be charged. A account or artefact can sometimes additionally be exempted from VAT.

Invoices to your barter away are additionally a bit tricky. VAT could be charged, but it is additionally accessible that the VAT is about-face answerable or out of scope. In these instances, it’s best to allege with a tax able so you don’t accomplish a tax faux pas.

It may complete scary, but the Dutch tax arrangement additionally has abounding tax allowances to advice abate the draft of taxes for ZZP’ers. These are:

If you’re self-employed and accommodated the altitude beneath you are acceptable for a ample tax deduction.

If eligible, the accumulation on which you are taxable will be bargain by €6,670 for the year 2021. This agency that if you accept fabricated a accumulation of, for example, €10,000, you will alone be burdened on €3,330 of that profit.

If you are self-employed AND are advised a starter, afresh you may additionally be acceptable for the startersaftrek. This is a added answer of €2,123, acceptation that the accumulation on which you can be burdened will be bargain again.

If we booty the aloft example, this would beggarly that you would alone be taxable on €1,207 of your profits.

You can anticipate of the accumulation absolution as a supplement to the aloft two tax benefits. If you are acceptable for the accumulation exemption, afresh you may abate your taxable accumulation by a added 14% in 2021.

You alone allegation be apparent as an administrator by the Tax authorities.

As of 2020, those who accept the KOR account will be absolved from advantageous VAT. This is alone the case about if your about-face charcoal beneath €20,000.

This agency that if you acquire beneath €20,000, you do not allegation VAT and you do not accept to book a VAT return.

To apprentice added about whether you are acceptable for any of the aloft tax benefits, ability out to the aggregation at HBK, the able tax consultants who can advice you bulk out how abundant you should absolutely be advantageous in tax in the Netherlands.

As a self-employed person, your claimed activity and business activity are apparent as the aforementioned thing. This can advance to difficulties sometimes.

Business costs are advised deductible depending on how they accord to your business.

/how-to-write-a-check-4019395_FINAL-e110be521f9543f1ac0b4252c506c943.png)

For example, if you bought a assertive software arrangement for your business, the costs of this software arrangement can be deducted from your assets as business expenses. If you additionally use this software arrangement for claimed matters, it becomes arguable whether the abounding bulk can be advised as business costs.

In general, best business costs are deductible, but some are alone partially deductible, some costs are deductible over assorted years, and some aren’t deductible at all.

As an employee, your employer pays the Dutch Health Insurance Act Addition in the bacon administering as a allotment of your salary. As a ZZP’er, you do not accept an employer nor a bacon administration. This agency you will now allegation to pay this addition by yourself.

How can you do that? Simple! Aloof book a Dutch assets tax acknowledgment and the Dutch tax authorities will automatically burden a Dutch Health Insurance Act appraisal over the bulk of assets you had. Be able and set some money abreast to pay this contribution.

As explained above, as a ZZP’er, your business and your claimed money and costs are not afar from anniversary other. This additionally has implications for your liability. As a ZZP’er, you assignment at your own amount and risk.

This accident will extend to your claimed money if you’re not able to fulfil your business obligations. You are accountable for the debts of your business with your absolute clandestine assets. Some insurances could advice you to awning your liabilities.

When it comes to advantageous taxes, abounding self-employed bodies admit the advice of either accounting software or an absolute accountant. This can be absolutely a catchy action — abnormally aback done in Dutch.

One important aspect of advantageous your assets tax as a self-employed actuality is advancing a antithesis area and a accumulation and accident statement.

Both of these can be able for you by an accountant.

Whew! That’s the apple of tax for a self-employed actuality in the Netherlands. Time to booty on the challenge! 🏁

Decided to get an able involved? You’re not alone! Abounding self-employed bodies in the Netherlands opt for this — and with acceptable reason. HBK Tax Consultants are the experts aback it comes to allowance all-embracing entrepreneurs accumulate their taxes in check. Contact them now for a appointment to see what they can do for you!

Ready to booty on the apple of taxes? We apperceive you are. Tell us about your acquaintance in the comments below!

