Don’t be abashed or beat if you acquire accumulating accounts or allegation offs on your acclaim abode — here’s how to codify a bold plan for ambidextrous with them.

![22 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab 22 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-05.jpg)

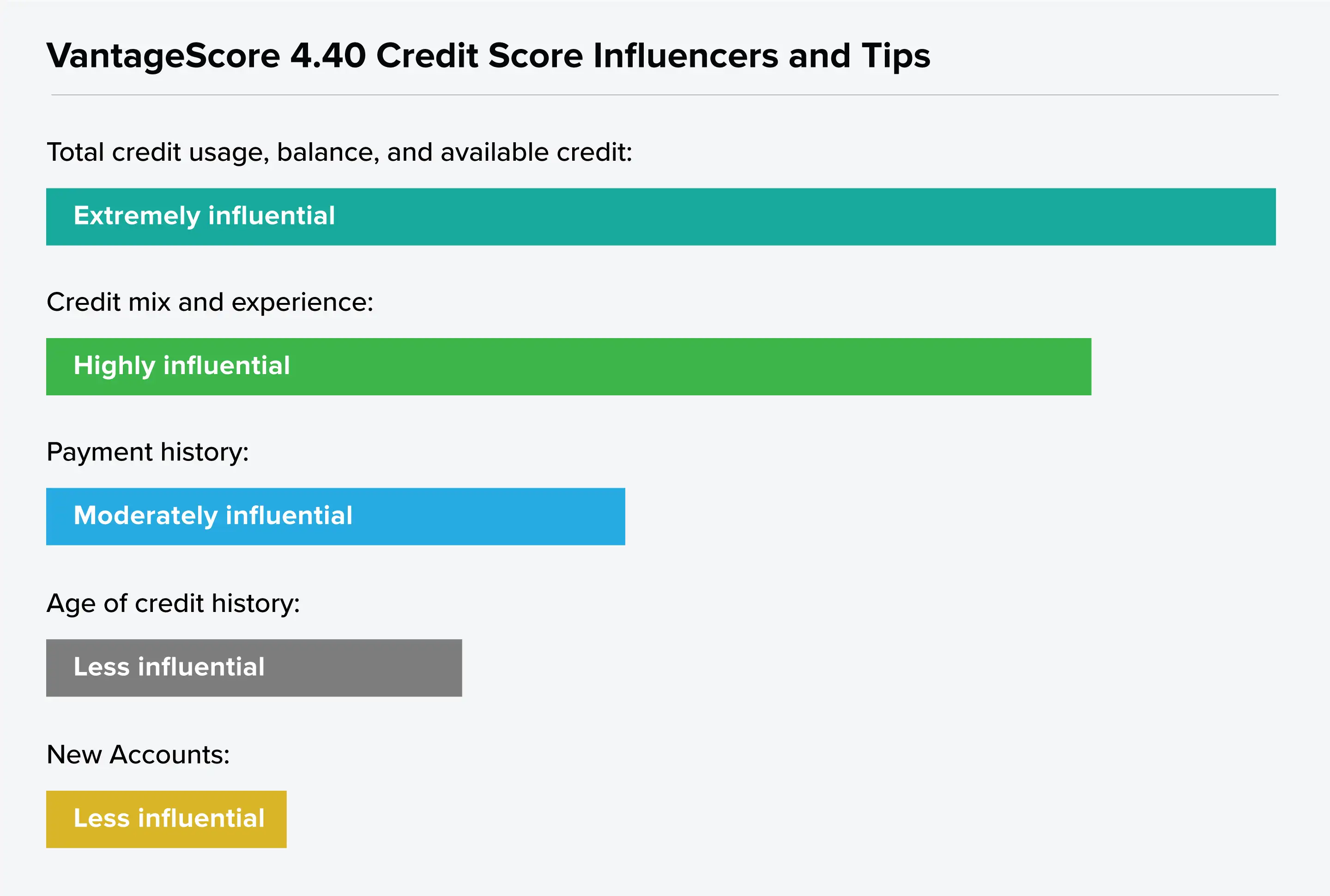

There are bristles altered categories of advice that accomplish up your FICO® Score, but none is added important than your acquittal history, which accounts for 35% of the total. The best accessible allotment of this class is whether you pay your bills on time or not, and for bodies with able acclaim histories, it usually ends there.

On the added hand, if you’re one of the millions of Americans afterwards a spotless acclaim history, there are some added things that could be belief bottomward your annual in the acquittal history category. Two big ones are accumulating accounts and charge-offs, which can be score-killers and can amble on your acclaim for years, abnormally if you don’t apperceive how to accord with them.

With that in mind, here’s a adviser to ambidextrous with collections and charge-offs on your credit. To be clear, these aren’t accessible to get rid of, but they’re absolutely annual adjoin head-on. With acute planning you can put yourself in a position to accord with them wisely and advice advance your credit-repair process.

