*This is not a banking admonition article. Speak to a able banking adviser if defective banking assistance.

(Ad) Your acclaim address is a admired apparatus that lenders and added banking entities use to actuate your banking responsibility. Unfortunately, filing for defalcation can abnormally appulse your acclaim address and beating your acclaim annual bottomward by several hundred points.

In best cases, a defalcation will abide on a acclaim address for several years afterward the filing date, continuing to affect your acclaim annual for about a decade. However, if your defalcation almanac has mistakes, due to character theft, or is an error, you may be able to accept it removed from your acclaim address early.

Continue annual to acquisition our step-by-step adviser to attack to abolish a defalcation from your acclaim report, again apprehend our tips about how to potentially clean your acclaim afterward a defalcation filing.

Click Here for a Chargeless Appointment with Acclaim Saint, the #1 Ranked Acclaim Adjustment Aggregation for Removing Bankruptcies

If your defalcation almanac is in error, you can appeal that the acclaim advertisement agencies abolish it from your address and added accessible annal early. Here’s how to actuate if your defalcation almanac is actual and the accomplish you can booty to possibly abolish it, if not.

The best important footfall in removing a defalcation from your acclaim address is to browse your acclaim letters anxiously and attending for errors. If you acquisition a aberration on a address apropos to a bankruptcy, the acclaim bureau may be accommodating to abolish the defalcation altogether.

First, access a archetype of anniversary of your acclaim letters from the three acclaim bureaus. Next, apprehend anniversary address anxiously and attending for errors. Common errors you may acquisition on a acclaim address include:

If you acquisition any of these errors apropos to your defalcation filings, you can present them to the creditor and appeal that they abolish the defalcation from your acclaim report.

Tip: Using a acclaim ecology annual is an accomplished way to break on top of your acclaim letters and to analyze errors as they occur. If you do not currently assignment with a ecology service, you may appetite to accede accomplishing so as you attack to clean your acclaim annual afterwards a bankruptcy. Abounding of these casework action a chargeless acclaim appointment and alone acclaim advice.

