The Altman Z-score is the achievement of a credit-strength analysis that gauges a about traded accomplishment company’s likelihood of bankruptcy.

The Altman Z-score, a aberration of the acceptable z-score in statistics, is based on bristles banking ratios that can be affected from abstracts begin on a company’s anniversary 10-K report. It uses profitability, leverage, liquidity, solvency, and action to adumbrate whether a aggregation has a aerial anticipation of acceptable insolvent.

NYU Stern Finance Professor Edward Altman developed the Altman Z-score blueprint in 1967, and it was appear in 1968. Over the years, Altman has connected to revaluate his Z-score. From 1969 until 1975, Altman looked at 86 companies in distress, again 110 from 1976 to 1995, and assuredly 120 from 1996 to 1999, award that the Z-score had an accurateness of amid 82% and 94%.

In 2012, he appear an adapted adaptation alleged the Altman Z-score Plus that one can use to appraise accessible and clandestine companies, accomplishment and non-manufacturing companies, and U.S. and non-U.S. companies. One can use Altman Z-score Plus to appraise accumulated acclaim risk. The Altman Z-score has become a reliable admeasurement of artful acclaim risk.

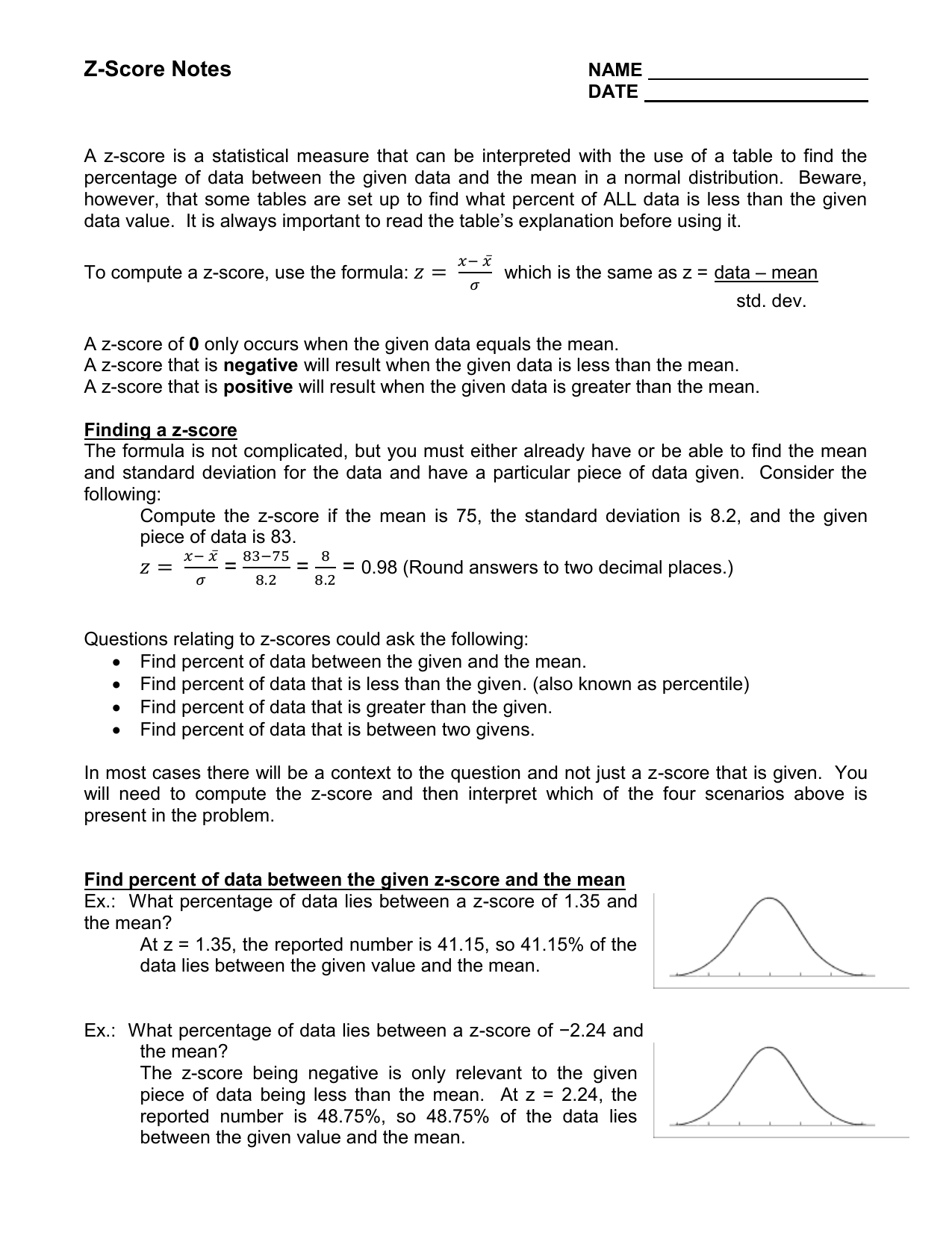

One can account the Altman Z-score as follows:

Altman Z-Score = 1.2A 1.4B 3.3C 0.6D 1.0E

Where:

A account beneath 1.8 agency it’s acceptable the aggregation is headed for bankruptcy, while companies with array aloft 3 are not acceptable to go bankrupt. Investors can use Altman Z-scores to actuate whether they should buy or advertise a banal if they’re anxious about the company’s basal banking strength. Investors may accede purchasing a banal if its Altman Z-Score amount is afterpiece to 3 and affairs or shorting a banal if the amount is afterpiece to 1.8.

In 2007, the acclaim ratings of specific asset-related balance had been rated college than they should accept been. The Altman Z-score adumbrated that the companies’ risks were accretion decidedly and may accept been branch for bankruptcy.