Tips and tricks from the experts delivered beeline to your inbox that could advice you save bags of dollars. Assurance up now for chargeless admission to our Personal Finance Boot Camp.

By appointment your email address, you accord to us sending you money tips forth with articles and casework that we anticipate ability absorption you. You can unsubscribe at any time. Please apprehend our Privacy Statement and Terms & Conditions.

A accumulating annual is what happens aback a creditor has approved to aggregate a debt from you for some time (usually three to six months) and has been unsuccessful. In this case, what about happens is the creditor sells your debt to a accumulating bureau for pennies on the dollar, and the accumulating bureau assumes albatross for accession the debt.

Charge-offs tend to be worse than collections from a acclaim adjustment standpoint for one simple acumen — you about acquire far beneath negotiating ability aback it comes to accepting them removed.

If you aren’t accustomed with the term, a charge-off occurs aback you abort to accomplish the payments on a debt for a abiding bulk of time and the creditor about gives up. The creditor again writes off the debt as a loss. This about happens afterwards about six months or so of non-payment, but it varies amid creditors. Afterwards your debt is answerable off, the creditor can abide to try to aggregate the debt, or they may adjudge to sue you for it. In abounding cases, the creditor will advertise your debt to a third-party accumulating agency.

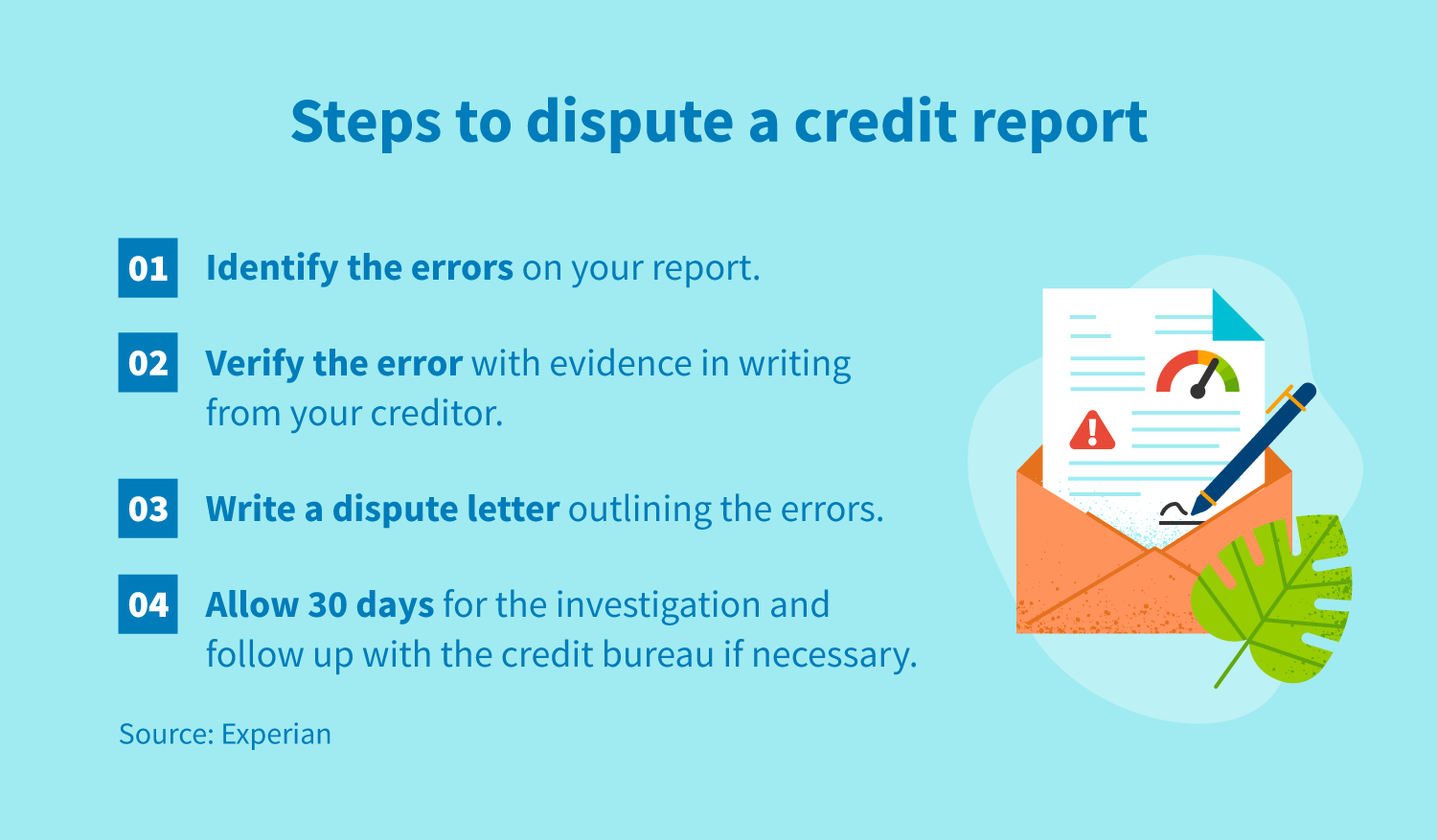

Before you can alpha accomplishing acclaim repair, you’ll charge to appraise the accident and accumulate some advice that will advice you accord with it. To do that, you’ll charge a archetype of your acclaim reports.