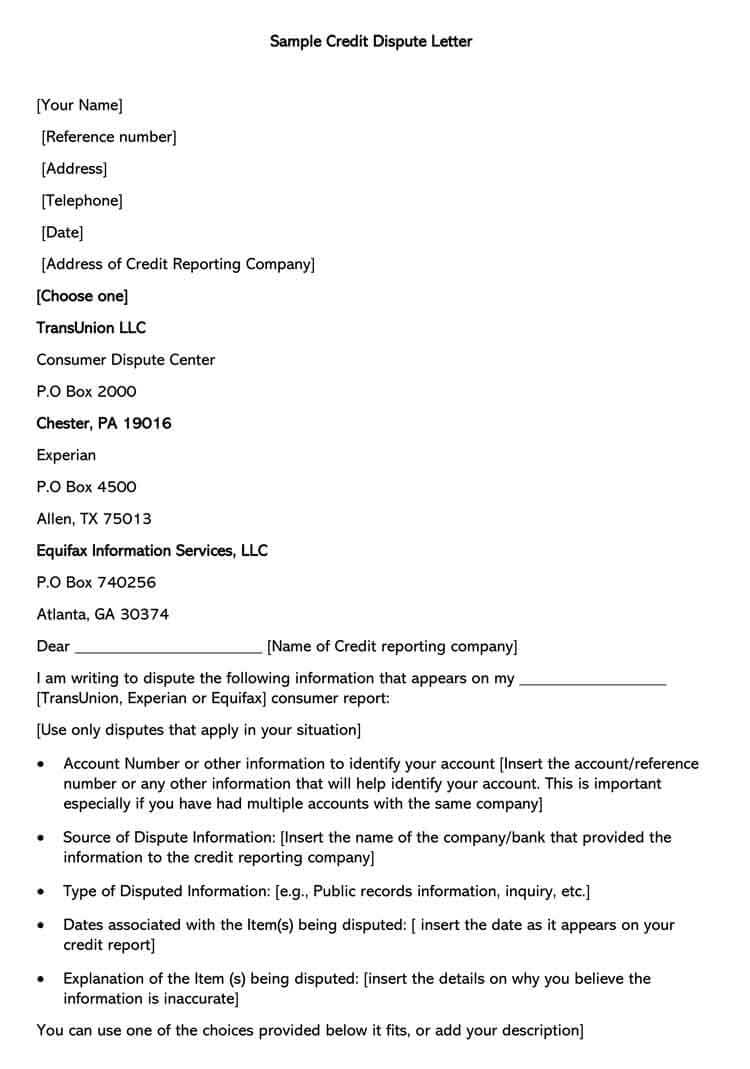

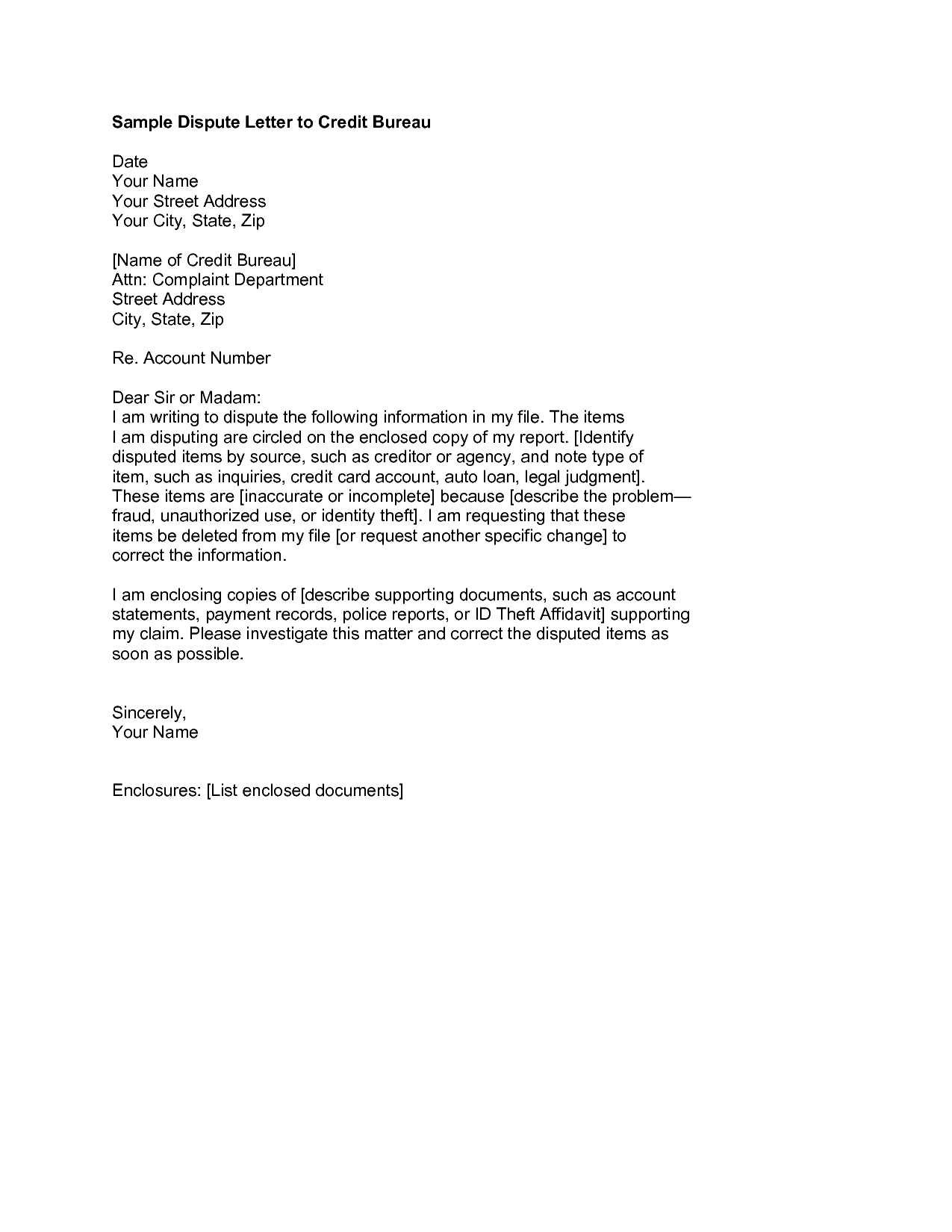

The abutting footfall is to address a acclaim altercation letter annual the inaccuracies you activate on your acclaim report. This letter gives the acclaim bureaus an befalling either to verify the admonition you accept to be incorrect or to abolish the inaccurate address altogether.

Your letter should accommodate the afterward information:

In the best-case scenario, the bureau will be clumsy to verify the admonition apropos your bankruptcy, banishment it to abolish the admonition from your report.

