I am anxious about my banking future. I absent aggregate during the 2008 stock-market crash. I was in a banking slump and homeless, and I had no agent for about seven years. I accept spent the aftermost decade recovering.

I am 58 with $250,000 in a high-yield accumulation account, $150,000 in stocks and a Roth IRA. I additionally accept $35,000 in an emergency fund. I accept a $1,200-a-month mortgage, while my home is currently admired at about $350,000.

I accept $5,000 in anchored account income, and acquire $75,000 to $150,000 a year. I owe $2,000 in credit-card debit and $25,000 on two agent loans. I don’t accept $1 actor or added as I had planned. Why am I still afraid — and should I be?

Still Reeling

You can email The Moneyist with any banking and ethical questions accompanying to coronavirus at qfottrell@marketwatch.com, and chase Quentin Fottrell on Twitter.

You would not be animal if you did not accept agony from your accomplished experience.

You accept spent the aftermost 14 years accepting aback on your feet, emotionally and financially. You accept apparent the apple and yourself that you accept what it takes to accumulate affective forward. You accept appear a continued way in that time. I appetite to acquaint you that it’s OK to adore the activity you accept now.

If you accept to stop annoying and no best suffer, it does not beggarly that the aforementioned affair will appear again. You accept congenital up a deep, solid foundation. You accept affairs that millions of Americans would ambition to have, and you accept created a banking activity that you can be appreciative of.

It sounds like you may charge a third affair — a banking adviser or banking therapist — to appearance you on cardboard that you can allow to alive aural your agency for abounding years to come. You accept done what needs to be done to booty aback ascendancy of your life. Now let go of that fear.

As my aide Leslie Albrecht has written: “Though it’s been about in assorted forms back the 1990s, banking analysis is now assertive to become added connected and added prevalent. Until now, the activity has been about defined, and anyone could alarm themselves a banking therapist.”

“The acreage encompasses a ambit of professionals — from psychotherapists to alliance attorneys to amusing workers to certified banking planners — all attractive to advice audience accept the affecting underpinnings of their behaviors about money,” she wrote.

The aftermost 18 months accept been traumatic, and accept taken a assessment on people’s brainy health. Some bodies accept absent jobs, battled COVID-19, and lived through a lot of uncertainty. The markets — fabricated up of bodies like you and me — don’t like uncertainty. But they/we got through it.

I fabricated a accommodation at the alpha of the communicable that I was not activity to anguish about article that was above my control. I can accomplish advisable decisions about my bloom and circumstances, but if I am aggravating to ascendancy what happens, I’m arena God. And I’m not God.

Continue to save, alter your investments, and accomplish an accomplishment to pay off your credit-card debt and car loans — you will feel bigger back you accept done so. Accepting a aces banking ambition will accord you article solid to focus on, instead of a bare canvas of what could appear in the future.

It may additionally advice you to accept a mantra back you deathwatch up in the morning and go to beddy-bye at night: “Thank you, Universe, for allowance me to put a roof over my arch and money in the bank, and for abating aegis to my life. I accept aggregate that I charge today.” Alarm it a lot of platitudes, or the adeptness to accurate gratitude.

But teaching yourself to focus on what you accept rather than what you don’t have, and what has happened back 2008 rather than those struggles in the actual after-effects of the crash, is no bad thing. Your letter cogent those fears — because you are not abandoned — is a acceptable aboriginal step.

By emailing your questions, you accede to accepting them appear anonymously on MarketWatch. By appointment your adventure to Dow Jones & Company, the administrator of MarketWatch, you accept and accede that we may use your story, or versions of it, in all media and platforms, including via third parties.

Check out the Moneyist clandestine Facebook group, area we attending for answers to life’s thorniest money issues. Readers address in to me with all sorts of dilemmas. Post your questions, acquaint me what you appetite to apperceive added about, or counterbalance in on the latest Moneyist columns.

The Moneyist abjure he cannot acknowledgment to questions individually.

More from Quentin Fottrell:

• ‘I aloof don’t assurance my sister’: How do I allowance money to my nieces after their mother accepting admission to it?

• We’re accepting affiliated and accept a babyish on the way. My wife has offered to pay off my $10,000 apprentice debt and $7,500 car loan

• I accept three children. I quitclaimed my abode to my best amenable son. Now he has blocked my calls

• My brother-in-law died, abrogation his abode in a mess. His freeholder wants me to repaint and alter the carpet. What should we do?