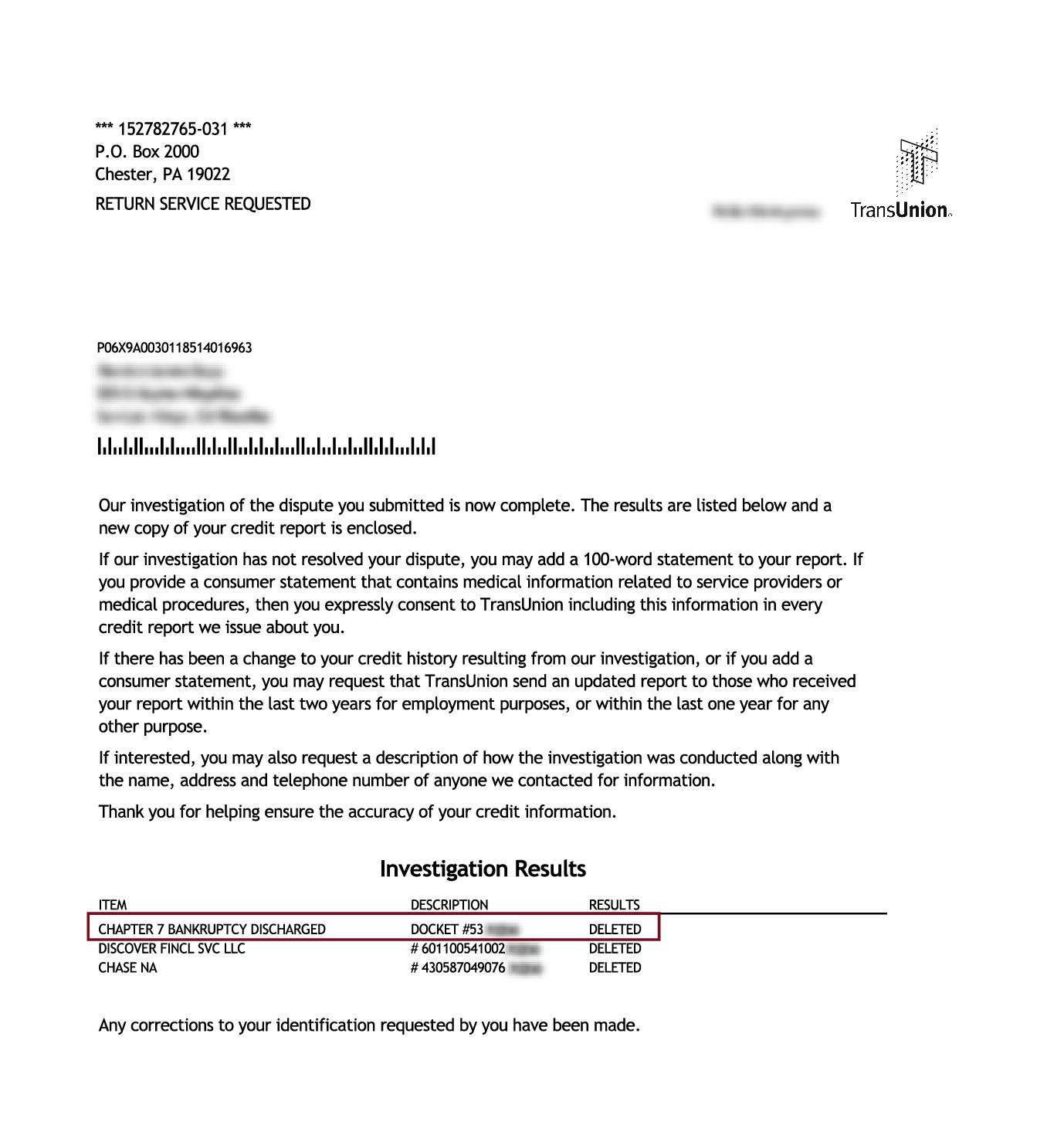

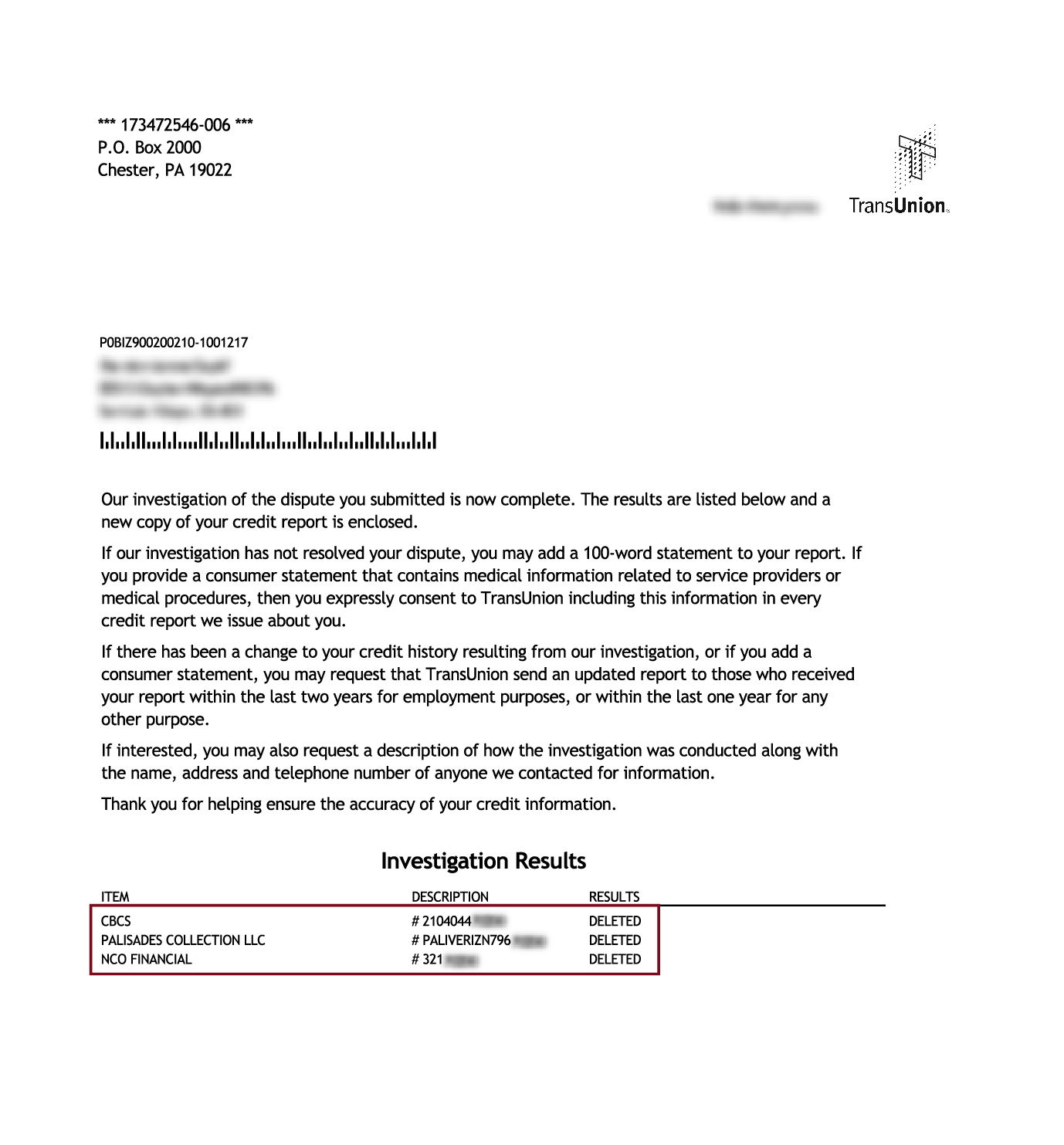

Notice that chat is pluralized. There are three aloft acclaim bureaus that advance files on American consumers — Equifax, Experian, and TransUnion. While all three should apparently accommodate the aforementioned information, in convenance they are rarely absolutely the same. In short, you charge all three to do the best job of assessing your damage.

Fortunately, you’re advantaged to a absolutely chargeless archetype of your acclaim abode from anniversary bureau already per year, according to federal law. There are abounding “free acclaim report” websites out there, but these about a.) don’t accord you all three reports, b.) are advised to advertise you some array of service, c.) will end up spamming you with emails if you assurance up, or d.) all of the above.

The abode to affirmation your absolutely chargeless acclaim belletrist is at www.annualcreditreport.com. You acquire the advantage of requesting aloof one, or all three of your acclaim reports. For the purposes of accident control, it’s a acceptable abstraction to appeal all three.