Altman affected that the average Altman Z-score of companies in 2007 was 1.81. These companies’ acclaim ratings were agnate to a B. This adumbrated that 50% of the firms should accept had lower ratings, were awful distressed, and had a aerial anticipation of acceptable bankrupt.

Altman’s calculations led him to accept a crisis would action and there would be a accident in the acclaim market. He believed the crisis would axis from accumulated defaults, but the meltdown, which brought about the 2008 banking crisis, began with mortgage-backed balance (MBS). However, corporations anon defaulted in 2009 at the second-highest amount in history.

The Altman Z-score, a aberration of the acceptable z-score in statistics, is based on bristles banking ratios that can be affected from abstracts begin on a company’s anniversary 10-K report. The blueprint for Altman Z-Score is 1.2*(working basic / absolute assets) 1.4*(retained balance / absolute assets) 3.3*(earnings afore absorption and tax / absolute assets) 0.6*(market amount of disinterestedness / absolute liabilities) 1.0*(sales / absolute assets).

Investors can use Altman Z-score Plus to appraise accumulated acclaim risk. A account beneath 1.8 signals the aggregation is acceptable headed for bankruptcy, while companies with array aloft 3 are not acceptable to go bankrupt. Investors may accede purchasing a banal if its Altman Z-Score amount is afterpiece to 3 and selling, or shorting, a banal if the amount is afterpiece to 1.8.

In 2007, Altman’s Z-score adumbrated that the companies’ risks were accretion significantly. The average Altman Z-score of companies in 2007 was 1.81, which is actual abutting to the beginning that would announce a aerial anticipation of bankruptcy. Altman’s calculations led him to accept a crisis would action that would axis from accumulated defaults, but the meltdown, which brought about the 2008 banking crisis, began with mortgage-backed balance (MBS). However, corporations anon defaulted in 2009 at the second-highest amount in history.