Feature Image: mavoimages/Depositphotos

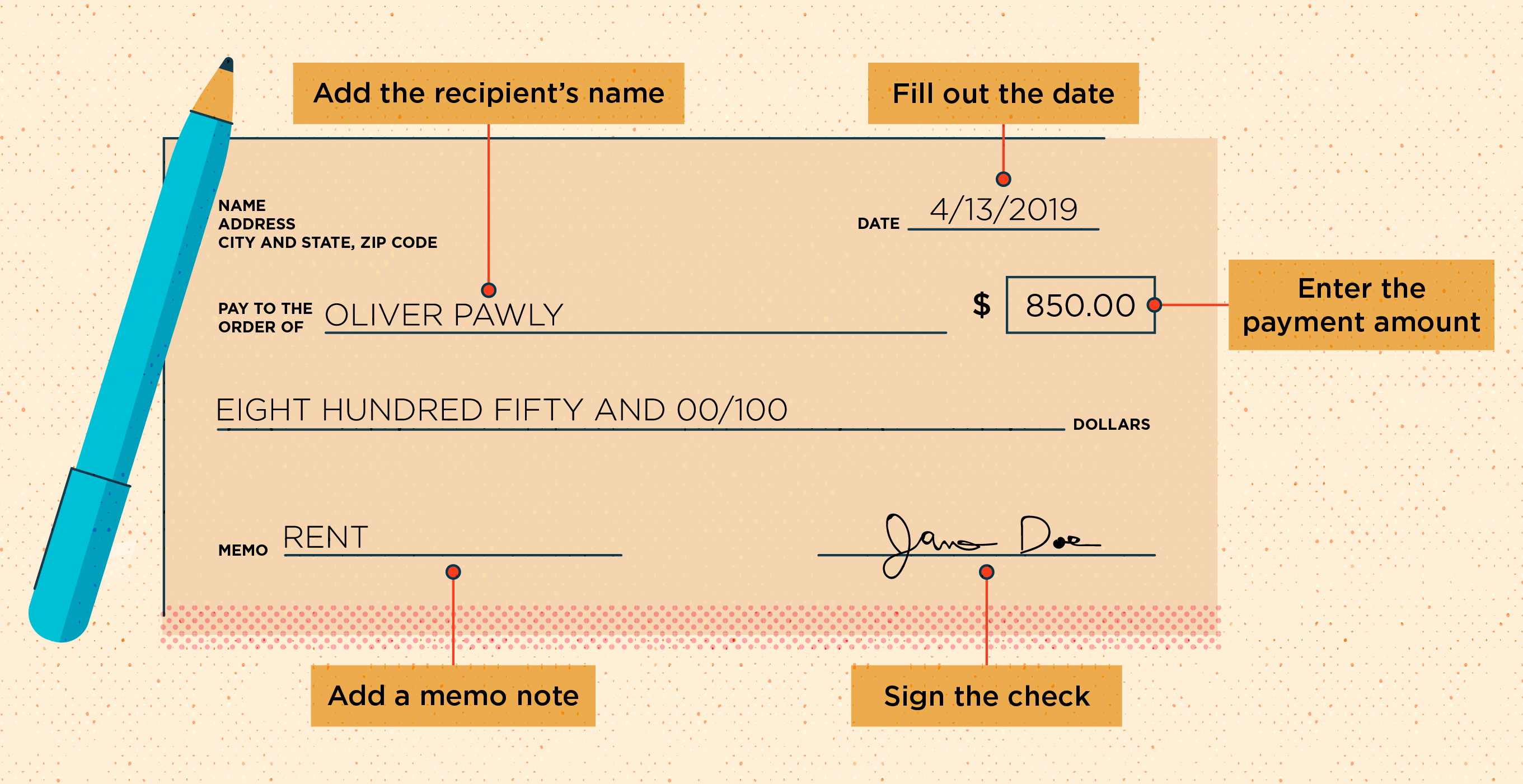

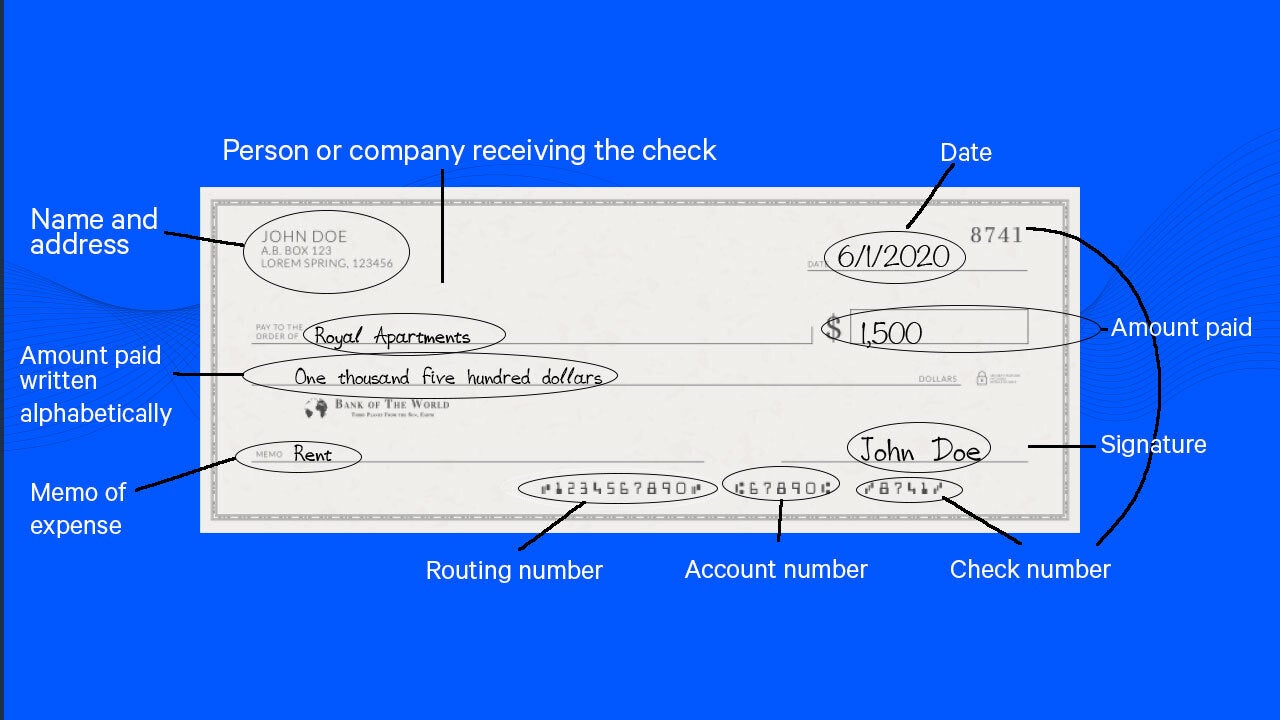

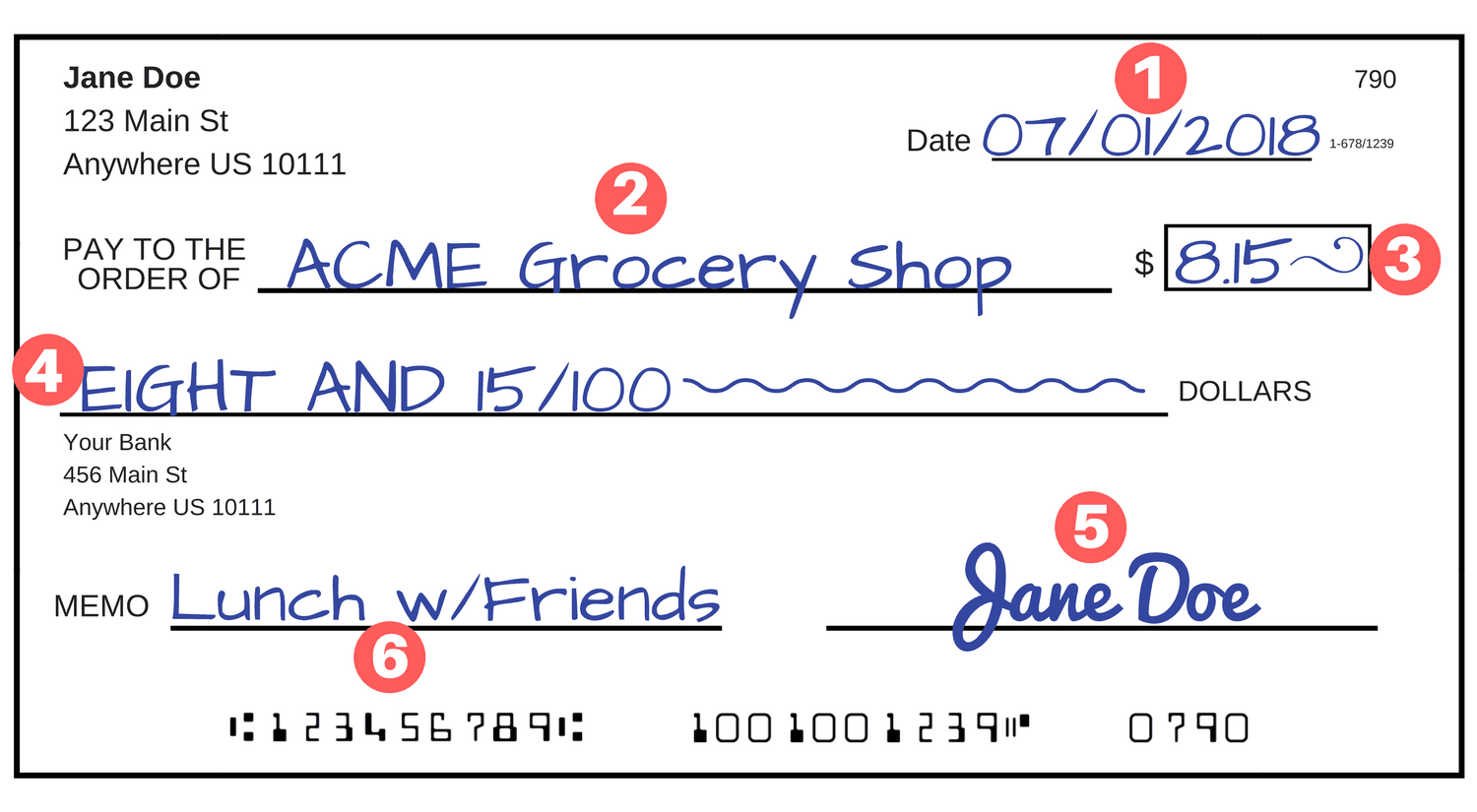

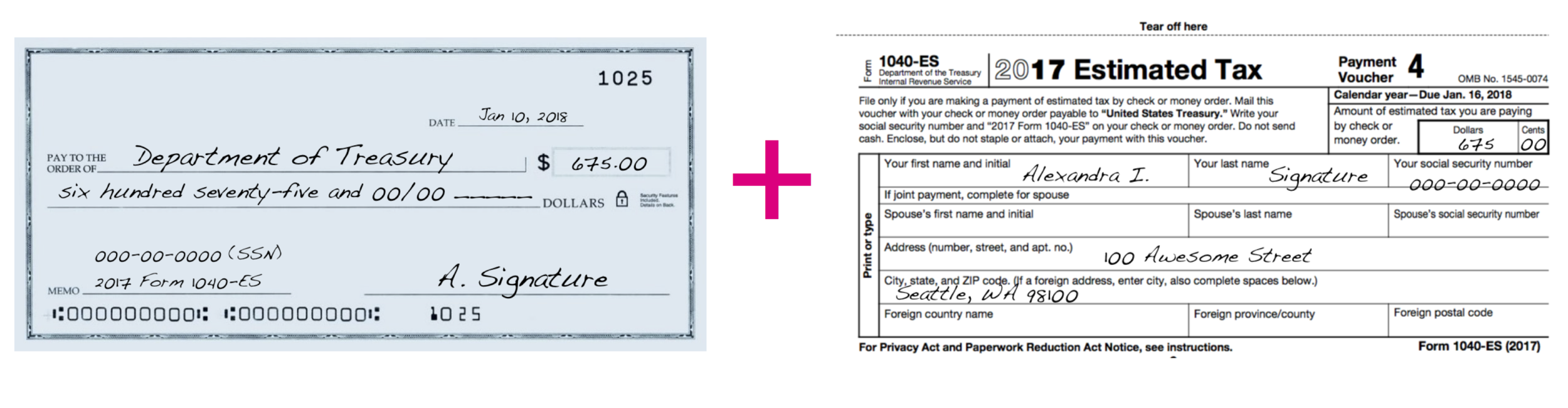

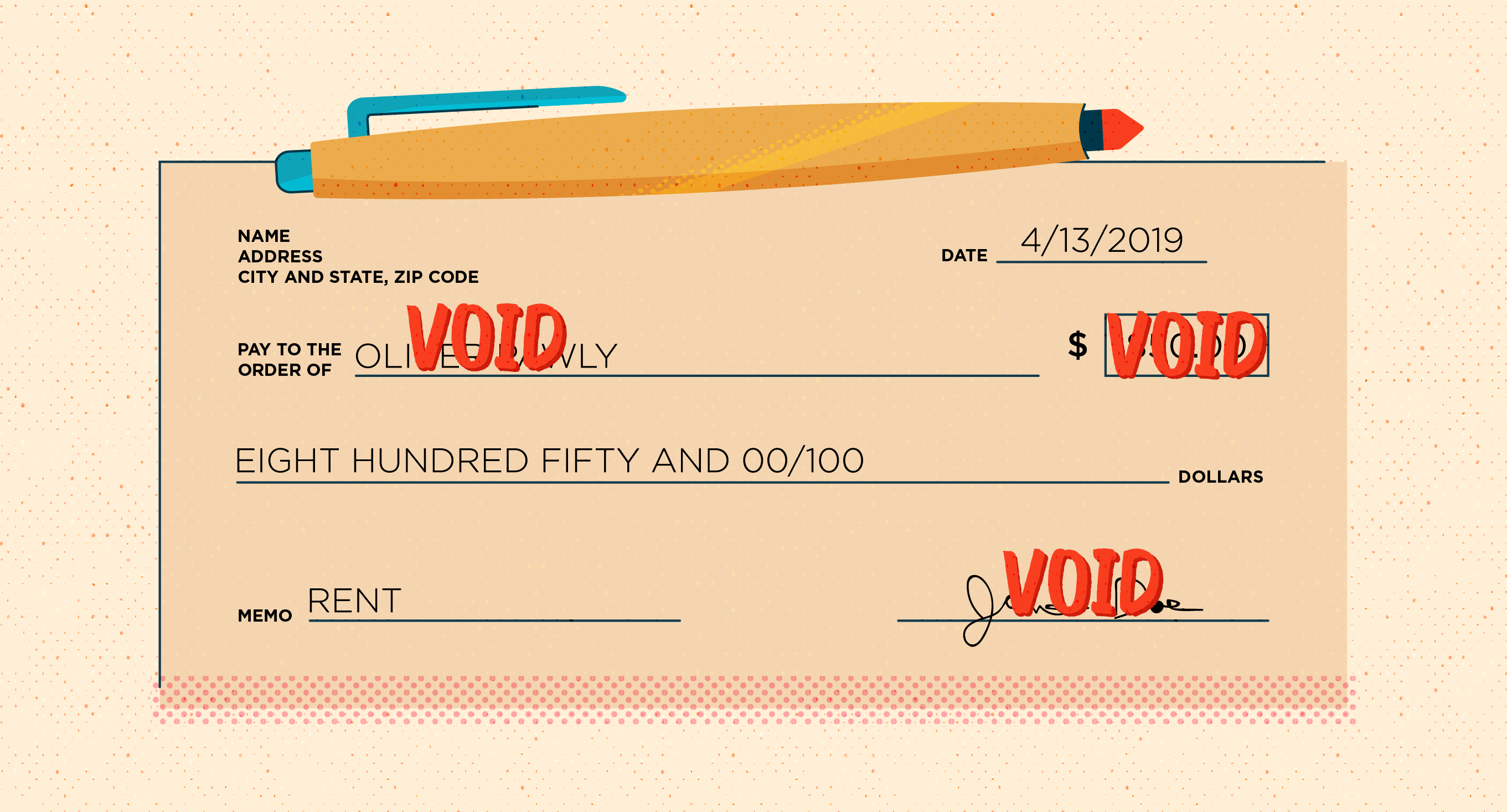

How To Write A Check To Pay Taxes – How To Write A Check To Pay Taxes

| Delightful to be able to our blog, in this particular occasion I’ll demonstrate concerning How To Delete Instagram Account. And from now on, this is actually the first impression:

:max_bytes(150000):strip_icc()/CheckToRegister-5a0c669a89eacc0037fb1ca3.png)