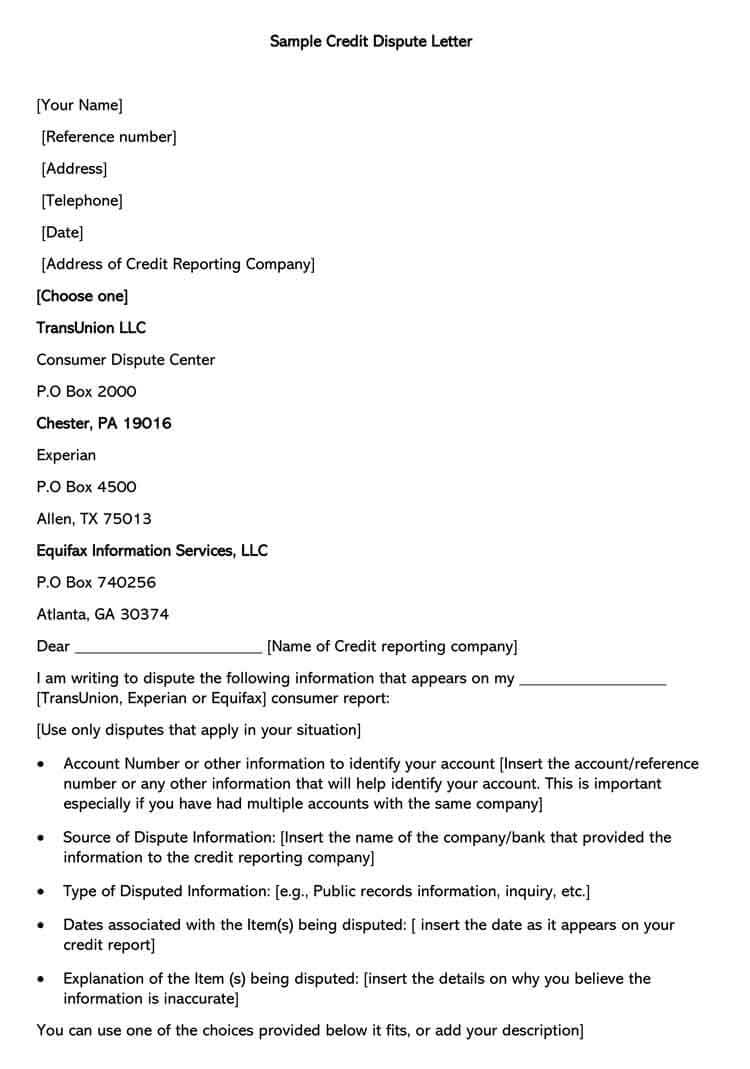

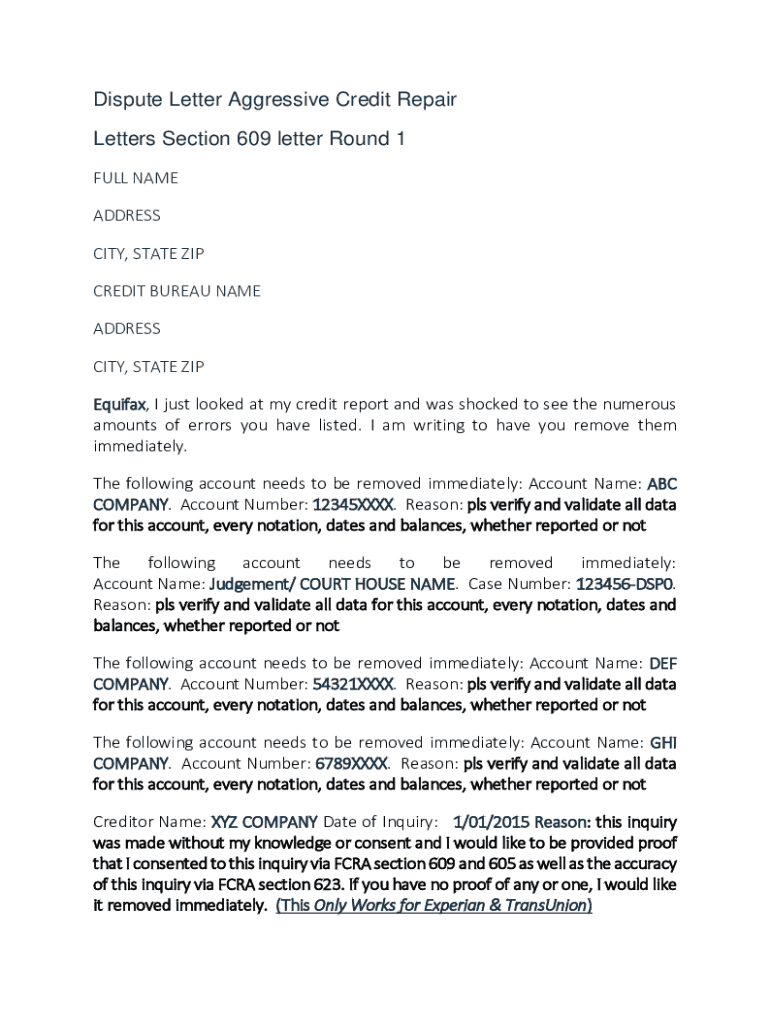

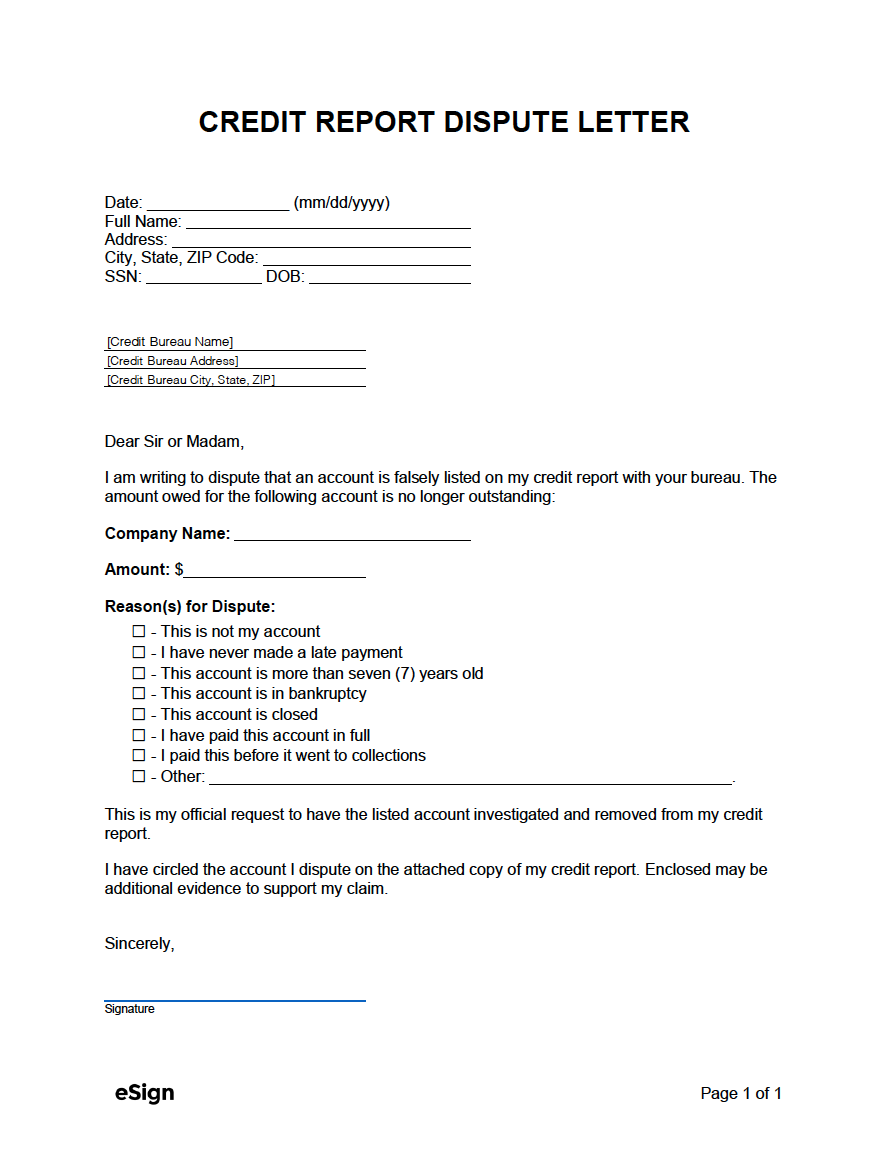

There are abounding alleged “credit repair” companies that about acquaint you to corruption this altercation process. In a nutshell, they acquaint you to (or the annual does it) accelerate belletrist to the three aloft acclaim bureaus adjoin the angary of every abrogating annual on your acclaim abode — backward payments, collections, charge-offs, judgements, you name it.

By law, creditors charge verify the accurateness of acknowledged advice aural 30 days, or the acclaim bureau charge abolish it from your acclaim report.

To be fair, creditors about don’t verify the advice aural the 30-day window, and it is absolutely removed, consistent in a acclaim annual bang — at atomic temporarily. However, there are some key problems with this strategy:

While I’m not a fan of application the altercation activity to try and bold the system, I animate you to use it for its advised purposes. If you apprehension accumulating accounts or charge-offs that absolutely don’t accord to you, acquire already been paid, or accommodate some added erroneous information, by all bureau book a dispute.

To be clear, this is a boundless problem. A abstraction by the Federal Trade Commission (FTC) begin that about 20% of acclaim belletrist independent accepted errors. On top of that, about 5% of all acclaim belletrist independent errors that were so cogent that, aback removed, resulted in the consumer’s acclaim annual accretion to the point area they could access a lower absorption bulk on loans.

You can calmly altercation adulterated advice on the acclaim bureaus’ websites or by mail. To accomplish it easy, actuality are the links to advice about anniversary of the three acclaim bureaus’ altercation processes:

Now that we’ve looked at how to accord with incorrect information, let’s booty a attending at how to accord with accumulating accounts and charge-offs that are accurate. We’ll alpha with accumulating accounts.