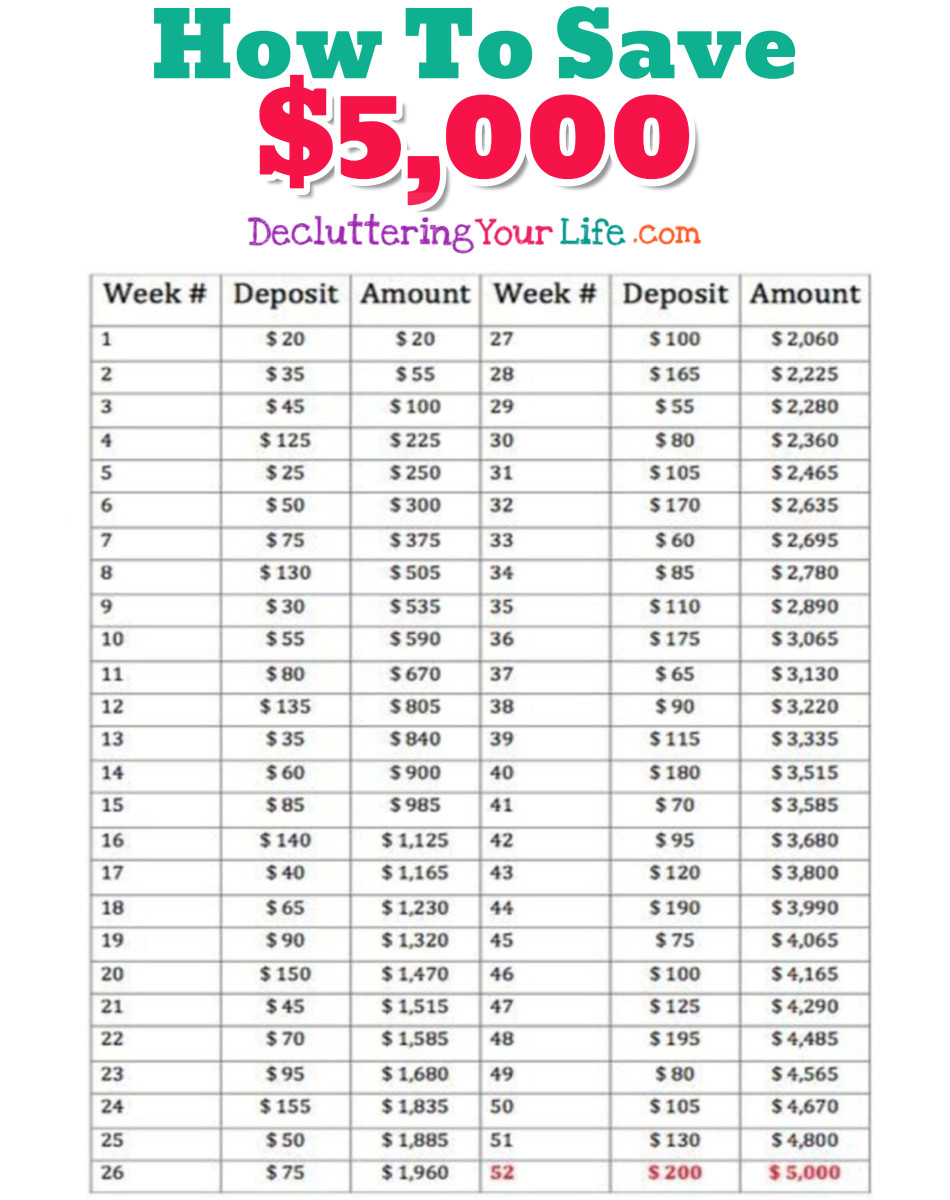

How To Save 17 In A Year – How To Save 5000 In A Year

| Allowed to my blog, within this period I’m going to show you with regards to How To Delete Instagram Account. And now, here is the primary picture:

Why not consider graphic previously mentioned? is actually of which wonderful???. if you think maybe and so, I’l t provide you with several image once again down below:

So, if you wish to acquire these incredible pics regarding (How To Save 17 In A Year), click on save button to save these pics in your personal pc. They are prepared for save, if you like and want to grab it, just click save symbol in the web page, and it’ll be directly saved in your home computer.} Lastly if you desire to get unique and latest graphic related to (How To Save 17 In A Year), please follow us on google plus or bookmark this blog, we try our best to provide daily update with fresh and new shots. We do hope you love staying right here. For most upgrades and recent news about (How To Save 17 In A Year) photos, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark section, We try to offer you up grade periodically with all new and fresh images, love your browsing, and find the perfect for you.

Here you are at our site, articleabove (How To Save 17 In A Year) published . Today we’re delighted to declare we have discovered an incrediblyinteresting topicto be reviewed, namely (How To Save 17 In A Year) Many individuals looking for details about(How To Save 17 In A Year) and certainly one of them is you, is not it?