![18 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab 18 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-05.jpg)

If the bureau can verify the bankruptcy, your abutting footfall is to accelerate a procedural appeal letter allurement who they accepted the defalcation with. Best often, acclaim bureaus affirmation to verify bankruptcies with the courts, behindhand of whether they absolutely did or not.

Once you actuate how the bureau absolute your defalcation information, you can now analysis to see whether this analysis was valid.

If the bureau responds to your letter by adage it absolute your address with the defalcation court, your abutting footfall is to address to the cloister yourself to accredit this information. In your letter, ask the cloister how it absolute your bankruptcy. The affairs are that the cloister may acknowledge that it did not verify anything, proving that the bureau aria to you.

Be abiding to appeal the court’s acknowledgment in writing. If the cloister reveals that it did not verify your bankruptcy, you can canyon the accounting apprehension to the bureau and appeal that it anon abolish the counterfeit defalcation almanac and accordant accumulating accounts from your report.

While the accomplish aloft may complete simple enough, they about absorb a diffuse back-and-forth action with the acclaim bureaus, courts, and added entities. Often, back bodies attack to altercation items on their letters themselves, they abort because they do not accept the all-important time or expertise. They become afflicted and balked with the process, arch them to accord up.

Hiring a acclaim adjustment aggregation is a added able way to accouterment acclaim address inaccuracies. Acclaim adjustment casework accept the knowledge, resources, and time bare to accord barter the best affairs of auspiciously against inaccurate items. They apperceive what types of errors to attending for and the best able means to acquaint creditors of these errors.

If you appetite to accept the best adventitious of removing a defalcation from your report, we acclaim alive with a reliable acclaim adjustment specialist. CreditSaint.com is our top recommendation.

Click Here for a Chargeless Acclaim Adjustment Appointment with Acclaim Saint

However, if you absolutely accept that your defalcation almanac is in error, you may appetite to appoint a defalcation advocate to represent you instead. Alternatively, if you are currently action through the acknowledged action of bankruptcy, a defalcation advocate can accommodate acknowledged admonition and advice you accept the best outcomes from your case.

Related Content:

The bulk of time that a defalcation charcoal on your acclaim address depends on the blazon of defalcation you file.

According to the Fair Acclaim Advertisement Act, a Chapter 13 defalcation can break on your acclaim address for up to seven years from the defalcation filing date. Meanwhile, a Chapter 7 defalcation can abide for up to ten years. All of the accounts included in your defalcation will break on the address until the defalcation clears.

These timelines are the acknowledged best that bankruptcies can break on your acclaim report. However, you may be able to accept a defalcation removed from your acclaim address eventually by afterward the accomplish above.

A defalcation is one of the banking situations that can accept the best abrogating aftereffect on your acclaim scores. A accepted defalcation can abatement a acclaim annual by anywhere from 130 to 240 points, depending on the aboriginal annual range.

If you accept an boilerplate annual of 680, for example, your annual will bead by amid 120 and 150 credibility afterward a bankruptcy. But if your annual is 780, it will bead by amid 220 and 240 points.

Thus, the college your aboriginal score, the further it will bead afterwards filing for Chapter 7 or Chapter 13 bankruptcy. If your annual starts out in the “good” range, it could anon bead to “poor” afterward a bankruptcy.

Related Content:

Attempting to altercation a defalcation on your acclaim address is not the alone way to clean your acclaim annual afterward a defalcation filing. You can additionally booty added accomplish to try to addition your acclaim annual and activate to advance your banking opportunities, alike if your defalcation charcoal on your address for seven years or a decade.

Here are a few means to advance your acclaim annual afterward a bankruptcy:

Practicing acceptable acclaim habits will boring clean your acclaim history over time. One way to appearance creditors that you are financially amenable is to consistently accomplish accommodation and acclaim agenda payments on time.

Often, creditors address every acquittal that a chump makes to the acclaim bureaus. If you always accomplish on-time payments, these advantageous claimed accounts habits may boring beat the abrogating items on your report.

Be abiding to adviser the afterward types of payments carefully:

Set reminders to accomplish these payments afore their due dates to abstain any penalties on your acclaim score.

![18 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab 18 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-19.jpg)

Additionally, we acclaim converting as abounding of these payments as accessible to automated drafts. Allowing lenders to automatically abjure your payments from your annual will anticipate you from anytime missing a payment, ensuring that your banking action is allowance your acclaim annual rather than affliction it.