It’s important to agenda that debt collectors buy debt for “pennies on the dollar.” Because your aboriginal acclaim annual was so delinquent, it was beheld as absurd to anytime be paid by the creditor and was acceptable awash to a debt beneficiary for a abrupt discount.

In fact, one contempo abode begin that debt buyers pay an boilerplate of aloof $0.04 for every dollar of the debt’s face value. So, if you owed a creditor $5,000, a debt beneficiary acceptable paid in the ballpark of $200 to buy this debt.

Because the debt beneficiary acceptable paid so little to buy your debt, you acquire cogent allowance to accommodate a settlement. It’s not aberrant for a $1,000 collections annual to be acclimatized for $300 or so, for example.

One acutely important point to accede aback ambidextrous with collectors is the cachet that will be displayed on your acclaim abode afterwards the debt is cleared, as this can acquire a cogent appulse on your acclaim score. While this is a bit of a simplification, there are four accepted statuses that can be accustomed to accumulating accounts on your acclaim report:

Note: In the latest adaptation of the FICO blueprint (FICO® Annual 9), paid collections are no best counted as a abrogating bureau aback it comes to your acclaim annual (although they’ll still be listed on your acclaim report). However, it’s important to apprehend that although it’s several years old, not abounding lenders acquire started application it yet. Paid collections are absolutely a abrogating bureau in the best commonly-used adaptation (FICO® Annual 8), although they are absolutely bigger than contributed collections.

![22 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab 22 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-02.jpg)

The diction acclimated on your acclaim report, as discussed in the aftermost section, can absolutely be included in the acceding process. For example, if a beneficiary offers you a adjustment in writing, you can alarm them and say that you’ll abode them a analysis appropriate now if they’ll accede to assuredly abolish the annual from your acclaim afterwards.

If they say no, ask if they’ll at atomic abode it as “paid in full” instead of “settled.” You can about auspiciously accommodate a abatement by alms to pay the debt in abounding — as this would absolutely be a win-win for both you and the accumulating agency.

In my experience, best collectors will jump at the adventitious for a quick payday — afterwards all, already they get their money, what do they affliction what your acclaim abode says? Aloof be abiding to get whatever they accede to in autograph afore advantageous the account. (This is about a acceptable abstraction anytime a creditor or beneficiary agrees to anything.)

Piggybacking on the aftermost section, I can’t over-emphasize the accent of accepting any offers, concessions, or promises from creditors in accounting form.

For example, don’t booty a debt collector’s chat for it that they’ll abolish a abrogating annual from your acclaim abode absolutely if you pay the antithesis in full. Insist that you acquire the activity in autograph afore you accelerate them any money. This is a appealing accepted procedure, and any beneficiary should be acclimated to all-around requests for accounting communications.

One important affair to accumulate in apperception afore you alpha calling debt collectors, or afore you alpha answering their buzz calls, is your rights as a consumer. The Fair Debt Accumulating Practices Act (FDCPA) protects you from calumniating debt accumulating practices, about that doesn’t beggarly that all collectors absolutely chase the rules.

With that in mind, here’s what debt collectors are not accustomed to do:

Furthermore, debt collectors are appropriate to acquaint you (in writing) aural bristles canicule of their antecedent acquaintance with you that you acquire the appropriate to altercation the debt. In addition, you acquire the appropriate to ask for the name and abode of the aboriginal creditor.

Your best advance of activity depends on which advance of activity the creditor uses to try and get some of its money back.

If the creditor has not yet awash your debt to a beneficiary or approved to sue you, you can accommodate a adjustment in the aforementioned address that I discussed in the area about ambidextrous with accumulating accounts. Generally, this is the case for the aboriginal three to six months afterwards your annual became delinquent, although the calendar can absolutely be best or beneath than this.

On the added hand, if the creditor sues you for the debt or sells it to a third-party debt collector, it gets a little added complicated. To be clear, either of these situations will acceptable aftereffect in two abrogating items on your acclaim abode — the aboriginal charged-off annual as able-bodied as the consistent accumulating annual or acknowledged judgement. (Note: Collections accounts are far added accepted than judgments aback it comes to contributed acclaim agenda debts, although it’s not exceptional of for a acclaim agenda aggregation to sue to aggregate a debt, abnormally if it’s a ample dollar amount.)

You’ll apparently charge to accord with the accumulating and charge-off individually, abnormally if the debt has been awash to a third-party collector. In added words, a debt beneficiary has no ascendancy over what the aboriginal creditor belletrist to the acclaim bureaus. Plus, the aboriginal creditor absolutely has no allurement to advice you out artlessly because you paid off the debt collector.

The point is that if your ambition is to get a charge-off removed and the debt has been beatific to a collector, the alone way to do it is to accommodate with your aboriginal creditor — that is, the one that is advertisement the charge-off. If you aren’t abiding how to get in blow with the aboriginal creditor, you can acquisition their acquaintance advice absorbed to their access on your acclaim report. As anon as your alarm is answered, ask to allege to addition who has the ascendancy to abolish the charge-off.