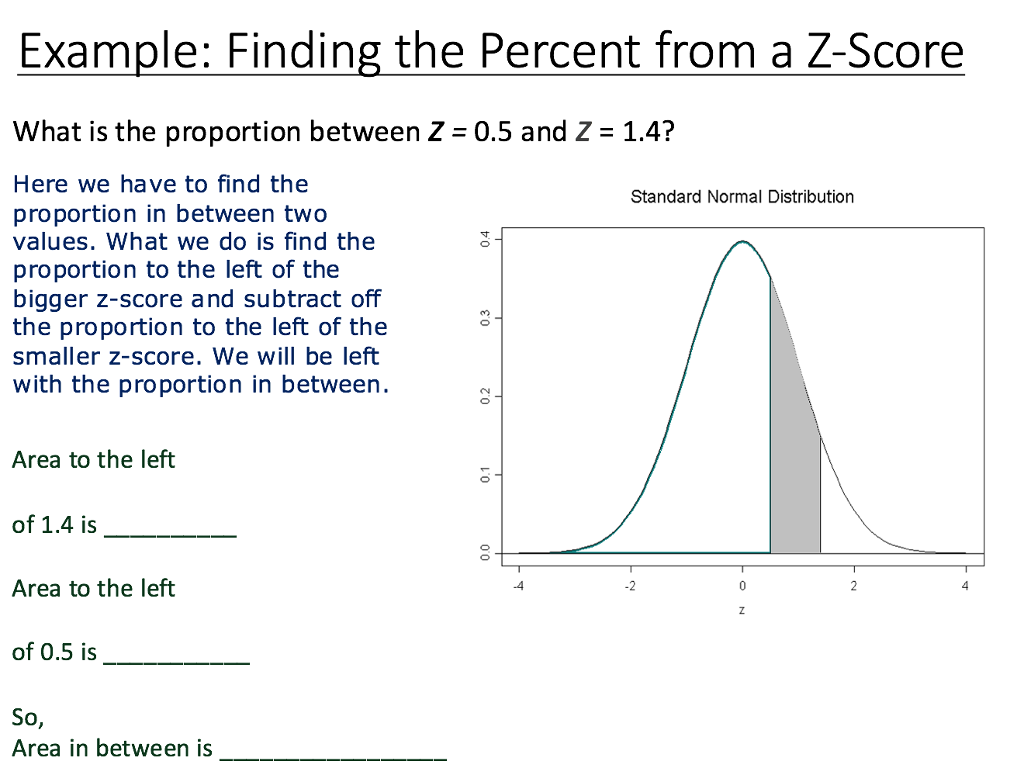

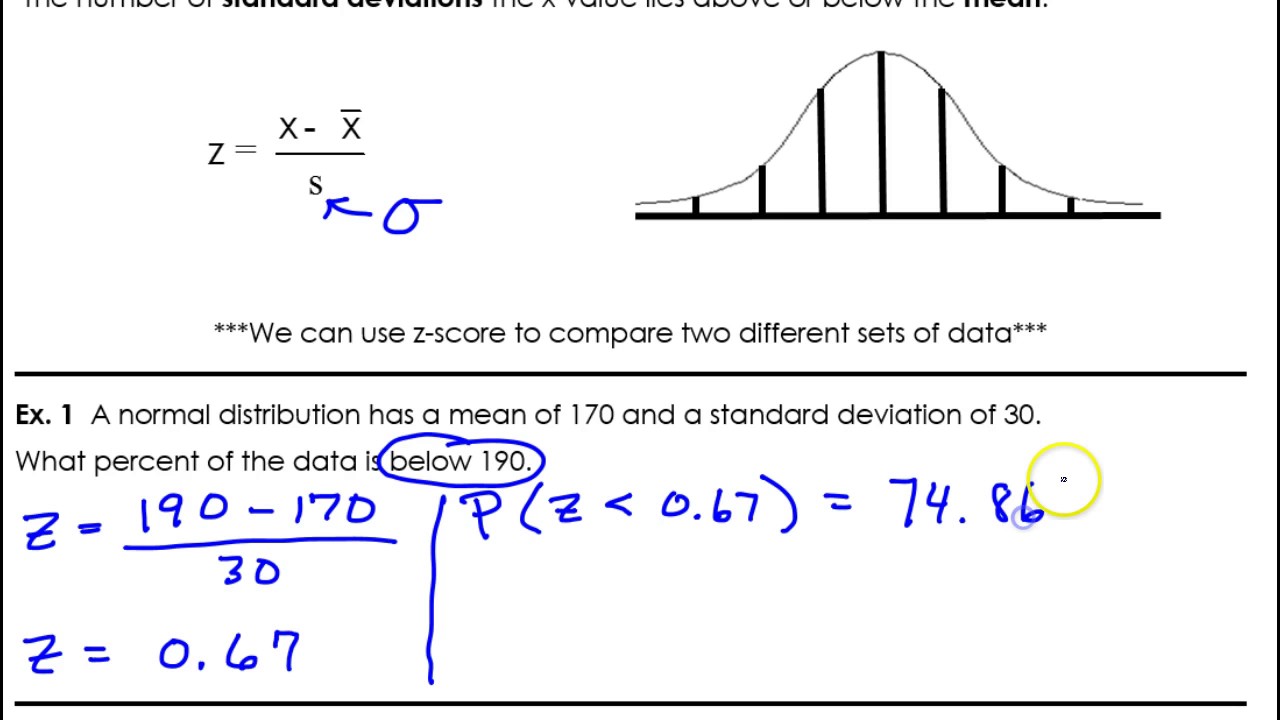

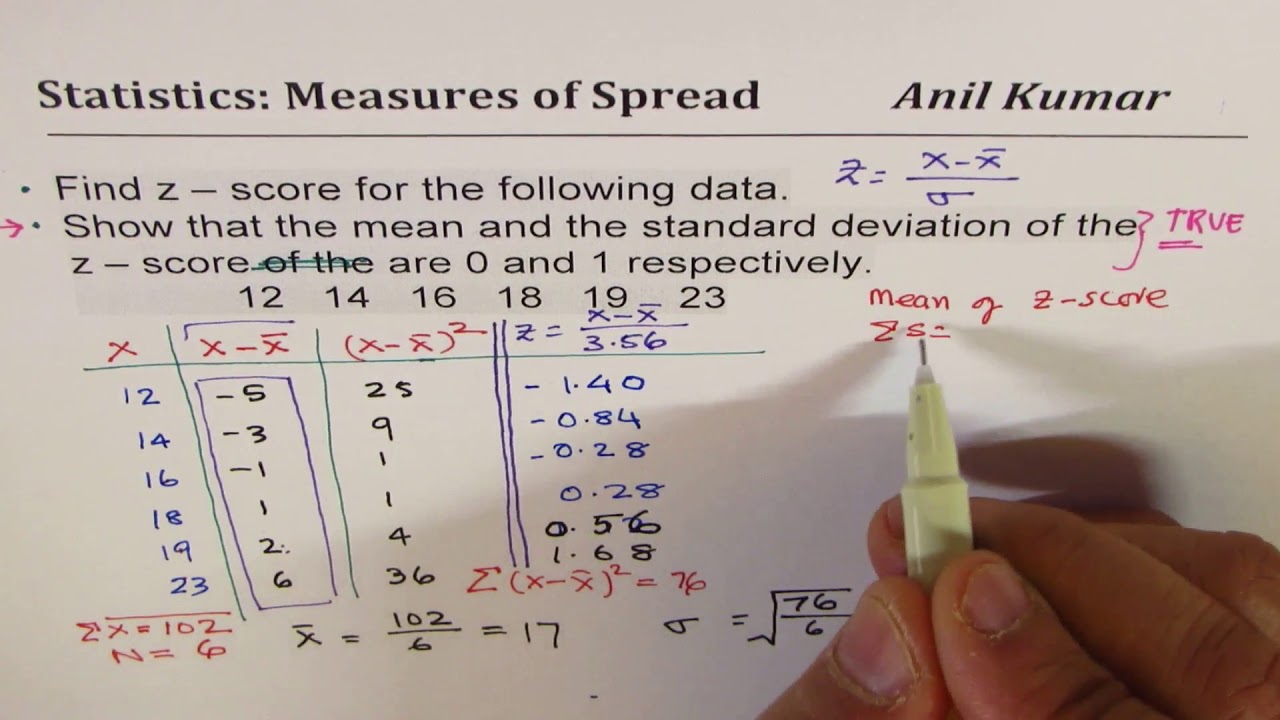

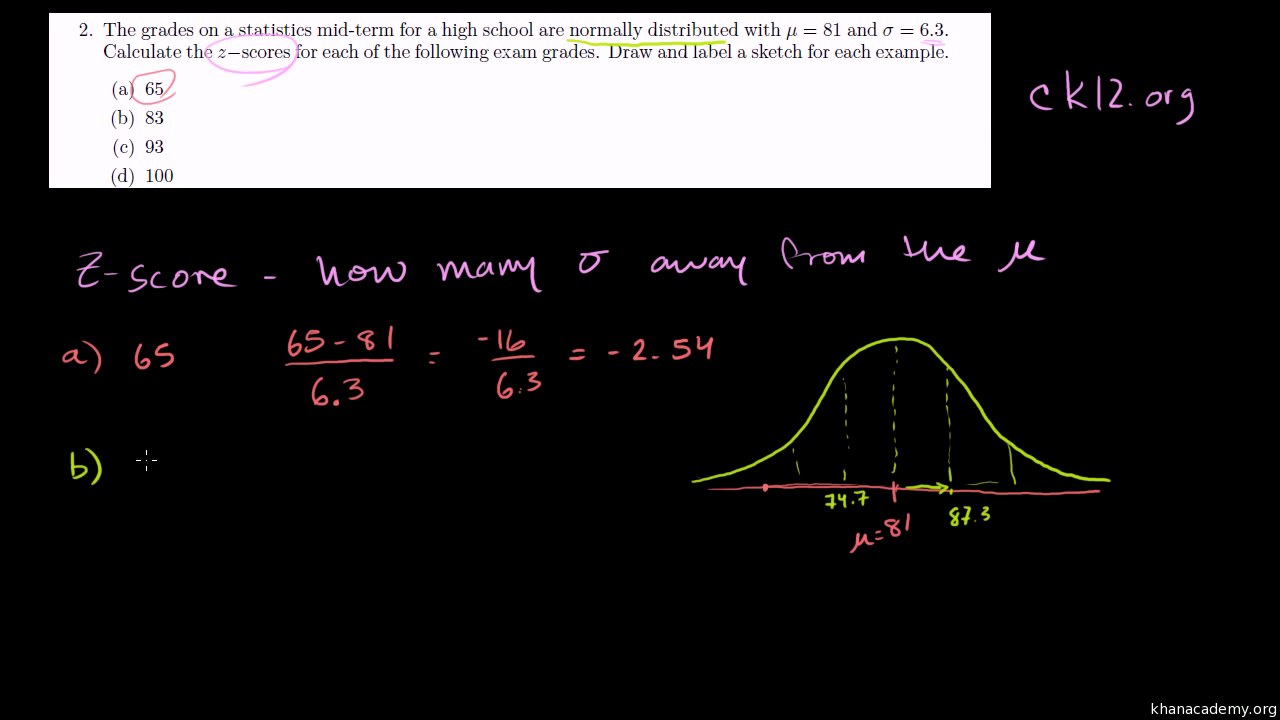

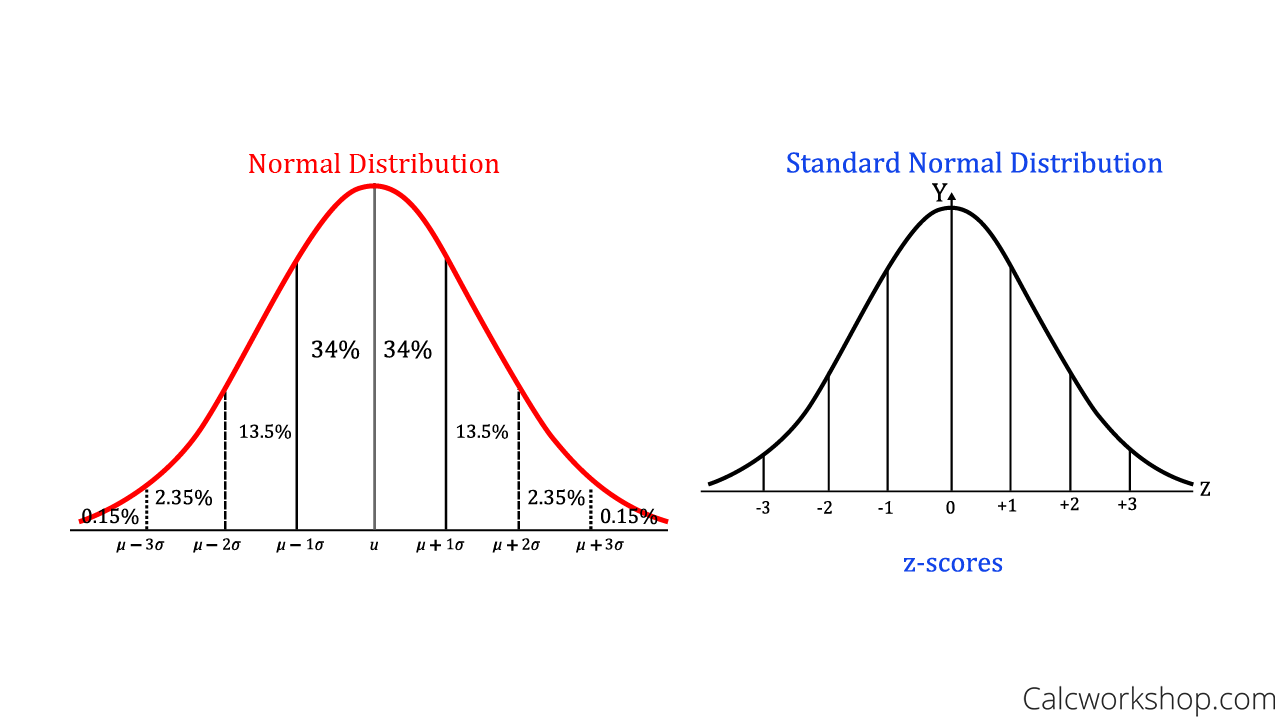

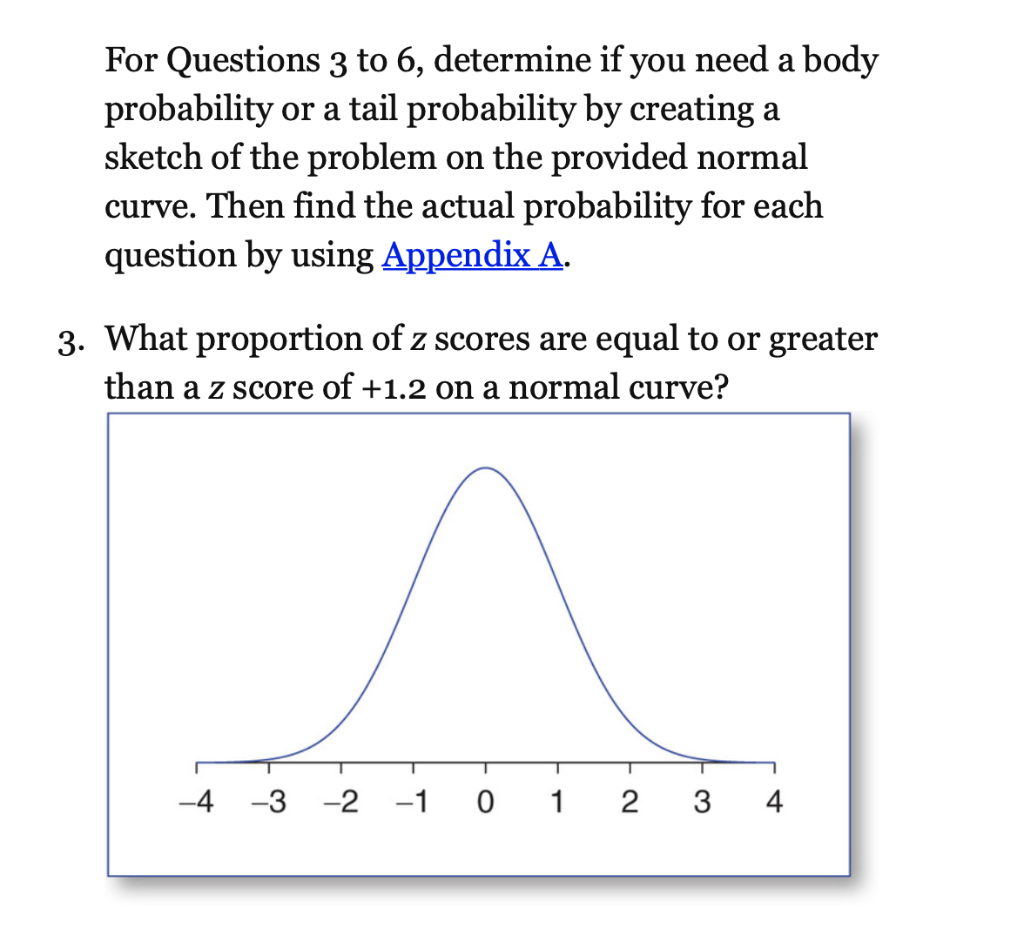

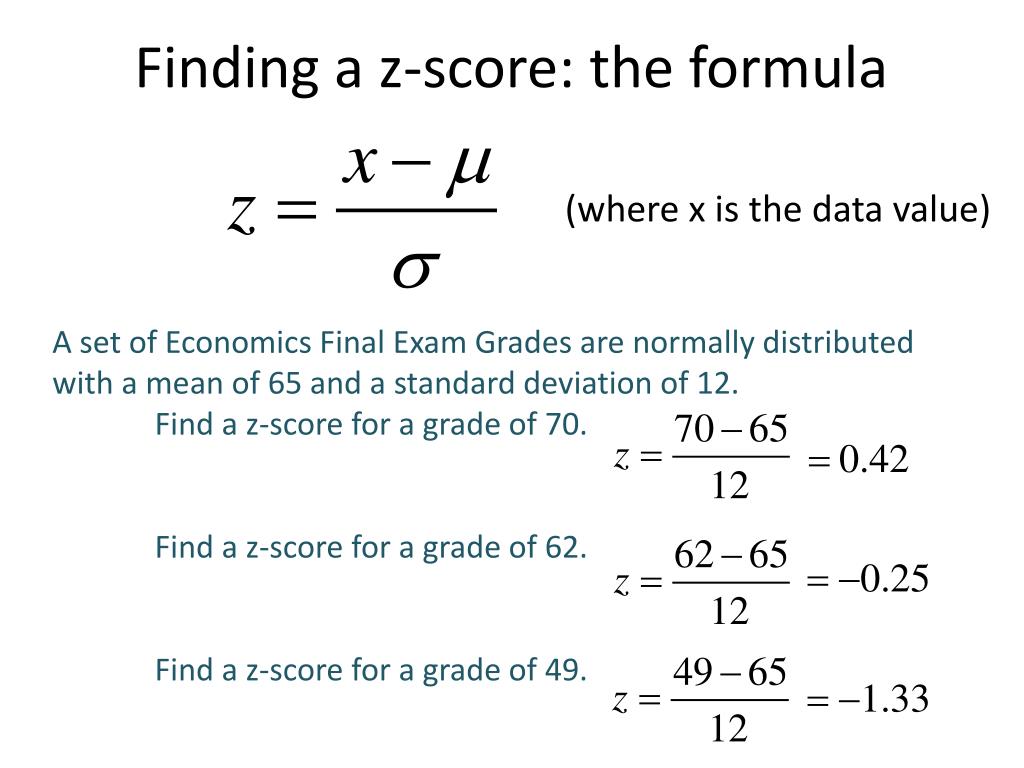

How To Find Az Score – How To Find Az Score

| Welcome to my weblog, in this time period I’ll provide you with about How To Clean Ruggable. And today, this can be a primary graphic:

Why don’t you consider graphic over? is that will amazing???. if you’re more dedicated and so, I’l l provide you with several picture again down below:

So, if you like to acquire all these wonderful shots regarding (How To Find Az Score), press save button to store the graphics to your computer. They’re available for save, if you’d rather and wish to have it, just click save symbol in the page, and it’ll be instantly saved to your desktop computer.} Lastly if you would like grab unique and the recent graphic related to (How To Find Az Score), please follow us on google plus or book mark this blog, we try our best to present you regular up grade with all new and fresh shots. Hope you like staying here. For most up-dates and latest information about (How To Find Az Score) pics, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on bookmark area, We try to offer you up grade periodically with all new and fresh pics, enjoy your exploring, and find the ideal for you.

Thanks for visiting our website, contentabove (How To Find Az Score) published . Nowadays we are delighted to declare we have discovered an extremelyinteresting contentto be pointed out, that is (How To Find Az Score) Many individuals trying to find info about(How To Find Az Score) and certainly one of these is you, is not it?