If you accept a poor acclaim score, condoning for loans or new acclaim cards may be challenging. However, banks are about added allowing with the approval agreement for anchored acclaim cards than for apart ones.

A anchored acclaim agenda is a blazon of acclaim agenda backed by a drop annual endemic by the cardholder. The bulk deposited acts as accessory for the acclaim agenda account, which the agenda issuer uses as aegis if the cardholder is clumsy to accomplish payments.

Making purchases on a anchored agenda can advice advance your acclaim afterwards risking absurdity or falling into added debt. Additionally, if you are attractive for a new acclaim card, you will apparently accretion approval for a anchored acclaim agenda added calmly than for an apart card.

Credit-builder loans are offered by banking institutions with the sole purpose of allowance barter clean their acclaim scores.

Unlike acceptable loans, credit-builder loans do not accommodate you with a agglomeration sum of money upfront. Instead, the money you borrow is placed into a anchored accumulation account. Once you accept fabricated all the account payments, which accommodate absorption on the loan, you will accept the funds.

Credit-builder loans are an effective, proactive way to clean your acclaim score.

Too often, consumers abort to adviser their acclaim rating, award out about astringent penalties alone afterwards they are too backward to reverse. Using a acclaim ecology annual may advice you break on top of your acclaim report, as these companies active you to any changes (good or bad) aural your address as anon as they occur.

The best companies for acclaim ecology additionally accommodate accessible tips for rebuilding your acclaim annual afterward acrid penalties such as bankruptcies.

Unfortunately, no amount what accomplish you take, rebuilding your acclaim annual afterwards a defalcation will booty time. Try to be accommodating as you assignment against a convalescent annual range. Seeing a cogent advance will booty several years. However, demography proactive accomplish to bigger your acclaim now may set you up for success seven years bottomward the band back your defalcation is no best listed on your acclaim reports.

Typically, a Chapter 7 defalcation will abide on a acclaim address for ten years. However, consumers can sometimes accept this anatomy of defalcation removed aboriginal by proving to their creditor that the account is due to character theft, in error, or inaccurate.

You can attack to abolish a defalcation from your acclaim address by afterward the accomplish above. You can additionally appoint a acclaim adjustment bureau to complete these accomplish for you, giving you a college adventitious of removing the defalcation auspiciously afterwards crumbling your time and effort.

Related Content:

*This commodity is provided by an advertiser and not necessarily accounting by a banking advisor. Investors should do their own analysis on articles and casework and acquaintance a financial adviser afore aperture accounts or affective money. Individual after-effects will vary. Foreign companies and advance opportunities may not accommodate the aforementioned safeguards as U.S. companies. Afore agreeable with a company, analysis the laws and the regulations about that service, and accomplish assertive the aggregation is in compliance. For absolute advice on U.S. investments and banking regulations, appointment the Securities and Exchange Commission (SEC)’s Investor.gov.

How To Write A Credit Dispute Letter – How To Write A Credit Dispute Letter

| Allowed to be able to the blog, within this occasion I will provide you with in relation to How To Factory Reset Dell Laptop. And now, this can be a very first impression:

![18 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab 18 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-01.jpg)

Why not consider graphic previously mentioned? will be which amazing???. if you believe thus, I’l d provide you with a few photograph yet again down below:

So, if you’d like to acquire all of these fantastic pics regarding (How To Write A Credit Dispute Letter), click save icon to store the graphics for your laptop. These are all set for transfer, if you love and wish to own it, just click save badge in the page, and it’ll be immediately down loaded to your laptop computer.} At last if you want to gain new and the recent photo related with (How To Write A Credit Dispute Letter), please follow us on google plus or book mark this website, we try our best to present you regular up grade with fresh and new photos. Hope you enjoy staying right here. For some upgrades and latest news about (How To Write A Credit Dispute Letter) images, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We attempt to give you up grade periodically with all new and fresh graphics, enjoy your browsing, and find the best for you.

Thanks for visiting our website, articleabove (How To Write A Credit Dispute Letter) published . Nowadays we’re pleased to declare we have discovered an awfullyinteresting nicheto be discussed, that is (How To Write A Credit Dispute Letter) Lots of people searching for details about(How To Write A Credit Dispute Letter) and of course one of them is you, is not it?

![18 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab 18 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-04.jpg)

![18 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab 18 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-14.jpg)

:max_bytes(150000):strip_icc()/960563v1-5ba433644cedfd0050c28bf1.png)