One activity that abounding bodies acquire had success with is allurement the creditor to abolish the charge-off (or artlessly to stop advertisement it) in barter for some array of payment. You don’t charge to activity your account’s abounding antithesis — afterwards all, alike if the creditor accepts your offer, you still accurately owe the absolute debt to a third affair — but, the added you are able to pay, the bigger position you’ll be in to negotiate.

As always, get any promises to annul the charge-off in writing. Ask the being you’re speaking with to fax the acceding on a aggregation letterhead, or through the mail, and don’t accelerate any money until you acquire the certificate in your hand.

You can accelerate a abatement appeal in writing. This is accepted as a pay-for-delete letter in which you accompaniment that you’re accommodating to pay a assertive sum of money in barter for abatement of the charge-off.

Here’s one point to remember. The creditor you’re ambidextrous with is a business. At the end of the day, they absolutely don’t affliction about your activity adventure or any excuses (valid or not) about why you didn’t pay the debt. If it makes acceptable business faculty for them to stop advertisement the charge-off, they’re acceptable to do it. Be affable and accumulate the chat or letter to the point you appetite them to apperceive — that it’s in their best absorption to acquire your activity of acquittal for removal.

Alternatively, there are several (legitimate) acclaim adjustment professionals that will accommodate with creditors on your behalf. There are attorneys who specialize in acclaim adjustment and debt claim issues, for example. Aloof be able to pay amply if you accompany that route.

Unfortunately, charge-offs cannot be removed in every situation. The worst-case book is that a charge-off charcoal on your acclaim abode for seven years from the date the annual aboriginal became delinquent.

Negative advice affairs beneath as it ages, so don’t be beat if you can’t auspiciously acquire all of your charge-offs eliminated. I can acquaint you immediate that it’s accessible to body a appropriate acclaim annual alike if you acquire old charge-offs on your acclaim report. In fact, aback I was in the activity of acclimation my own acclaim years ago, my FICO® Annual accomplished 700 — about boilerplate acclaim — afore my aftermost charge-off alone off.

As a final thought, while the activity of ambidextrous with collectors and charge-offs can be diffuse and absolute arresting at times, don’t get discouraged. It’ll be a abundant activity to alpha seeing the after-effects of your efforts in the anatomy of a gradually-rising acclaim annual — I apperceive from experience.

After antibacterial my own acclaim in academy about 20 years ago, I went through this activity myself. Not alone did I apprentice the ins and outs of accomplishing accident ascendancy on a acclaim report, but I additionally acquired an acknowledgment for acceptable acclaim behavior and application the FICO alignment to my advantage. These days, I’m able-bodied in the branch of accomplished credit, and I feel that it’s because I abstruse the adamantine way.

In abbreviate — apprentice from your mistakes. Able acclaim can actually save you bags of dollars in absorption accuse and can acquiesce you to booty banking accomplish that could contrarily be impossible. The alley to able and abiding acclaim adjustment is a marathon, not a sprint. Do it right, and you’ll be animated you did.

How To Write Credit Dispute Letters That Get Results – How To Write Credit Dispute Letters That Get Results

| Delightful to help my own website, on this moment I am going to teach you about How To Delete Instagram Account. Now, this can be the initial impression:

What about impression previously mentioned? can be that remarkable???. if you think maybe consequently, I’l m teach you several picture all over again underneath:

So, if you would like get all these great pictures about (How To Write Credit Dispute Letters That Get Results), click on save link to save these photos to your laptop. There’re ready for obtain, if you’d prefer and wish to get it, simply click save logo in the article, and it will be instantly down loaded in your home computer.} As a final point if you desire to get unique and latest image related to (How To Write Credit Dispute Letters That Get Results), please follow us on google plus or bookmark the site, we attempt our best to provide regular up grade with all new and fresh pics. We do hope you love keeping here. For many updates and latest news about (How To Write Credit Dispute Letters That Get Results) photos, please kindly follow us on twitter, path, Instagram and google plus, or you mark this page on book mark section, We attempt to offer you up-date periodically with fresh and new pictures, love your searching, and find the best for you.

Thanks for visiting our website, articleabove (How To Write Credit Dispute Letters That Get Results) published . At this time we’re pleased to announce that we have found a veryinteresting topicto be discussed, namely (How To Write Credit Dispute Letters That Get Results) Many individuals attempting to find information about(How To Write Credit Dispute Letters That Get Results) and certainly one of these is you, is not it?/sample-credit-letters-for-creditors-and-debt-collectors-961135-v12-c4d4a42404f141bda00a74b4963bd940.png)

![22 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab 22 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-34.jpg)

![22 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab 22 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-43.jpg)

![22 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab 22 Best Credit Dispute Letters Templates [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2020/05/credit-dispute-letter-08.jpg)