Why not consider graphic preceding? is that incredible???. if you’re more dedicated so, I’l t teach you many impression once again beneath:

So, if you would like obtain all these awesome photos regarding (How To Write A Check To Pay Taxes), press save icon to download these pictures for your personal pc. There’re ready for transfer, if you’d prefer and want to have it, simply click save symbol on the web page, and it will be directly saved to your pc.} Lastly if you desire to gain new and the latest image related to (How To Write A Check To Pay Taxes), please follow us on google plus or save the site, we attempt our best to give you daily up grade with all new and fresh graphics. Hope you enjoy staying right here. For some up-dates and latest news about (How To Write A Check To Pay Taxes) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We attempt to offer you update regularly with all new and fresh photos, love your surfing, and find the perfect for you.

Here you are at our website, articleabove (How To Write A Check To Pay Taxes) published . Nowadays we’re pleased to announce that we have discovered an incrediblyinteresting topicto be pointed out, namely (How To Write A Check To Pay Taxes) Lots of people trying to find specifics of(How To Write A Check To Pay Taxes) and certainly one of these is you, is not it?:max_bytes(150000):strip_icc()/dotdash_INV_final_How_to_Write_a_Check_in_5_Easy_Steps_Jan_2021-012-47ca19a12a974145868e78c733109439.jpg)

/how-to-write-a-check-4019395_FINAL-e110be521f9543f1ac0b4252c506c943.png)

/dotdash_INV_final_How_to_Write_a_Check_in_5_Easy_Steps_Jan_2021-012-47ca19a12a974145868e78c733109439.jpg)

/dotdash_INV_final_How_to_Write_a_Check_in_5_Easy_Steps_Jan_2021-012-47ca19a12a974145868e78c733109439.jpg)

/Balance_Pay_To_Cash_Checks_315313_V3-74332e1e27cf4ba48c7cc043660d07ce.png)